Abstract

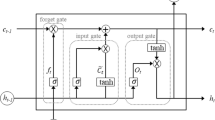

Deep Learning provides useful insights by analyzing information especially in the field of finance with advanced computing technology. Although, RNN–LSTM network with the advantage of sequential learning has achieved great success in the past for time series prediction. Conversely, developing and selecting the best computational optimized RNN–LSTM network for intra-day stock market forecasting is a real challenging task as a researcher. Since it analyses the most volatile data, requires to cope with two big factors such as time lag and the large number of architectural hyperparameters that affect the learning of the model. Furthermore, in addition to the design of this network, several former studies use trial and error based heuristic to estimate these factors which may not guarantee the most optimal network. This paper defines the solution to solve the above-mentioned challenging problems using the hybrid mechanism of the RNN–LSTM network integrating with a metaheuristic optimization technique. For this, a two-hybrid approach namely RNN–LSTM with flower pollination algorithm and RNN–LSTM with particle swarm optimization has been introduced to develop an optimal deep learning model to enhance the intra-day stock market prediction. This model suggests a systematic method which helps us with an automatic generation of optimized network. As the obtained network with tuned hyper parametric values-led towards a more precise learning process with the minimized error rate and accuracy enhancement. In addition, the comparative results evaluated over six different stock exchange datasets reflect the efficacy of an optimized RNN–LSTM network by attaining maximum forecasting accuracy approximately increment of 4–6% using the metaheuristic approach.

Similar content being viewed by others

References

Guo, Y., Liu, Y., Oerlemans, A., Lao, S., Wu, S., Lew, M.S.: Deep learning for visual understanding: a review. Neurocomputing 187, 27–48 (2016)

Chung, H., Shin, K.-S.: Genetic algorithm-optimized long short-term memory network for stock market prediction. Sustainability 10(10), 3765 (2018)

Baykasoğlu, A., Özbakır, L., Tapkan, P.: Artificial bee colony algorithm and its application to generalized assignment problem. In: Swarm intelligence, focus on ant and particle swarm optimization. IntechOpen 1, (2007)

Madasu, S.D., Kumar, M.S., Singh, A.K.: A lower pollination algorithm based automatic generation control of interconnected power system. Ain Shams Eng. J. 9(4), 1215–1224 (2016)

Tay, F.E., Cao, L.: Application of support vector machines in financial time series forecasting. Omega 29(4), 309–317 (2001)

Franses, P.H., Van Dijk, D.: Forecasting stock market volatility using (non-linear) garch models. J. Forecast. 15(3), 229–235 (1996)

Wei, L.-Y., Cheng, C.-H.: A hybrid recurrent neural networks model based on synthesis features to forecast the Taiwan stock market. Int. J. Innov. Comput. Inf. Control 8(8), 5559–5571 (2012)

Atsalakis, G.S., Valavanis, K.P.: Surveying stock market forecasting techniques-part II: soft computing methods. Expert Syst. Appl. 36(3), 5932–5941 (2009)

Kim, K.-J., Han, I.: Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index. Expert Syst. Appl. 19(2), 125–132 (2000)

Yu, H., Chen, R., Zhang, G.: A SVM stock selection model within PCA. Procedia Comput. Sci. 31, 406–412 (2014)

Gheyas, I.A., Smith, L.S.: A novel neural network ensemble architecture for time series forecasting. Neurocomputing 74(18), 3855–3864 (2011)

Patel, J., Shah, S., Thakkar, P., Kotecha, K.: Predicting stock market index using fusion of machine learning techniques. Expert Syst. Appl. 42(4), 2162–2172 (2015)

Ballings, M., Van den Poel, D., Hespeels, N., Gryp, R.: Evaluating multiple classifiers for stock price direction prediction. Expert Syst. Appl. 42(20), 7046–7056 (2015)

Lee, J., Jang, D., Park, S.: Deep learning-based corporate performance prediction model considering technical capability. Sustainability 9(6), 899 (2017)

Ding, X., Zhang, Y., Liu, T., Duan, J.: Deep learning for event-driven stock prediction. In: Twentyfourth international joint conference on artiicial intelligence 2327–2333, (2015)

Yoshihara, A., Fujikawa, K., Seki, K., Uehara, K.: Predicting stock market trends by recurrent deep neural networks. In: Paciic rim international conference on artiicial intelligence, pp. 759–769. Springer (2014)

Sezer, O.B., Ozbayoglu, M., Dogdu, E.: A deep neural-network based stock trading system based on evolutionary optimized technical analysis parameters. Procedia Comput. Sci. 114, 473–480 (2017)

Fischer, T., Krauss, C.: Deep learning with long short-term memory networks for financial market predictions. Eur. J. Oper. Res. 270(2), 654–669 (2018)

Hsieh, T.-J., Hsiao, H.-F., Yeh, W.-C.: Forecasting stock markets using wavelet transforms and recurrent neural networks: an integrated system based on artificial bee colony algorithm. Appl. Soft Comput. 11(2), 2510–2525 (2011)

Rather, A.M., Agarwal, A., Sastry, V.: Recurrent neural network and a hybrid model for prediction of stock returns. Expert Syst. Appl. 42(6), 3234–3241 (2015)

Kumar, K., Haider, M.T.U.: Blended computation of machine learning with the recurrent neural network for intra-day stock market movement prediction using a multi-level classifier. Int. J. Comput. Appl. 1–17 (2019)

Tsai, C.-F., Hsiao, Y.-C.: Combining multiple feature selection methods for stock prediction: union, intersection, and multi-intersection approaches. Decis. Support Syst. 50(1), 258–269 (2010)

Achelis, S.B.: Technical Analysis from A to Z. McGraw Hill, New York (2001)

Zhou, X., Pan, Z., Hu, G., Tang, S., Zhao, C.: Stock market prediction on high-frequency data using generative adversarial nets. Math. Probl. Eng. 2018, 1–11 (2018)

Arévalo, A., Ni no, J., Hernández, G., Sandoval, J.: High-frequency trading strategy based on deep neural networks. In: International conference on intelligent computing, pp. 424–436. Springer (2016)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors of the paper have no conflict of interest with any companies or institutions.

Human and animal rights statement

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Kumar, K., Haider, M.T.U. Enhanced Prediction of Intra-day Stock Market Using Metaheuristic Optimization on RNN–LSTM Network. New Gener. Comput. 39, 231–272 (2021). https://doi.org/10.1007/s00354-020-00104-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00354-020-00104-0