Abstract

In this article, the authors develop a Stock Price Network Autoregressive Model (SPNAR) to probe the behavior of the log-return based network of the Chinese stock market. We consider 105 companies of Shanghai and Shenzhen stock market, CSI300, during the steep sell-off in 2015–2016. This model is based on three effects of previous time effect, market effect, and independent noise effect. The results show that the accuracy and performance of this model are more than some time series models like Autoregressive (AR), Moving Average (MA), Autoregressive Moving Average (ARMA), and Vector Autoregressive (VAR) models. Furthermore, the parameter estimation in SPNAR model is more convenient and feasible than time series models as mentioned earlier. Moreover, In this article, the characteristics of three various periods, pre-turbulence, turbulence, and post-turbulence are analyzed, and findings show there is a significant difference between turbulence period with other periods in topological structure and the behavior of the networks.

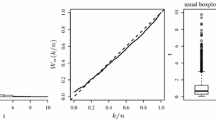

Graphical abstract

Similar content being viewed by others

References

R. Albert, A.-L. Barabási, Rev. Mod. Phys. 74, 47 (2002)

R.N. Mantegna, Eur. Phys. J. B 11, 193 (1999)

D. Hartman, J. Hlinka, Chaos 28, 083127 (2018)

J.P. Onnela, A. Chakraborti, K. Kaski, J. Kertesz, A. Kanto, Phys. Scr. 2003, 48 (2003)

M. Tumminello, F. Lillo, R.N. Mantegna, J. Econ. Behav. Organ. 75, 40 (2010)

T. Heimo, J. Saramäki, J.P. Onnela, K. Kaski, Physica A 383, 147 (2007)

S.L. Gan, M.A. Djauhari, J. Stat. Mech. Theor. Exp. 2015, P12005 (2015)

W.-Q. Huang, X.-T. Zhuang, S. Yao, Physica A 388, 2956 (2009)

H. Qiao, Y. Xia, Y. Li, PLoS ONE 11, e0156784 (2016)

H. Long, J. Zhang, N. Tang, PLoS ONE 12, e0180382 (2017)

A. Vizgunov, B. Goldengorin, V. Kalyagin, A. Koldanov, P. Koldanov, P.M. Pardalos, Comput. Manag. Sci. 11, 45 (2014)

S. Radhakrishnan, A. Duvvuru, S. Sultornsanee, S. Kamarthi, Physica A 444, 259 (2016)

J. Birch, A.A. Pantelous, K. Soramäki, Comput. Econ. 47, 501 (2016)

P. Fiedor, Phys. Rev. E 89, 052801 (2014)

P. Fiedor, Acta Phys. Polonica A 127, A33 (2015)

R. Zhuang, B. Hu, Z. Ye, Minimal spanning tree for Shanghai-Shenzhen 300 stock Index., in2008 IEEE Congress on Evolutionary Computation, 2008, pp. 1417–1424

M. Gała̧zka, Int. Rev. Finan. Anal. 20, 1 (2011)

C. Coronnello, M. Tumminello, F. Lillo, S. Miccichè, R.N. Mantegna, Acta Phys. Polonica B 36, 66010T (2007)

F.X. Diebold, K. Yilmaz,Financial and Macroeconomic Connectedness (Oxford University Press, Oxford, 2015)

M. Majapa, S.J. Gossel, Physica A 445, 35 (2016)

A. Nobi, S.E. Maeng, G.G. Ha, J.W. Lee, Physica A 407, 135 (2014)

R.H. Heiberger, Physica A 393, 376 (2014)

L. Sandoval, Entropy 16, 4443 (2014)

A. Rai, A. Bansal, A.S. Chakrabarti, Eur. Phys. J. B 92, 239 (2019)

L. Yu, X.W. Hu, K. Guo, Procedia Comput. Sci. 55, 422 (2015)

A. Sioofy, D. Han, Physica A 523, 1091 (2019)

Y. Tang, J.J. Xiong, Z.-Y. Jia, Y.-C. Zhang, Complexity 2018, 4680140 (2018)

M. Iosifescu.Finite Markov Processes and Their Applications. (Dover Publications, Mineola, New York, 2014)

M. Tumminello, T. Aste, T. Di Matteo, R.N. Mantegna, Proc. Natl. Acad. Sci. 102, 10421 (2005)

G.P. Massara, T. Di Matteo, J. Complex Netw. 5, 161 (2017)

R. Diestel,Graph Theory, 5th edn. (Springer, Berlin, 2017)

S.K.R. Unnithan, B. Kannan, M. Jathaveda, Int. J. Combinator 2014, 241723 (2014)

F.W. Takes, W.A. Kosters, Algorithms 6, 100 (2013)

A. Barrat, M. Barthelemy, R. Pastor-Satorras, A. Vespignani, Proc. Natl. Acad. Sci. 101, 3747 (2004)

L.C. Freeman, Social Netw. 1, 215 (1978)

P. Bonacich, P. Lloyd, Social Netw. 23, 191 (2001)

P. Bonacich, Am. J. Sociol. 92, 1170 (1987)

E. Estrada, Phys. Rev. E 71, 056103 (2005)

E. Estrada, N. Hatano, Phys. Rev. E 77, 036111 (2008)

J.J. Crofts, D.J. Higham, J. Roy. Soc. Interf. 6, 411 (2009)

M.E.J. Newman, Phys. Rev. E 67, 026126 (2003)

C. Chen, J. Twycross, J.M. Garibaldi, PLOS ONE 12, e0174202 (2017)

V. Boginski, S. Butenko, P.M. Pardalos, Comput. Stat. Data Anal. 48, 431 (2005)

N. Vandewalle, F. Brisbois, X. Tordoir, Quant. Finan. 1, 372 (2001)

H.-J. Kim, I.-M. Kim, Y. Lee, B. Kahng, J. Korean Phys. Soc. 40, 1105 (2002)

A. Clauset, C.R. Shalizi, M.E.J. Newman, SIAM Rev. 51, 661 (2009)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

The EPJ Publishers remain neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Khoojine, A.S., Han, D. Stock price network autoregressive model with application to stock market turbulence. Eur. Phys. J. B 93, 133 (2020). https://doi.org/10.1140/epjb/e2020-100419-9

Received:

Revised:

Published:

DOI: https://doi.org/10.1140/epjb/e2020-100419-9