Abstract

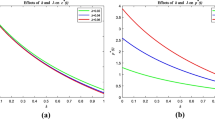

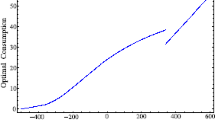

We investigate the optimal consumption, portfolio, and life insurance decisions problem of a liquidity constrained household whose preference is given by the CES (constant elasticity of substitution) utility function. By applying the martingale and duality method, we obtain the closed-form solution for the household’s value function and optimal strategies. We provide a rigorous proof for the optimality of the strategies. We exhibit comparative static results of the optimal decisions with respect to the elasticity of substitution between consumption and leisure.

Similar content being viewed by others

References

Ahn, S., Choi, K.J., Lim, B.H.: Optimal consumption and investment under time-varying liquidity constraints. J. Financ. Quant. Anal. 54, 1643–1681 (2019)

Bensoussan, A., Jang, B.-G., Park, S.: Unemployment risks and optimal retirement in an incomplete market. Oper. Res. 64, 1015–1032 (2016)

Choi, K.J., Shim, G., Shin, Y.H.: Optimal portfolio, consumption-leisure and retirement choice problem with CES utility. Math. Financ. 18, 445–472 (2008)

Dybvig, P.H., Liu, H.: Lifetime consumption and investment: retirement and constrained borrowing. J. Econ. Theory 145, 885–907 (2010)

Dybvig, P.H., Liu, H.: Verification theorems for models of optimal consumption and investment with retirement and constrained borrowing. Math. Oper. Res. 36, 620–635 (2010)

El Karoui, N., Jeanblanc-Picqué, M.: Optimization of consumption with labor income. Financ. Stoch. 2, 409–440 (1998)

Farhi, E., Panageas, S.: Saving and investing for early retirement: a theoretical analysis. J. Financ. Econ. 83, 87–121 (2007)

He, H., Pagès, H.F.: Labor income, borrowing constraints, and equilibrium asset prices. Econ. Theory 3, 663–696 (1993)

Jang, B.-G., Koo, H.K., Park, S.: Optimal consumption and investment with insurer default risk. Insur. Math. Econ. 88, 44–56 (2019)

Koo, H.K.: Consumption and portfolio selection with labor income: a continuous time approach. Math. Financ. 8, 49–65 (1998)

Karatzas, I., Shreve, S.E.: Methods of Mathematical Finance. Springer, New York (1998)

Lee, H.S., Shin, Y.H.: An optimal portfolio, consumption-leisure and retirement choice problem with CES utility: a dynamic programming approach. J. Inequal. Appl. 2015, 319 (2015)

Lee, H.S., Shim, G., Shin, Y.H.: Borrowing constraints, effective flexibility in labor supply, and portfolio selection. Math. Financ. Econ. 13, 173–208 (2019)

Lim, B.H., Kwak, M.: The impact of a partial borrowing limit on financial decisions. Quant. Financ. 19, 859–883 (2019)

Lim, B.H., Shin, Y.H.: Optimal investment, consumption and retirement decision with disutility and borrowing constraints. Quant. Financ. 11, 1581–1592 (2011)

Merton, R.C.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ. Stat. 51, 247–257 (1969)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3, 373–413 (1971)

Merton, R.C.: An intertemporal capital asset pricing model. Econometrica 41, 867–887 (1973)

Park, S., Jang, B.: Optimal retirement strategy with a negative wealth constraint. Oper. Res. Lett. 42, 208–212 (2014)

Vila, J.-L., Zariphopoulou, T.: Optimal consumption and portfolio choice with borrowing constraints. J. Econ. Theory 77, 402–431 (1997)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Lim was supported by the National Research Foundation of Korea Grant funded by the Korean Government (NRF-2017R1E1A1A03071107). The work of Ho-Seok Lee was supported by the National Research Foundation of Korea Grant funded by the Korean Government (NRF-2019R1F1A1060853) and by the Research Grant of Kwangwoon University in 2020.

About this article

Cite this article

Lim, B.H., Lee, HS. Household utility maximization with life insurance: a CES utility case. Japan J. Indust. Appl. Math. 38, 271–295 (2021). https://doi.org/10.1007/s13160-020-00437-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13160-020-00437-9