Abstract

In the general equilibrium with incomplete asset markets (GEI) model, the excess demand functions are typically not continuous at the prices for which the assets have redundant returns. The reason is that, at these prices, the return matrix drops rank and households’ budget sets collapse suddenly. This discontinuity results in a serious problem for the existence and computation of general equilibrium. In this paper, we show that this problem can be resolved with a new return matrix, which has constant rank. As a function of the price vector, the continuity of this new return matrix is ensured on a subset of the price space. This enables us to handle incomplete markets using a standard homotopy path-following argument by restricting the price vector to such a subset. The proposed approach naturally provides a constructive proof for the generic existence of general equilibrium. A homotopy method can then be applied to compute equilibria in the GEI model. Numerical experiments are presented to illustrate its efficiency.

Similar content being viewed by others

Notes

As argued in [21], “due to its reliance on the Grassmann manifold the algorithm by [5] is very difficult to implement and to apply”; “while [3] do not have this problem, their concept of switching homotopies is uncommon”; “both the algorithm by [5] and the one by [3] have each been applied to only one very specialized example.”

All these methods are classified as homotopy methods. This is not to say that only homotopy methods can be applied for computing an equilibrium. See Esteban–Bravo [9] for an efficient interior-point algorithm for GEI model under some mild (but not generic) assumptions, and [14] for variational inequalities techniques for a finance version of incomplete markets.

Since the index is homotopy invariant, the index theorem follows immediately if a homotopy method is constructed.

\(p_s\) are nominal prices rather than present-value prices.

In the literature, there are several standard assumptions on utility functions: \(u_h\) is smooth (\(u_h\in C^{\infty }\)); \(\nabla u_h(x)\in {\mathbb {R}}^M_{++}\) for all \(x\in {\mathbb {R}}^M_{++}\); \(\left\{ x\in {\mathbb {R}}^M_{++}\;|\;u_h(x)\ge u_h(\bar{x})\right\} \) is closed in \({\mathbb {R}}^M\) for all \(\bar{x}\in {\mathbb {R}}^M_{++}\); \(h^{\top }\nabla ^2u_h(x)h<0\) for all \(h\ne 0\) with \(\nabla u_h(x)^{\top }h=0\). We also adopt these assumptions in this paper.

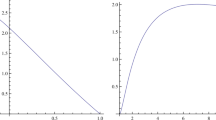

This figure is extracted from the Figure 3 in [3].

See “Appendix A”.

At a bad price, \(\beta _2\) and \(\beta _3\) are not unique. Any vector orthogonal to \(\beta _1\) is an eigenvector corresponding to zero eigenvalue. This non-uniqueness is of serious concern in this paper.

For a complete market, i.e. \(N=S\), things are much easier, since zero will be a simple eigenvalue and the corresponding eigenvector is a smooth function of p.

The proof for this lemma is trivial. According to the definition of \(a_i(p)\), we have \(a_i(p)=\sum _{N<r\le S}(\beta _r(p)^\top Y^u(p))\beta _r(p)+(\beta _i(p)^\top Y^u(p))\beta _i(p)\), where both \(\beta _i(p)\) and \(\beta _r(p)\) for \(N<r\le S\) are eigenvectors corresponding to zero eigenvalue.

\(-\widetilde{\beta }\) is also an eigenvector corresponding to a zero eigenvalue. The negative sign does not change the span.

\(1/\sqrt{3}\approx 0.577350\).

At \(t=0\), \(tT(p)=\mathbf{0}\). That is, the households are forbidden to trade across contingent commodities in different states. The whole economy can be separated as \(S+1\) Arrow–Debreu markets.

\({p^0} \in E\) since \({Y^u}({p^0}) = {P_1}{Z^u}({p^0}) = - {P_1}{Z^c}({p^0},0) = - tT({p^0}){\sum _{h \ne u}}{\xi ^h} = \mathbf{0} \).

The algorithm is coded and implemented in MATLAB on a desktop PC (3.4 GHz).

As argued in Sect. 4.2, such a homotopy system may not be a good choice to achieve numerical efficiency. The number of iterations depends on the parameters for predictor–corrector process. In this example, parameters are chosen to make the predictor step short and precise, since we want to see how the path passes through bad prices.

As stated in [3], the criterion “is chosen to tradeoff the computational inefficiency of switching with the potential for numerical instability near a bad point.”

It was shown in [19] that the index theorem does not hold when the incompleteness is odd. This fact rules out the possibility to construct a single smooth homotopy path on \(\triangle ^M_{++}\times [0,1]\). However, in this paper, the homotopy is built on a submanifold of the price simplex. The index theorem restricted on such a submanifold follows immediately.

See [13] for a variational inequality approach on the Arrow–Debreu market.

It is straight forward to see that \(\left\{ AA^{\top }\phi \;|\;\phi \in {\mathbb {R}}^m\right\} \subseteq \left\{ A\theta \;|\;\theta \in {\mathbb {R}}^n\right\} \). For any \(A\theta \) with \(\theta \in {\mathbb {R}}^n\), there exists a \(\phi \in {\mathbb {R}}^m\) with \(AA^\top \phi =A\theta \) if \(\text {rank }AA^\top =\text {rank }[AA^\top ,\;A\theta ]\). Clearly, \(\text {rank }AA^\top \le \text {rank }[AA^\top ,\;A\theta ]=\text {rank }A[A^\top ,\;\theta ]\le \text {rank }A=\text {rank }AA^\top \). Thus, we have \(\left\{ AA^{\top }\phi \;|\;\phi \in {\mathbb {R}}^m\right\} \supseteq \left\{ A\theta \;|\;\theta \in {\mathbb {R}}^n\right\} \).

The idea is from the proof for Theorem V, [3].

References

Allgower, E.L., Georg, K.: Numerical Continuation Methods: An Introduction. Springer, New York (1990)

Anderson, R.M., Raimondo, R.C.: Incomplete markets with no hart points. Theor. Econ. 2(2), 115–133 (2007)

Brown, D.J., Demarzo, P.M., Eaves, B.C.: Computing equilibria when asset markets are incomplete. Econometrica 64(1), 1–27 (1996)

Cass, D.: Competitive equilibrium with incomplete financial markets. J. Math. Econ. 42(4–5), 384–405 (2006)

DeMarzo, P.M., Eaves, B.C.: Computing equilibria of GEI by relocalization on a Grassmann manifold. J. Math. Econ. 26(4), 479–497 (1996)

Dubey, P., Geanakoplos, J., Shubik, M.: Default and punishment in general equilibrium. Econometrica 73(1), 1–37 (2005)

Duffie, D., Shafer, W.: Equilibrium in incomplete markets: I: a basic model of generic existence. J. Math. Econ. 14(3), 285–300 (1985)

Eaves, B.C., Schmedders, K.: General equilibrium models and homotopy methods. J. Econ. Dyn. Control 23(9), 1249–1279 (1999)

Esteban-Bravo, M.: An interior-point algorithm for computing equilibria in economies with incomplete asset markets. J. Econ. Dyn. Control 32(3), 677–694 (2008)

Hart, O.D.: On the optimality of equilibrium when the market structure is incomplete. J. Econ. Theory 11(3), 418–443 (1975)

Herings, P.J.J., Kubler, F.: Computing equilibria in finance economies. Math. Oper. Res. 27(4), 637–646 (2002)

Herings, P.J.J., Peeters, R.: Homotopy methods to compute equilibria in game theory. Econ. Theor. 42(1), 119–156 (2010)

Jofré, A., Rockafellar, R.T., Wets, R.J.-B.: Variational inequalities and economic equilibrium. Math. Oper. Res. 32(1), 32–50 (2007)

Jofré, A., Rockafellar, R.T., Wets, R.J.-B.: Convex analysis and financial equilibrium. Math. Program. 148(1–2), 223–239 (2014)

Kubler, F., Schmedders, K.: Computing equilibria in stochastic finance economies. Comput. Econ. 15(1), 145–172 (2000)

Lee, J.M.: Introduction to Smooth Manifolds. Springer, New York (2012)

Magill, M., Quinzii, M.: Theory of Incomplete Markets. MIT Press, Cambridge (1998)

Mas-Colell, A.: The Theory of General Economic Equilibrium: A Differentiable Approach. Cambridge University Press, Cambridge (1989)

Momi, T.: Failure of the index theorem in an incomplete market economy. J. Math. Econ. 48(6), 437–444 (2012)

Ross, S.A.: Return, risk, and arbitrage. In: Friend, I., Bicksler, J. (eds.) Risk and Return in Finance. Cambridge: Ballinger (1977)

Schmedders, K.: Computing equilibria in the general equilibrium model with incomplete asset markets. J. Econ. Dyn. Control 22(8), 1375–1401 (1998)

Acknowledgements

This work was completed while Yang Zhan was visiting the Chair of Quantitative Business Administration, University of Zurich, hosted by Karl Schmedders. We are also grateful to Jean-Jacques Herings, Kenneth Judd, Felix Kubler and Dolf Talman for their very helpful comments that resulted in numerous improvements.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was partially supported by GRF: CityU 11304620 of Hong Kong SAR Government.

Appendix

Appendix

1.1 A. Linear algebra

For a real matrix \(A\in {\mathbb {R}}^{m\times n}\),

-

\(AA^\top \in {\mathbb {R}}^{m\times m}\) is positive semi-definite, since for any \(x\in {\mathbb {R}}^m\), \(x^\top AA^\top x = \left\Vert A^\top x\right\Vert \ge 0\);

-

with any matrix \(B\in {\mathbb {R}}^{m\times t}\), rank \(A\le \) rank \([A,\;B]\), and with any matrix \(C\in {\mathbb {R}}^{n\times t}\), rank \(A\ge \) rank AC;

-

rank \(A=\) rank \(A^\top =\) rank \(AA^\top =\) rank \(A^\top A\); and

-

span \(A=\) span \(AA^\top \), i.e. \(\left\{ A\theta \;|\;\theta \in {\mathbb {R}}^n\right\} =\left\{ AA^{\top }\phi \;|\;\phi \in {\mathbb {R}}^m\right\} \).Footnote 20

1.2 B. Some useful theorems

For completeness, below we state several useful theorems.

Theorem 3

(Regular Level Set, [16]) Every regular level set of a smooth map is a closed embedded submanifold whose codimension is equal to the dimension of the range.

Theorem 4

(Transversality, [18]) Suppose U and W are \(C^r\) manifolds and \(f:U\times W\rightarrow {\mathbb {R}}^k\) is a \(C^r\) function with \(r>\text {dim }U-k\). If y is a regular value of f, then for almost every \(w\in W\), \(f(\cdot ,w)\) has y as a regular value.

Theorem 5

(Generalized implicit function theorem, Theorem I in [3]) Let \(F:U\rightarrow {\mathbb {R}}^m\) be a smooth function on the manifold \(\mu \in U\). Let \(\Pi :U\rightarrow {\mathbb {R}}^{t\times m}\) and \(G:U\rightarrow {\mathbb {R}}^{t\times n}\) be smooth functions such that, for all \(\mu \in U\), \(\Pi (\mu )\) and \(G(\mu )\) have constant rank t and n respectively. If:

-

1.

\(F=0\) implies rank DF is at least \(k=m+n-t\), and,

-

2.

\(\Pi (\mu )F(\mu )\in \) span \(G(\mu )\) for all \(\mu \),

then \(F^{-1}(0)\) is a smooth submanifold of U with codimension k. In addition, rank \(DF=k\) on this set.

In the proof of Lemma 6, we need to apply the generalized implicit function theorem with \(m=M-1\), \(n=N\), \(t=S\) and \(k=M+N-S-1\).

1.3 C. Proofs

We will show that generically the path will not run into a doubly bad price.Footnote 21

Proof

Suppose there exists a sequence in the path that converges to a point \((p^*,t^*)\) where \(p^*\) is a doubly bad price. The excess demand \(\tilde{Z}^h(p,T(p),t)\) will converge to \(\tilde{Z}^h(p^*,G,t^*)\), where G is the limit of T(p) along the path. Since T(p) always has rank N, its span must converge to some N-dimensional subspace of \({\mathbb {R}}^S\). That is,

where \(\Phi \) is a permutation matrix and \(V\in {\mathbb {R}}^{(S-N)\times N}\). Therefore, we have

where \(\Gamma \in {\mathbb {R}}^{N\times N}\) is a diagonal matrix. At a doubly bad price, the eigenvalues of G will be uniquely determined by \(R(p^*)R(p^*)^\top \) and \(t^*\). Then, \(\Gamma \) is uniquely determined by \(p^*\), V and \(t^*\). Note that \(\Gamma \) is a smooth function of \((p^*,V,t^*)\), since \(\Phi [I\quad V^\top ]^\top \) always has full rank N. Thus, G can be regarded as a smooth function of \((p^*,V,t^*)\). From the continuity of \(\tilde{Z}^h\) we have

As a doubly bad price, there exist at least two columns being redundant, say the ith and the jth, of the matrix \([R(p^*)\; Y^u(p^*)]\). (the case that \(Y^u(p)\in R(p)\) at a bad price can be treated in a similar way, so omitted here.) Then, we have

for some vector \(\alpha _1\) and \(\alpha _2\) in a unit sphere of \({\mathbb {R}}^N\). For \(G(p^*,V,t^*)\), each column of \([R(p^*)\; Y^u(p^*)]\) must be in the span of \(G(p^*,V,t^*)\). Thus, we have

The four equations above are a system of \(M-1+2S+(S-N)(N-2)\) equations with unknowns \((p^*,t^*,V,\alpha _1,\alpha _2)\). These unknowns belong to a manifold of dimension \(M+(S-N)N+2(N-1)\). Note that from Lemma 3 the left side of (12) is smooth and we do not need to restrict the price to be in E. Taking derivative of (12) with respect to \(\omega ^0\) shows it has rank \(M-1\); taking the derivative of (13) and (14) with respect to \(A_j\) and \(A_i\), respectively, shows them each to have rank S; taking derivative of (15) with respect to \(A_{-ij}\) shows it has rank \((S-N)(N-2)\). Then, generically the set of solutions is a manifold of

which means that generically these equations have no solution and the path will not converge to a doubly bad price. \(\square \)

The following proves that the path will generically converge to a good price at \(t=1\).

Proof

Suppose by contradiction that \({p}^*\in \triangle _b\). From the continuity of the homotopy, we have

Since \(T(p^*)\) is only smooth on E, we shall replace it with another positive semi-definite matrix G. Similar to the approach used in the previous proof, G can be defined as (11), where it is a function of \(p^*\) and V. That is, we have \(T(p^*,1)=G(p^*,V)\) for some \(V\in {\mathbb {R}}^{(S-N)\times N}\). Then, from the equation above, we have

Since the left side is smooth for any \(p\in \triangle ^M_{++}\), parameters \(\chi _0\) can be used in applying the transversality theorem. At a bad price \(p^*\), suppose the ith column of R(p) is redundant, we have

where \(\alpha \) is a vector in the unit sphere of \({\mathbb {R}}^N\). According to the definition of T(p), each column of R(p) and \(Y^u(p)\) must be in the span of \(G(p^*,V)\), we have

For the three equations above, the unknowns \((p^*,V,\alpha )\) belong to a manifold of dimension \(M-1+(S-N)N+N-1\). Taking derivatives with respect to \(\omega ^h\) for some constrained household, to \(A_{i}\), and to \(A_{-i}\) and \(\omega ^0\), respectively, shows that they have rank \(M+N-S-1\), S, and \((S-N)N\). Therefore, the set of solutions of these three equations is generically a manifold of dimension

This completes the proof. \(\square \)

1.4 D. An explanation on Example 3

It was shown in [17] that the model of a stochastic finance economy can essentially be reduced to a two-period model with many goods (the GEI model studied in this paper). Only slightly changes in our algorithm are necessary to compute equilibria for multi-period models. For the particular problem in Example 3, the parameters (endowments and payoffs) are listed in Table 4, where \(\pi ^j_{t,s}\) indicates the price of asset j at (t, s). Under the assumption of no-arbitrage, the asset prices can be determined by the dividends and state prices \(p\in {\mathbb {R}}^M_{++}\), that is

where \(\mathscr {D}_{t,s}\) is the set of states that can occur after (t, s). The five columns (\(r^{stock}\)) indicate the payoffs (in the commodity) of the stock in the \(M=21\) states. Together with that for asset 1 (the bond), we can construct the payoff matrix \(W(\pi )\in {\mathbb {R}}^{M\times N}\), where \(N=10\) is the total number of assets traded. \(r^{bond}_{1,1}\), \(r^{bond}_{1,2}\) and \(r^{bond}_{1,4}\) are not listed in the table. The nominal return matrix \(R(p)\in {\mathbb {R}}^{(M-1)\times N}\) in this model is given by \(R(p)=P_1 W(\pi )\), where \(P_1\in {\mathbb {R}}^{(M-1)\times M}\) is constructed by deleting the first row of diag(p). R(p) is clearly a linear function of price vector p. This stochastic finance economy can be analyzed in the same framework of the standard GEI model, that is, households are facing problem (2), where the return matrix R(p) is formulated in a different way.

Rights and permissions

About this article

Cite this article

Zhan, Y., Dang, C. A smooth homotopy method for incomplete markets. Math. Program. 190, 585–613 (2021). https://doi.org/10.1007/s10107-020-01551-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10107-020-01551-9