Abstract

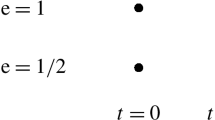

A model is presented of the financial market with a discrete-time uncertain deterministic evolution of prices in which asset prices evolve under uncertainty described using a priori information on possible price increments; i.e., it is assumed that they lie in given compact sets that depend on the prehistory of prices. Trading constraints depending on the history of prices are assumed to be convex, concern only risky assets, and allow all funds to be invested in a risk-free asset. A new geometric criterion is obtained for a robust condition (i.e., the condition ensuring the structural stability of the model) under which there is no guaranteed arbitrage with unlimited profit.

Similar content being viewed by others

Notes

Affine hulls of these sets regarded as smooth submanifolds of \(\mathbb{R}^{n}\) intersect transversally; see, e.g., [4, Part II, Ch. 2, Sec. 10].

In the terminology of [5], hyperplane \(H\) separates sets \(C_{1}\) and \(C_{2}\), if they lie in the opposite closed half-spaces generated by \(H\). Hyperplane \(H\) properly separates \(C_{1}\) and \(C_{2}\) if at least one of sets \(C_{1}\) and \(C_{2}\) is not contained entirely in \(H\).

This condition regarding trading constraints is met when, e.g., short positions are not allowed.

Specific models for which the compactness of trading constraints holds are given in [1, Example 2.1, Item 4].

Recall that \(0\in D_{t}(\cdot)\).

REFERENCES

S. N. Smirnov, ‘‘A guaranteed deterministic approach to superhedging: financial market model, trading constraints and Bellman-Isaacs equations,’’ Mat. Teor. Igr Prilozh. 10 (4), 59–99 (2018).

S. N. Smirnov, ‘‘A guaranteed deterministic approach to superhedging: ‘‘no arbitrage’’ market properties,’’ Mat. Teor. Igr Prilozh. 11 (2), 68–95 (2019).

S. N. Smirnov, ‘‘A guaranteed deterministic approach to superhedging: the proprieties of semicontinuity and continuity of solutions of the Bellman-Isaacs equations,’’ Mat. Teor. Igr Prilozh. 11 (4), 87–115 (2019).

B. A. Dubrovin, S. P. Novikov, and A. T. Fomenko, Modern Geometry: Methods and Applications, 2nd ed. (Nauka, Moscow, 1986) [in Russian].

R. T. Rockafellar, Convex Analysis (Princeton Univ. Press, Princeton, 1970; Mir, Moscow, 1973).

E. V. Shikin, Linear Spaces and Mappings (Mosk. Gos. Univ., Moscow, 1987) [in Russian].

K. Leichtweiss, Convex Sets (Nauka, Moscow, 1985) [in Russian]; Konvexe Mengen (Springer, Berlin, 1980) [in German].

Funding

This work was supported by the Russian Foundation for Basic Research, project nos. 19–01–00613a and 16–29–04191ofi_m).

Author information

Authors and Affiliations

Corresponding author

Additional information

Translated by I. Tselishcheva

About this article

Cite this article

Smirnov, S.N. Geometric Criterion for a Robust Condition of No Sure Arbitrage with Unlimited Profit. MoscowUniv.Comput.Math.Cybern. 44, 146–150 (2020). https://doi.org/10.3103/S0278641920020077

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.3103/S0278641920020077