Abstract

Japan’s mid-century strategy to reduce greenhouse gas (GHG) emissions by 80% by 2050 requires rapid energy system changes, which may lead to stranded assets in fossil fuel-related infrastructure. Existing studies have shown that massive stranding of assets in the energy supply side is possible; few studies have involved economy-wide stranded asset analysis. In this study, we estimated stranded investments in both the energy supply and demand sectors in Japan in the context of near-term goals for 2030 and the mid-century strategy. To this end, multiple emission scenarios for Japan were assessed based on various emission reduction targets for 2030 and 2050. The results show that stranded investments in the energy supply sectors occur mainly in coal power plants without carbon capture and storage (CCS), especially in scenarios without enhanced near-term mitigation targets. Increases of stranded investment in demand sectors were observed primarily under stringent mitigation scenarios, which exceed the 80% reduction target. In particular, investment for oil and gas heating systems in the buildings sector may be stranded at levels up to $20 billion US between 2021 and 2050. We further simulated a scenario incorporating a subsidy for devices that do not use fossil fuels as a sector-specific policy; this reduced the amount of stranded investment in the buildings sector. We confirmed the benefit of enhancing near-term mitigation targets to avoid generating stranded investments. These findings support the importance of inclusive energy and climate policy design involving not only pricing of carbon emissions but also complementary cross-sector economy-wide policies.

Similar content being viewed by others

Introduction

The Paris Agreement requires that parties submit Nationally Determined Contributions (NDCs), which include mitigation targets for reducing emissions of greenhouse gases (GHGs) by 2030, and encourages each party to formulate a long-term low-emission development strategy, known as the mid-century strategy (MCS), which focuses mainly on emission reduction targets in 2050 and later. Japan was the sixth-largest emitter of GHGs in 2018 (Olivier and Peters 2020) and has submitted an NDC of reducing GHG emissions by 26.0% in 2030 relative to the 2013 level. As a long-term national target, the government of Japan has submitted an MCS that includes the quantitative goal of reducing GHG emissions by 80% in 2050 and the aim of achieving decarbonization of society as soon as possible in the second half of this century. Regarding the consistency between these national targets and the global goals stated in the Paris Agreement, Oshiro et al. (2019) have suggested that the 80% reduction goal by 2050 would be on track to the global 2 °C goal in terms of the carbon budget based on the cost effectiveness allocation whereas additional efforts would be required for 1.5 °C goal, although the national emission ranges implied by the global pathways are largely depending on the effort sharing scheme (van den Berg et al. 2019).

In this regard, several studies have assessed the energy and economic implications of Japan’s near- to mid-term emission pathways using energy system models and integrated assessment models (IAMs), that integrate relevant disciplines such as energy, economy, agriculture, and land use into single modeling framework (Fujimori et al. 2019; Kato and Kurosawa 2019; Oshiro et al. 2019; Silva Herran et al. 2019; Sugiyama et al. 2019). Generally, these national scenario analyses have suggested that attainment of both the NDC and MCS targets without strengthening the near-term target would require rapid emission reductions between 2030 and 2050, which would involve non-linear energy system transformation during this period (Oshiro et al. 2017). Such rapid transformation would involve dramatic increases in the carbon price and associated mitigation costs during this period (Fujimori et al. 2019; Sugiyama et al. 2019). In this regard, technological, economic and political feasibility is a critical challenge for reaching the mid-century goals.

In terms of the feasibility of such drastic energy system changes, existing studies have pointed out transition risks, such as carbon lock-in, stranded investment, and premature retirement relative to the expected lifetime of fossil fuel-related infrastructure (Campiglio et al. 2018; Mercure et al. 2018; Seto et al. 2016). At the global scale, several studies using IAMs have indicated that the lack of short-term mitigation actions would lead to premature phase-out of coal power plants and stranding of fossil fuel assets, resulting in increased stranded investment in the energy supply sectors (Bertram et al. 2015; Cui et al. 2019; Johnson et al. 2015). At the national level, Iyer et al. (2017) explicitly focused on disruptive changes between the US NDC and MCS, and quantified stranded coal capacity by 2050 using the Global Change Assessment Model (GCAM). Wang et al. (2019) and Malik et al. (2020) estimated the stranded coal capacity under the low-emission scenarios in China and India, respectively, using both global and national IAMs. These studies stressed that near-term actions including enhancement of NDCs are effective for avoiding the stranding of high-carbon infrastructure such as coal power plants without carbon capture and storage (CCS). Meanwhile, few studies have focused on the energy demand sectors rather than on the energy supply sector (Davis et al. 2010; IRENA 2017). Therefore, the economy-wide risk of stranded investment and measures to avoid those risks remain unclear.

Given this background, the present study aims to clarify the risk of stranded investment in the context of rapid energy system transformation in both energy demand and supply sectors. To this end, we quantified the stranded investment arising from rapid energy system transition between 2030 and 2050 in Japan using a bottom-up energy system model. In addition, this study aims to explore the policy implications of stranded investment risk mitigation.

Materials and methods

Model

We used AIM/Enduse [Japan], which is a dynamic recursive partial equilibrium model that explicitly represents individual energy-use technologies in both the energy supply and demand sectors as listed in Table 1. The operating conditions and amount of new installation of each technology, along with the resulting energy use and GHG emissions, are calculated based on linear programming to minimize total energy system costs. The results are subject to exogenous parameters, including a technological parameter, energy service demands, and emissions constraints. The detailed model description, including equations and parameter assumptions, was reported by Kainuma et al. (2003). For this study, we used a model that incorporates an electricity dispatch module and a detailed regional classification scheme that divides Japan into 10 regions (Oshiro et al. 2017; Oshiro and Masui 2015). The model used in this study employs a 1-h time representation for electricity load to account for the impacts of variable renewable energies (VREs), whereas the previous version had 3-h resolution. The power sector module includes measures taken to integrate VREs into the grid, such as electricity storage, demand response (DR) using battery-powered electric vehicles and heat pump devices, and interconnections. The capacity of the energy infrastructure is calculated based on newly installed capacity and residual capacity remaining today, which is in turn calculated based on the constructed year, capacity, and expected lifetime of each plant. In the energy demand sectors, numerous mitigation options are included in the sectors of industry, buildings, and transportation, such as energy-efficient devices and fuel changes. The details of these parameter assumptions have been reported previously (Fujimori et al. 2019). Introduction of CCS is considered in the power and industry sectors, while CCS-ready and conversion to CCS-equipped plant after operation are not taken into account in the model.

The solution horizon of AIM/Enduse [Japan] is based on recursive dynamic which is myopic for technological and economical changes in the future. In each period, investment for energy technologies is determined by minimization of total energy system costs which include initial, operation and management and emission costs of technologies. The detail on investment calculation is summarized in the Electronic Supplementary Material (ESM). It means that technological and economic changes, such as availability of new technology, changes of carbon prices and energy import prices, are not taken into consideration in investment calculation.

Stranded investment calculation

In the existing literature, several indicators are used to represent the impacts of stranded assets in terms of physical or monetary units. For example, Bertram et al. (2015); Iyer et al. (2017); Malik et al. (2020) used physical indicators such as the idling capacity of coal power plants as stranded asset indicators. Cui et al. (2019) compared the average real lifetime of coal power plants with their expected or planned lifetimes. Johnson et al. (2015) appraised stranded investment in monetary units by multiplying the stranded capacity with the annualized cost. In this paper, we quantified stranded capacity and investments. Here, stranded capacity is estimated as the stock quantity that is never in operation in each time step. The assumptions for the expected lifetime of each infrastructure and device type are summarized in Table S1 in the ESM. The stranded investment calculation in this paper followed the method of Johnson et al. (2015), which entails multiplying the stranded capacity by the annualized investment of each technology using a 5% interest rate. To measure the amount of stranded investments associated with climate policy implementation, the stranded capacity and investment are represented in this study as additional values compared to the baseline case wherein no additional climate policy is implemented, unless otherwise noted. Detailed descriptions of stranded investment estimation in this study, including the equations used, can be found in the Supplementary texts in the ESM.

Scenario

Assumptions on climate policy, socio-economic, and technology developments are based on the harmonized scenario design of the Energy Modeling Forum (EMF) 35 Japan Model Intercomparison Project (JMIP) (Sugiyama et al., under review). We assumed several scenarios based on a combination of different mitigation levels in 2030 and 2050 and considering various emission reduction speeds (Table 2). The 26by30 + 80by50 scenario, which meets the NDC target (26% reduction in 2030 with respect to the 2013 level) and the 80% reduction goal by 2050 of Japan’s MCS, was used as the central scenario. We also assessed the 36by30 and 16by30 scenarios for the 2030 target, which achieve 36% and 16% reductions, respectively. In terms of the 2050 target, 70%, 85%, and 90% scenarios, referred to as 70by50, 85by50 and 90by50, were also taken into consideration. In addition to the 70by50 and 90by50 scenarios which are included in Sugiyama et al. (under review) for the sensitivity analysis, the 85by50 scenario is also evaluated because of non-linear behavior of Japan’s energy systems where the reduction level exceed around 80% in the existing literatures (Oshiro et al. 2019, 2018). Mitigation begins in 2020 for all scenarios, and the emission trajectories are linearly interpolated between 2020 and 2030 and between 2030 and 2050.

In the baseline scenario, no specific climate policy is taken into account, whereas mitigation options whose investment can be recovered owning to their energy saving, so called no regret options, can be introduced even in the baseline scenario in AIM/Enduse [Japan]. It should be noted that there are critical issues to assume a baseline as no-policy scenario (Grant et al. 2020), the baseline scenario in this study, however, did not consider additional policy since Japan’s emission pathways and associated energy system are very close between the no-policy and current policy scenario according to the multi-model studies conducted in Roelfsema et al. (2020). Also, the climate impacts on energy system, which are pointed out in Grant et al. (2020), are not taken into consideration in this study.

In addition to the scenarios in EMF35-JMIP, sectoral policy scenarios were assessed in this study to explore their effects in reducing stranded investment. As a sectoral policy, we assumed introduction of a subsidy after 2030 that accounts for one-third of the installation cost of electrified devices in the buildings sector, such as high-efficiency air conditioners and heat pump water heaters, based on a policy in Japan called the ASSET (Advanced technologies promotion Subsidy Scheme with Emission reduction Targets) scheme, implemented by the Ministry of the Environment (IGES et al. 2016).

The assumption on nuclear power availability follows Oshiro et al. (2017), where the nuclear power generation is generally identical to that stated in the NDC, with an extension of lifetime to 60 years for some nuclear plants. This assumption is identical with the LimNUC case in the JMIP harmonized scenario (Sugiyama et al., under review). In terms of socio-economic conditions, GDP growth is based on that of the NDC until 2030, equivalent to around 1.7% growth, and with the Shared Socio-economic Pathway (SSP) 2 assumption thereafter (Riahi et al. 2017). Population growth is consistent with the medium-fertility and medium-mortality estimate of the National Institute of Population and Social Security Research (IPSS 2017). These assumptions are identical with the HarmDem scenario of Sugiyama et al. (under review). The assumptions underlying the socio-economic and energy service demand indicators used in this study are summarized in Table S2.

Results

Energy system changes

As show in Fig. 1, long-term energy system changes in both the energy supply and demand sectors are needed to achieve the emissions reductions targets for 2030 and 2050, which are summarized in Fig. S1. As depicted in Fig. 1a–d, in all mitigation scenarios, increase of low-carbon resources which include renewables, nuclear and fossil fuel with CCS, energy efficiency improvement, and electrification are key options to meet the long-term goals. While the share of low-carbon resources declines around 2015 due to the suspension of nuclear power, it reaches 70% or more by 2050 owing to deployment of renewables, restart of nuclear power plants and CCS. Generally, energy supply-side indicators, such as the proportions of low-carbon resources in primary energy supply and power generation, vary among scenarios after 2030 (Fig. 1a–b, Figs. S2 and S3). In the energy demand sectors, development of energy efficiency and electrification are drivers of decarbonization, and variations among scenarios are found mainly after 2040, later than the energy supply indicators (Fig. 1c, d, Fig. S4). Carbon prices and energy system costs increase over time, with especially rapid changes after 2040 in the 90by50 scenarios (Fig. 1e, f). In the 36by30 scenarios, high carbon price and energy system costs are observed in 2030 due to the additional emission reductions. In those scenarios, the carbon price reaches around $3,000 US per t-CO2 by 2050, and additional total energy system costs relative to the baseline account for around 2% of GDP in 2050.

Energy system transitions in the different scenarios. Share of low-carbon energies in a primary energy supply and b electricity supply, where low-carbon energies include renewables, nuclear and fossil fuel with CCS. c Final energy consumption relative to the 2010 level. d Share of electricity in total final energy demand. e Carbon prices. f Additional energy system costs per GDP relative to the baseline. The line color refers to the emission reduction rate in 2050 relative to the 2010 level

Stranded investments

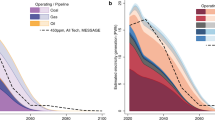

Stranded investments accumulated between 2021 and 2050 are summarized in Fig. 2a. The total amount of stranded investment under the 16by30 scenarios is double or more those of the 26by30 and 36by30 scenarios, mainly due to greater stranded investment in the energy supply sector. By contrast, in terms of 2050 emission levels, the variations in stranded investment among scenarios are moderate, especially among the 80by50, 85by50, and 90by50 scenarios. Stranded investment in energy demand sectors is generally smaller than that in the energy supply sectors, but reaches around $20 billion US in the 90by50 reduction scenarios. Energy demand investments are stranded mainly in the buildings sector, where they increase dramatically from 2040 to 2050 in the 85by50 and 90by50 reduction scenarios (Fig. S5). Long-term stranded investment is also observed in the industry sector, but its impact is smaller than that of the buildings sector. Stranded investment in the transport sector is mainly due to short-term stranding of the public transport such as train because of its relatively longer lifetime and residual inefficient capacities. In the 90by50 reduction scenarios, the stranded investments in energy demand sectors exceed those of energy supply sectors.

a Cumulative stranded investment between 2021 and 2050. The horizontal axis refers to the emission reduction level in 2050. The placement of bars refers to the 2030 target. Because the additional investments from the baseline scenarios are shown here, some sectors resulted in negative value. b Cumulative stranded investments as a function of cumulative CO2 emissions between 2021 and 2050. The colors of shaded area refer to the level of carbon budgets

Figure 2b shows the relationship between the cumulative stranded investment and cumulative CO2 emissions during 2021–2050. The gray area indicates the 95–105% range of the 26by30 + 80by50 scenario carbon budget, which is consistent with Japan’s NDC and MCS. At the levels of the NDC and MCS, the stranded investment in the 16by30 scenario accounts for more than $75 billion US, which is approximately three times larger than that in the 26by30 scenarios. This result suggests that 2030 emission levels are the key determinant of stranded investment within a carbon budget category.

The amount of stranded investments is affected by the speed of emissions reduction and energy system transition. Figure 3 shows the relationships between stranded investments and the speed of CO2 emission reduction, which differ between the energy supply and demand sectors. In the energy supply sector, stranded investment increases in the 2–5% range of annual emission reductions and becomes saturated in scenarios where the emission reduction rate exceeds 5%. The near-term goal level also drives saturation of stranded investments in the energy supply sector. By contrast, there is an exponential relationship between stranded investments in energy demand sectors and the speed of emission reduction. Although stranded investment in energy demand sectors is trivial with changes of less than 5% in annual emissions, it rises exponentially at higher emission reduction rates.

Stranded investment in energy supply

As shown in Fig. 2a, the energy supply sector is the largest contributor to total stranded investment in most scenarios. This result is due to the rapid system transition in the energy supply sector, especially upscaling of low-carbon energies, and the associated phase-out of fossil fuel-related infrastructure. Figure 4a shows the stranded coal capacity over time without CCS. Because the capacity factor of coal power plants without CCS in 2050 approaches zero in all scenarios (Fig. 4b), the stranded capacity in 2050 is comparable to the residual coal capacity shown in Fig. S6. In the 16by30 scenarios, because installation of new coal plants continues until 2030 (Fig. S7), stranded capacity accounts for more than 30 GW between 2040 and 2050. By contrast, stranded capacity peaks before 2040 in the 26by30 and 36by30 scenarios, with levels around 10 GW or less by 2050. Because the stranded coal capacity peaks around 2030–2040 and declines thereafter in most scenarios, stranded investment in energy supply sectors becomes saturated, as shown in Fig. 3b. The capacity factor of gas power plants accounts for around 20% or less by 2050 in the 80by50–90by50 scenarios (Fig. 4c), and stranded gas capacity without CCS is limited compared with that of coal (Fig. S8). This difference is due to the role of gas power plants as back-up power generation resources for integration of VREs into the electricity grid in conjunction with other resources, such as electricity storage batteries and demand responses.

Figure S9a depicts the comparison of the stranded coal capacity and capacity of coal with CCS. Since the capacity of coal with CCS accounts for around a half of peak stranded capacity in some scenarios, it suggests the possibility of reducing stranded investment by introducing power plants with CCS-ready. Nevertheless, the peak stranded capacity still reaches more than 20GW in the most of 16by30 scenarios when assuming CCS-ready is fully implemented for coal power plants (Fig. S9b).

Stranded investment in energy demand

Increased stranded investments in energy demand sectors occur mainly under deep decarbonization scenarios that require 85% and 90% emission reductions by 2050. In particular, the buildings sector would face premature retirement of fossil fuel-related devices (e.g., oil and gas space- and water-heating systems). Figure 5a shows the investment in non-fossil technologies in the buildings sector, including renewables, electricity, heat, and hydrogen under selected scenarios in which the carbon budgets are similar to that of the 26by30 + 80by50 scenario. The results in other scenarios are summarized in Fig. S 10. In the 16by30 + 90by50 scenario, non-fossil investment increases by more than six times between 2040 and 2050. In the 26by30 + 80by50 and 26by30 + 85by50 scenarios, the investment level is doubled and tripled during this period, respectively, leading to increased electrification rates between 2040 and 2050 (Fig. 1d). Similarly, stranded investment can occur in the industry and transport sectors, but these impacts are smaller than those in the buildings sector (Fig. 2a, Fig. S5). While lifetime of sector specific technologies in the industry sector is assumed around 30 years similar to thermal power plants in the power sector, stranded investment in the industry sector is much smaller than that in the power sector. It is because some industrial technologies are already introduced in the baseline scenario and the most of technologies are exhausted in the mitigation scenarios.

a Investments for non-fossil-based technologies in the buildings sector. Non-fossil technologies include renewables, electricity, heat, and hydrogen. b Cumulative stranded investment between 2021 and 2050 in the buildings sectors. NoSecPol indicates the default scenarios without sector specific policy. SecPol indicates scenarios with sector specific policy. Only the scenarios where carbon budget category is same with the 26by30 + 80by50 scenario are presented

Effects of sectoral policies

Given the impacts of stranded investments in the buildings sector under the most stringent scenarios, the effects of sectoral policies on reducing the stranded investment were estimated. Figure 5b and Fig. S11 show comparison of stranded investments in the buildings sector between scenarios with and without the sector-specific policies that promote near-term penetration of non-fossil infrastructure. Sectoral policies can reduce stranded investments in the buildings sector by one-third in the 16by30 + 90by50 scenario. In the most scenarios, sectoral policies result in decrease of stranded investment in the buildings sector, whereas in the limited scenarios, such as the 36by30 + 80by50 scenario, stranded investments in the SecPol scenario is larger than that of NoSecPol scenario because the sectoral policy would cause earlier retirement of fossil based devices between 2030 and 2040 (Fig. S12). The required subsidy accounts for about $15 billion US per year in 2050, which is equivalent to around 0.2% of GDP (Fig. S13). The amount of subsidy is similar across all scenarios because end-use electrification is the important mitigation option by 2050. Although the implementation of sectoral policies is effective for avoiding generating stranded investments, the cumulative amount of stranded investment in the buildings sector in the 16by30 + 90by50 scenario is much larger than that in the 26by30 + 80by50 scenario. This result implies that near-term mitigation is still a critical driver of stranded investment in both the energy demand and supply sectors, even though the sectoral specific policies are implemented.

Discussion and conclusion

Based on the scenario analysis presented in the previous sections, we explored two processes driving increases in stranded investment. First, energy supply investment can be stranded beginning in the near term due to delayed mitigation action and associated development of emission-intensive infrastructure, such as coal-fired power plants without CCS. In this case, the energy supply infrastructure becomes idle when the emission constraints become stringent. Second, energy demand investment becomes stranded during rapid emission reductions and the associated energy system transition around 2050 under the deep decarbonization scenarios. This result is mainly due to the need for removal of residual emissions from fossil fuel-related infrastructure in the demand sectors, such as gas and oil heaters and boilers, to attain rapid electrification. In some scenarios with a 90% reduction in 2050, the amount of stranded investment in energy demand sectors exceeds that in energy supply sectors. From these findings, it is reconfirmed that weak near-term mitigation actions would exacerbate the feasibilities of long-term climate goals.

Nevertheless, the impacts of stranded investment can be reduced through near-term actions and sectoral policy implementation. In the energy supply sector, the stranded coal capacity can be reduced by half or more by strengthening the 2030 emission target. Implementation of CCS-ready for coal power plants would also be effective to reduce stranded coal capacity, while their economic attractiveness is depending on the remaining lifetime of power plants. In energy demand sectors, stranded investments can also be reduced by implementing sector-specific policies, such as a subsidy for devices that do not use fossil fuels. A 33% subsidy for electrified technologies such as heat pump space- and water-heating systems would lessen stranded investments in the buildings sector by one-third. This finding indicates that holistic policy design in conjunction with implementation of a simple carbon pricing policy could make the deep decarbonization goal feasible.

There are several limitations and caveats to interpretation of the stranded investment estimates in this study. First, in this study, we used a myopic energy system model that does not account for future changes in the operating rate of each infrastructure type; hence, the stranded capacity might be overestimated compared to the intertemporal model. Nevertheless, according to an existing multi-model study (Bertram et al. 2015), the amount of stranded investment estimated with a myopic model is not always higher than that based on intertemporal optimization. Therefore, the model type used for each time horizon would not significantly affect the key findings of this study. Secondly, Japan’s NDC states that the share of coal is targeted at around 26% of total power generation, equivalent to 277 billion kWh in 2030. In this study, coal power generation in 2030 was estimated at 0.86 EJ in the 26by30 scenarios (239 billion kWh) based on a cost-optimization mechanism. If the energy policy is implemented as planned, stranded capacity may become greater than the estimates reported in this study. Third, whereas stranded investment is represented by the cumulative investment between 2021 and 2050, as shown in Fig. 2, the stranding of long-life infrastructure such as coal power plants without CCS could occur after 2050, especially in the 26by30 and 16by30 scenarios, as shown in Fig. 4a. Although the cumulative amount of stranded investment by 2050 which was similar between the 26by30 and 36by30 scenarios than that of the 26by30 scenario, would be greater if impacts in the second half of this century were considered. Fourth, while this study considered only a subsidy for electrified devices as a sectoral policy, many other policies that can reduce stranded investment risks are possible. For example, a fossil fuel use ban would directly reduce the amount of stranded investment in energy demand sectors. In addition, support for other decarbonized energy carriers in addition to electricity, such as the renewable sources of bioenergy, heat, and hydrogen, would be effective. Policies promoting structural changes, such as effective urban design targeting effective use of centralized district heating, would also help to reduce the stranding of investment in end-use devices.

The findings of this study have several policy implications in the Japanese context. First, in accordance with existing modeling investigations, this study confirmed the requirement for high carbon prices of around $3,000 US per t-CO2 in 2050 under the 90by50 scenario (Fig. 1e). While implementation of carbon pricing alone might create stranded investments in energy demand sectors, the impact of stranded investment can be reduced significantly (i.e., by one-third) if carbon pricing is complemented by sector-specific policies, such as subsidies for low-carbon devices. Because the removal of energy devices before their expected lifetime would be very challenging without very strong policy interventions, especially in the private sector, implementation of a comprehensive climate policy in the near term is critical for the longer-term challenges associated with decarbonization. To this end, policymakers should be informed about which technology to install in the long term. In this regard, energy and climate scenario analysis using an energy system model should play an important role in policy design. Second, in energy supply sectors, while the results show that the capacity factor of natural gas power plants without CCS decreased to less than 30% by 2050, the most of their capacity are not stranded owing to their role as back-up capacity for VREs integration. Given this role of natural gas power, complementary policies are essential to maintaining the required back-up capacity.

References

Bertram C, Johnson N, Luderer G, Riahi K, Isaac M, Eom J (2015) Carbon lock-in through capital stock inertia associated with weak near-term climate policies. Technol Forecast Soc Chang 90:62–72. https://doi.org/10.1016/j.techfore.2013.10.001

Campiglio E, Dafermos Y, Monnin P, Ryan-Collins J, Schotten G, Tanaka M (2018) Climate change challenges for central banks and financial regulators. Nature Clim Change 8:462–468. https://doi.org/10.1038/s41558-018-0175-0

Cui RY, Hultman N, Edwards MR, He L, Sen A, Surana K, McJeon H, Iyer G, Patel P, Yu S, Nace T, Shearer C (2019) Quantifying operational lifetimes for coal power plants under the Paris goals. Nature Commun 10:4759. https://doi.org/10.1038/s41467-019-12618-3

Davis SJ, Caldeira K, Matthews HD (2010) Future CO2 emissions and climate change from existing energy infrastructure. Science 329:1330–1333. https://doi.org/10.1126/science.1188566

Fujimori S, Oshiro K, Shiraki H, Hasegawa T (2019) Energy transformation cost for the Japanese mid-century strategy. Nature Commun 10:4737. https://doi.org/10.1038/s41467-019-12730-4

Grant N, Hawkes A, Napp T, Gambhir A (2020) The appropriate use of reference scenarios in mitigation analysis. Nature Clim Change 10:605–610. https://doi.org/10.1038/s41558-020-0826-9

IGES, EDF, IETA (2016) Japan: market-based climate policy case study. https://www.ieta.org/resources/Resources/Case_Studies_Worlds_Carbon_Markets/2016/Japan_Case_Study_2016.pdf

IPSS (2017) Population projections for Japan: 2016 to 2065. In: National Insitute of Population and Social Security Research. https://www.ipss.go.jp/pp-zenkoku/e/zenkoku_e2017/pp_zenkoku2017e.asp

IRENA (2017) Stranded assets and renewables: how the energy transition affects the value of energy reserves, buildings and capital stock. In: International Renewable Energy Agency (IRENA), Abu Dhabi. https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2017/Jul/IRENA_REmap_Stranded_assets_and_renewables_2017.pdf

Iyer G, Ledna C, Clarke L, Edmonds J, McJeon H, Kyle P, Williams JH (2017) Measuring progress from nationally determined contributions to mid-century strategies. Nature Clim Change 7:871–874. https://doi.org/10.1038/s41558-017-0005-9

Johnson N, Krey V, McCollum DL, Rao S, Riahi K, Rogelj J (2015) Stranded on a low-carbon planet: implications of climate policy for the phase-out of coal-based power plants. Technol Forecast Soc Chang 90:89–102. https://doi.org/10.1016/j.techfore.2014.02.028

Kainuma M, Matsuoka Y, Morita T (2003) Climate policy assessment: Asia-Pacific integrated modeling. Springer, Tokyo

Kato E, Kurosawa A (2019) Evaluation of Japanese energy system toward 2050 with TIMES-Japan—deep decarbonization pathways. Energy Procedia 158:4141–4146. https://doi.org/10.1016/j.egypro.2019.01.818

Malik A, Bertram C, Després J, Emmerling J, Fujimori S, Garg A, Kriegler E, Luderer G, Mathur R, Roelfsema M, Shekhar S, Vishwanathan S, Vrontisi Z (2020) Reducing stranded assets through early action in the Indian power sector. Environ Res Lett. https://doi.org/10.1088/1748-9326/ab8033

Mercure JF, Pollitt H, Viñuales JE, Edwards NR, Holden PB, Chewpreecha U, Salas P, Sognnaes I, Lam A, Knobloch F (2018) Macroeconomic impact of stranded fossil fuel assets. Nature Clim Change 8:588–593. https://doi.org/10.1038/s41558-018-0182-1

Olivier JGJ, Peters JAHW (2020) Trends in global CO2 and total greenhouse gas emissions: 2019 report. In: PBL Netherlands Environmental Assessment Agency, The Hague. https://www.pbl.nl/sites/default/files/downloads/pbl-2020-trends-in-global-co2-and-total-greenhouse-gas-emissions-2019-report_4068.pdf

Oshiro K, Masui T (2015) Diffusion of low emission vehicles and their impact on CO2 emission reduction in Japan. Energy Policy 81:215–225. https://doi.org/10.1016/j.enpol.2014.09.010

Oshiro K, Kainuma M, Masui T (2017) Implications of Japan's 2030 target for long-term low emission pathways. Energy Policy 110:581–587. https://doi.org/10.1016/j.enpol.2017.09.003

Oshiro K, Masui T, Kainuma M (2018) Transformation of Japan's energy system to attain net-zero emission by 2050. Carbon Manag 9:493–501. https://doi.org/10.1080/17583004.2017.1396842

Oshiro K, Gi K, Fujimori S, van Soest HL, Bertram C, Després J, Masui T, Rochedo P, Roelfsema M, Vrontisi Z (2019) Mid-century emission pathways in Japan associated with the global 2 °C goal: national and global models’ assessments based on carbon budgets. Clim Change. https://doi.org/10.1007/s10584-019-02490-x

Riahi K, van Vuuren DP, Kriegler E, Edmonds J, O’Neill BC, Fujimori S, Bauer N, Calvin K, Dellink R, Fricko O, Lutz W, Popp A, Cuaresma JC, Kc S, Leimbach M, Jiang L, Kram T, Rao S, Emmerling J, Ebi K, Hasegawa T, Havlik P, Humpenöder F, Da Silva LA, Smith S, Stehfest E, Bosetti V, Eom J, Gernaat D, Masui T, Rogelj J, Strefler J, Drouet L, Krey V, Luderer G, Harmsen M, Takahashi K, Baumstark L, Doelman JC, Kainuma M, Klimont Z, Marangoni G, Lotze-Campen H, Obersteiner M, Tabeau A, Tavoni M (2017) The Shared socioeconomic pathways and their energy, land use, and greenhouse gas emissions implications: an overview. Glob Environ Change 42:153–168. https://doi.org/10.1016/j.gloenvcha.2016.05.009

Roelfsema M, van Soest HL, Harmsen M, van Vuuren DP, Bertram C, den Elzen M, Höhne N, Iacobuta G, Krey V, Kriegler E, Luderer G, Riahi K, Ueckerdt F, Després J, Drouet L, Emmerling J, Frank S, Fricko O, Gidden M, Humpenöder F, Huppmann D, Fujimori S, Fragkiadakis K, Gi K, Keramidas K, Köberle AC, Aleluia Reis L, Rochedo P, Schaeffer R, Oshiro K, Vrontisi Z, Chen W, Iyer GC, Edmonds J, Kannavou M, Jiang K, Mathur R, Safonov G, Vishwanathan SS (2020) Taking stock of national climate policies to evaluate implementation of the Paris Agreement. Nature Commun 11:2096. https://doi.org/10.1038/s41467-020-15414-6

Seto KC, Davis SJ, Mitchell RB, Stokes EC, Unruh G, Ürge-Vorsatz D (2016) Carbon lock-in: types, causes, and policy implications. Annu Rev Environ Resour 41:425–452. https://doi.org/10.1146/annurev-environ-110615-085934

Silva Herran D, Fujimori S, Kainuma M (2019) Implications of Japan’s long term climate mitigation target and the relevance of uncertain nuclear policy. Clim Policy 19:1117–1131. https://doi.org/10.1080/14693062.2019.1634507

Sugiyama M, Fujimori S, Wada K, Endo S, Fujii Y, Komiyama R, Kato E, Kurosawa A, Matsuo Y, Oshiro K, Sano F, Shiraki H (2019) Japan's long-term climate mitigation policy: multi-model assessment and sectoral challenges. Energy 167:1120–1131. https://doi.org/10.1016/j.energy.2018.10.091

Sugiyama M, Fujimori S, Wada K, Oshiro K, Kato E, Komiyama R, Silva Herran D, Matsuo Y, Shiraki H, Ju Y. EMF 35 JMIP study for Japan’s long-term climate and energy policy: scenario designs and key findings. Sustain Sci (under review)

van den Berg NJ, van Soest HL, Hof AF, den Elzen MGJ, van Vuuren DP, Chen W, Drouet L, Emmerling J, Fujimori S, Höhne N, Kõberle AC, McCollum D, Schaeffer R, Shekhar S, Vishwanathan SS, Vrontisi Z, Blok K (2019) Implications of various effort-sharing approaches for national carbon budgets and emission pathways. Clim Change. https://doi.org/10.1007/s10584-019-02368-y

Wang H, Chen W, Zhang H, Li N (2019) Modeling of power sector decarbonization in China: comparisons of early and delayed mitigation towards 2-degree target. Clim Change. https://doi.org/10.1007/s10584-019-02485-8

Acknowledgements

This study was supported by JSPS KAKENHI Grant no. JP20K14860, the Environmental Research and Technology Development Fund (JPMEERF20201002) of the Environmental Restoration and Conservation Agency of Japan, and the Sumitomo Foundation Environmental Research Fund.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Handled by Masa Sugiyama, University of Tokyo, Japan.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Oshiro, K., Fujimori, S. Stranded investment associated with rapid energy system changes under the mid-century strategy in Japan. Sustain Sci 16, 477–487 (2021). https://doi.org/10.1007/s11625-020-00862-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11625-020-00862-2