Abstract

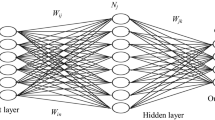

In this article, firstly the factors influencing the prices of cash market transactions on the basis of gold coin (Bahar Azadi coin) prices and futures contract trading on the Iran Mercantile Exchange are examined during a full year. Then, based on these factors, two new models for predicting the price of the futures contract of gold coin have been presented. These patterns are based on the general linear regression model in a vague and Z-based environment. To this end, regression estimation by the neural network with Z-number-based coefficients and D distance-based optimization technique and the Z-numbering method are used. We also compare some of the proposed methods in terms of efficiency with our previous method (which is the only method available to estimate regression coefficients). We show that the proposed method in this paper has less accuracy and less computational cost. It shows that the new proposed method has better accuracy and less computational cost. Finally, in two practical examples the price of forthcoming coins is anticipated.

Similar content being viewed by others

References

Allahviranloo, T.: Advanced Uncertainty and Linear Equations, Uncertain Information and Linear Systems. Studies in Systems, Decision and Control, vol. 254, pp. 211–254. Springer, Cham (2020)

Alive, R.A., Alizadeh, A.V., Huseynov, O.H.: The arithmetic of discrete Z-numbers. Inf. Sci. 290, 134–155 (2015)

Alive, R.A., Huseynov, O.H., Alive, R.R., Alizadeh, A.V.: The Arithmetic of Z-Numbers. Theory and Applications. World Scientific, Singapore (2015)

Alive, R.A., Huseynov, O.H., Serdaroglu, R.: Ranking of Z-numbers, and its application in decision making. Int. J. Inf. Technol. Decis. Mak. 15, 1503–1519 (2016)

Bakar, A.S.A., Gegov, A.: Multi-layer decision methodology for ranking Z-numbers. Int. J. Comput. Intell. Syst. 8, 395–406 (2015)

Bardossy, A.: Note on fuzzy regression. Fuzzy Sets Syst. 37, 65–75 (1990)

Bardossy, A., Bogardi, I., Duckstein, L.: Fuzzy regression in hydrology. Water Resour. Res. 26, 1497–1508 (1990)

Blose, L.E.: Gold prices, cost of carry, and expected inflation. J. Econ. Bus. 62(1), 35–47 (2010)

Cheng, C.B., Lee, E.S.: Fuzzy regression with radial basis function network. Fuzzy Sets Syst. 119(2), 291–301 (2001)

Coppi, R.: Management of uncertainty in statistical reasoning: the case of regression analysis. Int. J. Approx. Reason. 47(3), 284–305 (2008)

Diamond, P.: Fuzzy least squares. Inf. Sci. 46, 141–157 (1988)

Ezadi, S., Allahviranloo, T.: Numerical solution of linear regression based on Z-numbers by improved neural network. Intell. Autom. Soft Comput. 24(1), 1–11 (2017)

Ezadi, S., Allahviranloo, T.: New multi-layer method for Z-number ranking using hyperbolic tangent function and convex combination. Intell. Autom. Soft Comput. 24(1), 1–7 (2017)

Ezadi, S., Allahviranloo, T.: Two new methods for ranking of Z-numbers based on sigmoid function and sign method. Int. J. Intell. Syst. 33(7), 1476–1487 (2018)

Kang, B., Wei, D., Li, Y., Deng, Y.: Decision making using Z-numbers under uncertain environment. J. Comput. Inf. Syst. 7, 2807–2814 (2012)

Hojati, M., Bector, C.R., Smimou, K.A.: Simple method of fuzzy linear regression. Eur. J. Oper. Res. 166, 172–184 (2005)

Kang, B., Wei, D., Li, Y., Deng, Y.: A method of converting Z-number to classical fuzzy number. J. Inf. Comput. Sci. 3, 703–709 (2012)

Kao, C., Chyu, C.L.: Least-squares estimates in fuzzy regression analysis. Eur. J. Oper. Res. York 148, 426–435 (2003)

Liu, C., Nocedal, J.: On the limited memory BFGS method for large scale optimization. Math. Program. 45(3), 503–528 (1989)

Modarres, M., Nasrabadi, E., Nasrabadi, M.M.: Fuzzy linear regression models with least square errors. Appl. Math. Comput. 163, 977–989 (2005)

Mohamad, D., Shaharani, S.A., Kamis, N.H.: A Z-number based decision making procedure with ranking fuzzy numbers method. AIP Conf. Proc. 1635, 160–166 (2014)

Mosleh, M., Allahviranloo, T., Otadi, M.: Evaluation of fully fuzzy regression models by fuzzy neural network. Neural Comput. Appl. 21, 105–112 (2012)

Mosleh, M., Otadi, M., Abbasbandy, S.: Fuzzy polynomial regression with fuzzy neural networks. Appl. Math. Model. 35, 5400–5412 (2011)

Mohammadi, J., Taheri, S.M.: Pedomodels fitting with fuzzy least squares regression. Iran. J. Fuzzy Syst. 1(2), 45–61 (2004)

MelekAcarBoyacioglu, A., Avci, D.: An adaptive network-based fuzzy inference system (ANFIS) for the prediction of stock market return: the case of the Istanbul Stock Exchange. Expert Syst. Appl. 37, 7908–7912 (2010)

Mashhadizadeh, M., Dastgir, M., Salahshour, S.: Economic appraisal of investment projects in solar energy under uncertainty via fuzzy real option approach (case study: a 2-MW photovoltaic plant in south of Isfahan, Iran). Adv. Math. Finance Appl. 3(4), 29–51 (2018)

Nouriani, H., Ezzati, R.: The subject of the article is said: application of Simpson quadrature rule and iterative method for solving nonlinear fuzzy delay integral equations. Fuzzy Sets Syst. (2020) (in press)

Pousti, F., Sadeghiani, J.: An econometrics method for estimating gold coin futures prices. Manag. Sci. Lett. 1, 621–630 (2011)

Rohaninasab, N., Maleknejad, K., Ezzati, R.: Numerical solution of high-order Volterra-Fredholm integro-differential equations by using Legendre collocation method. Appl. Math. Comput. 328(c), 171–188 (2018)

Rahaman, M., Mondal, S.P., Shaikh, A.A., Ahmadian, A., Senu, N., Salahshour, S.: Arbitrary-order economic production quantity model with and without deterioration: generalized point of view. Adv. Differ. Equ. 16, 1–30 (2020)

Peters, G.: Fuzzy linear regression with fuzzy intervals. Fuzzy Sets Syst. 63, 45–55 (1994)

Rosenblatt, F.: Principles of Neuro dynamics. Perceptrons and the Theory of Brain Mechanisms, pp. 242–248. Spartan Books, Washington, DC (1962)

Savic, D.A., Pedrycz, W.: Evaluation of fuzzy linear regression models. Fuzzy Sets Syst. 39, 51–63 (1991)

Shirian, J., ÖzgurKis-i, B.: Comparison of genetic programming with neuro-fuzzy systems for predicting short-term water table depth fluctuations. Comput. Geosci. 37, 1692–1701 (2011)

Shafiee, S., Topal, E.: An overview of global gold market and gold price forecasting. Resour. Policy 35(3), 178–189 (2010)

Salahshour, S., Allahviranloo, T., Abbasbandy, S.: Solving fuzzy fractional differential equations by fuzzy Laplace transforms. Commun. Nonlinear Sci. Numer. Simul. 17(3), 1372–1381 (2012)

Sarkar, B., Mondal, S.P., Hur, S., Ahmadian, A., Salahshour, S., Guchhait, R., Waqas Iqbal, M.: An optimization technique for national income determination model with stability analysis of differential equation in discrete and continuous process under the uncertain environment. RAIRO Oper. Res. 53, 1649–1674 (2019)

Shaikh, A.H., Zahid, I.: Using neural networks for forecasting volatility of S&P 500 Index futures prices. J. Bus. Res. 57(10), 1116–1125 (2004)

Tanaka, H., Havashi, I., Watada, J.: Possibilistic linear regression analysis for fuzzy data. Eur. J. Oper. Res. 40, 389–396 (1989)

Tanaka, H., Uejima, S., Asai, K.: Linear regression analysis with fuzzy model. IEEE Trans. Syst. Man Cybern. 12(6), 903–907 (1982)

Tabrizi, H.A., Panahian, H.: Stock price prediction by artificial neural networks: a study of Tehran’s Stock Exchange (T.S.E), pp. 1–7. Hand Research Foundation (2013). http://www.handresearch.org/

Tully, E., Lucey, B.M.: A power GARCH examination of the gold market. Res. Int. Bus. Finance 21(2), 316–325 (2007)

Yager, R.R.: On Z-valuations using Zadeh’s Z-numbers. Int. J. Intell. Syst. 27, 259–278 (2012)

Zadeh, L.A.: Fuzzy sets. Inf. Control 8, 338–353 (1965)

Zadeh, L.A.: A note on Z-numbers. Inf. Sci. 181, 2923–2932 (2011)

Zhang, Y.J., Wei, Y.M.: The crude oil market and the gold market: evidence for cointegration, causality and price discovery. Resour. Policy 35(3), 168–177 (2010)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Daryakenari, N., Allahviranloo, T. & Nouri, M. Providing a model for predicting futures contract of gold coin price by using models based on Z-numbers. Math Sci 15, 215–228 (2021). https://doi.org/10.1007/s40096-020-00347-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40096-020-00347-4