Abstract

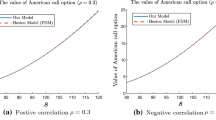

In this paper, we study the option pricing problem for the conditional Asian option that appears as a recent market product, offering a cheaper and new alternative to the regular Asian option. We develop the new characteristics of short-maturity asymptotic for the prices of the conditional Asian option provided that the underlying asset follows a local volatility model. The asymptotics for out-of-the-money and at-the-money using fixed strike conditional Asian options are presented, respectively, which provide the linear approximation description of call/put option price. Moreover, the approximating solution for the corresponding variational problem under the well-known Black–Scholes model is also given. The theoretical results derived in the paper are practically relevant and numerical experiments are shown to validate the theoretical outcomes of the paper.

Similar content being viewed by others

References

Avellaneda, M., Boyer-Olson, D., Busca, J., Friz, P.: Application of large deviation methods to the pricing of index options in finance. C. R. Math. Acad. Sci. Paris 336, 236–266 (2003)

Bayraktar, E., Xing, H.: Pricing asian options for jump diffusion. Math. Financ. 21(1), 117–143 (2011)

Berestycki, H., Busca, J., Florent, I.: Asymptotics and calibration of local volatility models. Quant. Financ. 2, 61–69 (2002)

Cai, N., Song, Y., Kou, S.: A general framework for pricing Asian options under Markov processes. Oper. Res. 63(3), 540–554 (2015)

Canhanga, B., Malyarenko, A., Murara, J.-P., Ni, Y., Silvestrov, S.: Numerical studies on asymptotics of European option under multiscale stochastic volatility. Methodol. Comput. Appl. Probab. 19(4), 1075–1087 (2017)

Cao, J., Roslan, T.R.N., Zhang, W.: Pricing variance swaps in a hybrid model of stochastic volatility and interest rate with regime-switching. Methodol. Comput. Appl. Probab. 20(4), 1359–1379 (2018)

Carr, P., Schröder, M.: Bessel processes, the integral of geometric Brownian motion, and Asian options. Theory Probab. Appl. 48, 400–425 (2003)

Cheng, W., Costanzino, N., Liechty, J., Mazzucato, A., Nistor, V.: Closed-form asymptotics and numerical approximations of 1d parabolic equations with applications to option pricing. SIAM J. Financ. Math. 2, 901–934 (2011)

Cui, Z., Kirkby, J., Nguyen, D.: Equity-linked annuity pricing with cliquet-style guarantees in regime-switching and stochastic volatility models with jumps. Insur. Math. Econ. 74, 46–62 (2017)

Cui, Z., Lee, C., Liu, Y.: Single-transform formulas for pricing Asian options in a general approximation framework under Markov processes. Eur. J. Oper. Res. 266(3), 1134–1139 (2018)

Dembo, A., Zeitouni, O.: Large Deviations Techniques and Applications, 2nd edn. Springer, New York (1998)

Durrleman, V.: From implied to spot volatilities. Financ. Stoch. 14, 157–177 (2010)

Feng, J., Forde, M., Fouque, J.: Short maturity asymptotics for a fast mean-reverting Heston stochastic volatility model. SIAM J. Financ. Math. 1, 126–141 (2010)

Feng, R., Volkmer, H.W.: Conditional Asian options. Int. J. Theor. Appl. Financ. 18(6), 24 (2015)

Figueroa-López, J.E., Ólafsson, S.: Short-term asymptotics for the implied volatility skew under a stochastic volatility model with Lévy jumps. Financ. Stoch. 20, 973–1020 (2016)

Forde, M., Jacquier, A., Lee, R.: The small-time smile and term structure of implied volatility under the Heston model. SIAM J. Financ. Math. 3, 690–708 (2012)

Fouque, J.-P., Han, C.-H.: Pricing Asian options with stochastic volatility. Quant. Financ. 3(5), 353–362 (2003)

Friedman, A.: Stochastic Differential Equations and Applications. Academic Press, Cambridge (1975)

Gatheral, J., Hsu, E.P., Laurent, P., Ouyang, C., Wang, T.H.: Asymptotics of implied volatility in local volatility models. Math. Financ. 22, 591–620 (2012)

Geman, H., Yor, M.: Bessel processes, Asian options and perpetuities. Math. Financ. 3, 349–375 (1993)

Kirkby, J., Nguyen, D., Cui, Z.: A unified approach to Bermudan and barrier options under stochastic volatility models with jumps. J. Econ. Dyn. Control 80, 75–100 (2017)

Li, L., Zhang, G.: Error analysis of finite difference and markov chain approximations for option pricing with non-smooth payoffs. Math. Financ. 28(3), 877–919 (2018)

Linetsky, V.: Spectral expansions for Asian (average price) options. Oper. Res. 52, 856–867 (2004)

Petroni, N.C., Sabino, P.: Pricing and hedging Asian basket options with quasi-Monte Carlo simulations. Methodol. Comput. Appl. Probab. 15(1), 147–163 (2013)

Pirjol, D., Wang, J., Zhu, L.: Short maturity forward start Asian options in local volatility models. Appl. Math. Financ. 26(3), 187–221 (2019)

Pirjol, D., Zhu, L.: Discrete sums of geometric Brownian motions, annuities and Asian options. Insur. Math. Econ. 70, 19–37 (2016)

Pirjol, D., Zhu, L.: Short maturity Asian options in local volatility models. SIAM J. Financ. Math. 7(1), 947–992 (2016)

Pirjol, D., Zhu, L.: Asymptotics for the discrete-time average of the geometric Brownian motion and Asian options. Adv. Appl. Probab. 49(2), 446–480 (2017)

Pirjol, D., Zhu, L.: Short maturity Asian options for the CEV model. Probab. Eng. Inf. Sci. 33, 258–290 (2019)

Varadhan, S.: Diffusion processes in a small time interval. Commun. Pure Appl. Math. 20, 659–685 (1967)

Varadhan, S.: Large Deviations and Applications. SIAM, Philadelphia (1984)

Varadhan, S.: Large deviations. Ann. Probab. 36, 397–419 (2008)

Vecer, J.: A new PDE approach for pricing arithmetic average Asian options. J. Comput. Financ. 4, 105–113 (2001)

Vecer, J.: Unified Asian pricing. Risk 15, 113–116 (2002)

Vecer, J.: Black–Scholes representation for Asian options. Math. Financ. 24(3), 598–626 (2014)

Vecer, J., Xu, M.: Pricing Asian options in a semimartingale model. Quant. Financ. 4(2), 170–175 (2004)

Yan, J., Peng, S., Fang, S., Wu, L.: Selected Teaching of Stochastic Analysis. Science Press, Beijing (1997)

Acknowledgements

Nian Yao was supported in part by the Natural Science Foundation of China 11371283, and Mingqing Xiao was supported in part by NSF-DMS 1419028, 1854638 of the United States. The first author, Nian Yao, would like to thank the hospitality from the Department of Mathematics, Southern Illinois University Carbondale during her visit from March 2017–August 2018, and this joint work is conducted during the visit. Also, the authors would like to thank Prof. Dan Pirjol, Prof. Wen Yang, and Prof. Jingyi Wang for the helpful discussions with the first author. The authors are also grateful to the editor and the referees for their careful reading of this manuscript as well as for their many suggestions that lead to the significant improvement of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yao, N., Ling, Z., Zhang, J. et al. Short maturity conditional Asian options in local volatility models. Math Finan Econ 14, 307–328 (2020). https://doi.org/10.1007/s11579-020-00257-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-020-00257-y