Abstract

This paper considers a decision maker whose preferences are locally upper- or/and lower-semicontinuous in measure. We introduce the notion of a rich set which encompasses any standard vector space of random variables but also much smaller sets containing only random variables with at most two different outcomes in their support. Whenever preferences are complete on a rich set of random variables, lower- (resp. upper-) semicontinuity in measure becomes incompatible with convexity of strictly better (resp. worse) sets. We discuss implications for utility representations and risk-measures. In particular, we show that the value-at-risk criterion violates convexity exactly because it is lower-semicontinuous in measure.

Similar content being viewed by others

Notes

Of course, continuity concepts are not directly testable through finitely many observations of choice behavior. Violations of convexity alone—as, e.g., expressed by the popularity of the value-at-risk criterion—cannot prove that these decision makers’ preferences are continuous in measure. We come back to this point when we discuss the behavioral meaning of continuity.

For references to the economic literature which uses subjective belief data from the HRS or/and the SCF, see, e.g., Groneck, Ludwig, and Zimper [25].

A connected topological space is characterized by the property that only the empty set and the universal set are simultaneously open and closed (cf. Chapter 1.11.1 in Bourbaki [9]). Whereas some of the spaces considered in this paper are connected (e.g., the space of all random variables) others are not (e.g., the ‘small’ rich set of our Example 1 below).

Our preferred interpretation is that the decision maker is ‘aware’ of the random variables in L. At this point, we do not even require the decision maker to have complete preferences over all random variables in L.

The converse statement is, in general, not true. A violation of lower-semicontinuity of U at some \(Y\in L\) implies that the strictly better set \(S^{*}\left( c\right) =\left\{ Z\in L\mid c<U\left( Z\right) \right\} \) cannot be open for some \(c\in \mathbb {R}\) (cf., Theorem 1, p. 76 in Berge 1996). However, we do not always have that \(c=U\left( X\right) \) for some \(X\in \mathcal {F}\).

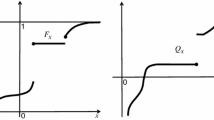

The distribution \(\mu _{Z}\) of random variable Z is the probability measure on \(\left( \mathbb {R},\mathcal {B}\left( \mathbb {R} \right) \right) \) such that

$$\begin{aligned} \mu _{Z}\left( A\right) =\mu \left( \left\{ \omega \in \Omega \mid Z\left( \omega \right) \in A\right\} \right) \text { for all }A\in \mathcal {B}\left( \mathbb {R}\right) \text {.} \end{aligned}$$Point (i) is explained in detail in the present paper. For point (ii) see our analysis in Assa and Zimper [5] and references therein. For example, Savage’s [29] subjective expected utility axiomatization requires a bounded (Bernoulli) utility function as he considers complete preferences over the set of all random variables. Compare Wakker [37] who writes:

Ever since, the extension of Savage’s theorem to unbounded utility has been an open question, and with that the question ”what is wrong with Savage’s axioms?”. \(\left[ \ldots \right] \) I think that ”what is wrong with Savage’s axioms”, is primarily his requirement of completeness of the preference relation on the set of all (alternatives=) acts \(\left[ \ldots \right] \). (p. 448)

To see the formal relationship between the CEU- and the mutliple priors representation of ambiguity aversion, observe that for a convex \(\nu \)

$$\begin{aligned} \int _{\Omega }^{Choquet}u\left( Z\right) d\nu =\min _{\pi \in \mathcal {P} }\int _{\Omega }u\left( Z\right) d\pi \end{aligned}$$where \(\mathcal {P}\) is defined as the core of \(\nu \).

Coherent risk measures, defined on some vector space \(L\subseteq L^{0}\), have to satisfy positive homogeneity and subadditivity which implies convexity.

Note that lower-semicontinuity of U becomes, by (8), upper-semicontinuity of \(\rho \).

In Assa and Zimper (2018) we had incorrectly claimed that value-at-risk preferences are continuous in measure without the qualifying condition (10).

We write \(\mathrm {VaR}_{\alpha }\left( Z\right) \) whenever (10) holds for Z.

Our formal definition of the average value-at-risk also appears in the literature as the definition of the “conditional value-at-risk” or of the “expected shortfall”. We follow here Föllmer and Schied ([21], p. 233) who argue that the notion of the average over the interval \(\left( 0,\beta \right) \) is more precise as it clarifies that the conditional distribution in question is the uniform distribution.

To see this, note that all converging sequences \(\left\{ Y_{n}\right\} \rightarrow Y\) which determine whether the strictly better set at X is open are, by (12), of the form

$$\begin{aligned} Y_{n}=\alpha \left( n\right) Y+\left( 1-\alpha \left( n\right) \right) Z^{\prime } \end{aligned}$$such that \(\lim _{n\rightarrow \infty }\alpha \left( n\right) =1\).

References

Agner, E., Loewenstein, G.: Behavioral Economics. In: Mäki, Uskali (ed.) Handbook of the Philosophy of Science: Philosophy of Economics Chapter 13, pp. 641–690. Elsevier, Amsterdam (2012)

Aliprantis, D.C., Border, K.: Infinite Dimensional Analysis, 2nd edn. Springer, Berlin (2006)

Artzner, P., Delbaen, F., Eber, J., Heath, D.: Thinking coherently. Risk 10, 68–71 (1997)

Artzner, P., Delbaen, F., Eber, J., Heath, D.: Coherent measures of risk. Math. Finance 9, 203–228 (1999)

Assa, H., Zimper, A.: Preferences over all random variables: incompatibility of convexity and continuity. J. Math. Econ. 75, 71–83 (2018)

Azevedo, E.M., Gottlieb, D.: Risk-neutral firms can extract unbounded profits from consumers with prospect theory preferences. J. Econ. Theory 147, 1291–1299 (2012)

Berge, C.: Topological Spaces. Dover Publications, New York. (An “unabridged and unaltered republication” of the original English publication from 1963.) (1997)

Billingsley, P.: Probability and Measure. Wiley, New York (1995)

Bourbaki, N.: Elements of Mathematics. General Topology. Chapters 1–4. Springer, Berlin (1989)

Cerreia-Vioglio, S., Maccheroni, F., Marinacci, M., Montrucchio, L.: Uncertainty averse preferences. J. Econ. Theory 146, 1275–1330 (2011)

Chateauneuf, A., Cohen, M., Meilijson, I.: More pessimism than greediness: a characterization of monotone risk aversion in the rank-dependent expected utility model. Econ. Theory 25, 649–667 (2005)

Chew, S., Karni, E., Safra, Z.: Risk aversion in the theory of expected utility with rank dependent preferences. J. Econ. Theory 42, 370–381 (1987)

Day, M.M.: The spaces \(L^{p}\) with \(0{\le }p{\le }1\). Bull. Am. Math. Soc. 46, 816–823 (1940)

Danan, E., Gajdos, T., Tallon, J.-M.: Harsanyi’s aggregation theorem with incomplete preferences. Am. Econ. J. Microecon. 7, 61–69 (2015)

Dekel, E.: Asset demands without the independence axiom. Econometrica 57, 163–169 (1989)

Delbaen, F.: Coherent risk measures on general probability spaces. In: Advances in Finance and Stochastics, pp. 1-37. Springer, Berlin (2002)

Delbaen, F.: Risk measures for non-integrable random variables. Math. Finance 19, 329–333 (2009)

Eilenberg, S.: Ordered topological spaces. Am. J. Math. 63, 39–45 (1941)

Fishburn, P.C.: Utility Theory for Decision Making. Wiley, New York (1970)

Föllmer, H., Schied, A.: Convex measures of risk and trading constraints. Finance Stoch. 6, 429–447 (2002)

Föllmer, H., Schied, A.: Stochastic Finance. An Introduction in Discrete Time, 4th edn. Walter de Gruyter GmbH, Berlin (2016)

Gerasimou, G.: On Continuity of Incomplete Preferences. Social Choice and Welfare 41, 157–167 (2013)

Gilboa, I.: Expected utility with purely subjective non-additive probabilities. J. Math. Econ. 16, 65–88 (1987)

Gilboa, I., Schmeidler, D.: Maxmin expected utility with non-unique priors. J. Math. Econ. 18, 141–153 (1989)

Groneck, M., Ludwig, A., Zimper, A.: A life-cycle model with ambiguous survival beliefs. J. Econ. Theory 162, 137–180 (2016)

Kahn, M.A., Uyanık, M.: Topological connectedness and behavioral assumptions on preferences: a two-way relationship. Economic Theory (forthcoming) (2019) https://doi.org/10.1007/s00199-019-01206-7

Maccheroni, F., Marinacci, M., Rustichini, A.: Ambiguity aversion, robustness, and the variational representation of preferences. Econometrica 74, 1447–1498 (2006)

Rudin, W.: Functional Analysis, 2nd edn. McGraw-Hill, New York (1991)

Savage, L.J.: The Foundations of Statistics. Wiley, New York (1954)

Samuelson, P.A.: A note on the pure theory of consumer’s behaviour. Economica 5, 61–71 (1938)

Schmeidler, D.: A condition for the completeness of partial preference relations. Econometrica 39, 403–404 (1971)

Schmeidler, D.: Integral representation without additivity. Proc. Am. Math. Soc. 97, 255–261 (1986)

Schmeidler, D.: Subjective probability and expected utility without additivity. Econometrica 57, 571–587 (1989)

Sen, A.: Quasi-transitivity, rational choice and collective decisions. Rev. Econ. Stud. 36, 381–393 (1969)

Sonnenschein, H.: The relationship between transitive preference and the structure of the choice space. Econometrica 33, 624–634 (1965)

Wakker, P.P.: The algebraic versus the topological approach to additive representations. J. Math. Psychol. 32, 421–435 (1988)

Wakker, P.P.: Unbounded utility for Savage’s “Foundations of Statistics” and other models. Math. Oper. Res. 18, 446–485 (1993)

Wakker, P.P.: Prospect Theory for Risk and Ambiguity. Cambridge University Press, Oxford (2010)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We are grateful to comments and suggestions from Frank Riedel, Alex Ludwig, an anonymous referee as well as from seminar participants at the Universities of Bielefeld, Frankfurt, Padova, Udine, and the ETH Zürich.

Appendix: Formal proofs

Appendix: Formal proofs

Proof of Proposition 1

The if-part We show that \( \lim _{n\rightarrow \infty }d_{k}\left( X,X_{n}\right) =0\) implies \( X_{n}\rightarrow _{\mu }X\). For an arbitrary \(\epsilon \) with \(0<\epsilon <k\) define the event

Because of

\(\lim _{n\rightarrow \infty }d_{k}\left( X,X_{n}\right) =0\) implies \( \lim _{n\rightarrow \infty }\mu \left( A_{n}\right) =0\).

The only-if part We show that \(X_{n}\rightarrow _{\mu }X\) implies \( \lim _{n\rightarrow \infty }d_{k}\left( X,X_{n}\right) =0\). For an arbitrary \( \epsilon \) with \(0<\epsilon <k\) pick some sufficiently fine partition such that \(\mu \left( A_{n}\right) <\epsilon \). Note that

For every \(\epsilon >0\) we have that \(X_{n}\rightarrow _{\mu }X\) implies \( \lim _{n\rightarrow \infty }\mu \left( A_{n}\right) =0\). Consequently, \( \lim _{n\rightarrow \infty }d_{k}\left( X,X_{n}\right) \le \epsilon \) for all \(\epsilon >0\) which proves the only-if part. \(\square \)

Proof of Lemma 1

Consider a rich set \(R\left( \mathcal {F}\right) \subseteq L\) such that \(Y\in \mathcal {F}\) as well as \(Y\in A\) for some open and convex \(A\subseteq \left( L,d_{k}\right) \). To prove the Lemma, we have to show that \(\mathcal {F}\subseteq A\).

Step 1 Fix some \(k>0\). Next, fix \(Y\in \mathcal {F}\) and consider an arbitrary \(X\in \mathcal {F}\). Since \(R\left( \mathcal {F}\right) \) is rich, we have

for \(n\ge 1\). Next note that

Consequently, we have for all \(Y_{i_{n}}\), \(i_{n}\in \left\{ 1,\ldots ,n\right\} \), that

where \(B_{\varepsilon }\left( Y;d_{k}\right) \) denotes an open ball around Y in \(\left( L,d_{k}\right) \) with radius \(\varepsilon .\)

Step 2 Fix any open set \(A\subseteq \left( L,d_{k}\right) \) such that \(Y\in A\). By definition, there must exist some sufficiently small \( \varepsilon >0\) such that

so that, by Step 1, \(Y_{i_{n}}\in A\) for all \(i_{n}\in \left\{ 1,\ldots ,n\right\} \) with \(n\ge \frac{k}{\varepsilon }\).

Step 3 Finally, note that convexity of A implies

which gives the desired result \(X\in A\) for any \(X\in \mathcal {F}\). \(\square \)

Proof of Theorem 1

Ad (i) Assume that \(S^{*}\left( X\right) \) is convex. Because of \(X\prec Y\), we have \(Y\in S^{*}\left( X\right) \). If \( S^{*}\left( X\right) \) was open, Lemma 1 implies that \(X\in S^{*}\left( X\right) \), a contradiction. Consequently, \(\preceq \) cannot be lower-semicontinuous in measure above X. \(\square \)

Ad (ii) Assume now that \(s^{*}\left( Y\right) \) is convex. Because of \(X\prec Y\), we have \(X\in s^{*}\left( Y\right) \). An open \( s^{*}\left( Y\right) \) would, by Lemma 1, imply the contradiction \(Y\in s^{*}\left( Y\right) \). Consequently, \(\preceq \) cannot be upper-semicontinuous in measure below Y. \(\square \)

Proof of Observation 2

If \(\preceq \) is not lower-semicontinuous above X, the strictly better set \(S^{*}\left( X\right) \) is not open. That is, there must exist some \(Y\in S^{*}\left( X\right) \) which is not an interior point of \(S^{*}\left( X\right) \), i.e., for all \( \delta >0\), there are Z such that

Let \(\delta _{n}=\frac{1}{n}\) and pick \(Y_{n}\in B_{\delta _{n}}\left( Y;d_{k}\right) \) such that \(Y_{n}\notin S^{*}\left( X\right) \). By (14), such \(Y_{n}\) exist for all \(n\ge 1\). This constructs a converging sequence \(\left\{ Y_{n}\right\} \), \(d_{k}\left( Y_{n},Y\right) \rightarrow 0\), such that \(Y_{n}\notin S^{*}\left( X\right) \) for all n, implying

Let

to see that, for all n,

But this violates (3) so that U is not lower-semicontinuous at Y. The argument for upper-semicontinuity proceeds analogously. \(\square \)

Proof of Observation 3(i)

If \(S^{*}\left( X\right) \) is empty, the result obtains trivially. Suppose therefore that \(Y,Z\in S^{*}\left( X\right) \) so that \(U\left( X\right) <U\left( Y\right) \) as well as \(U\left( X\right) <U\left( Z\right) \). If U is concave on a convex L, we have for any \(\lambda \in \left( 0,1\right) \)

implying

\(\square \)

Proof of Observation 4

If u is concave we have, for all \(\omega \) ,

Next observe that

which proves part (i). Part (ii) is proved analogously. \(\square \)

Rights and permissions

About this article

Cite this article

Zimper, A., Assa, H. Preferences over rich sets of random variables: on the incompatibility of convexity and semicontinuity in measure. Math Finan Econ 15, 353–380 (2021). https://doi.org/10.1007/s11579-020-00280-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-020-00280-z