Abstract

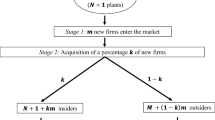

This paper proposes a dynamic model for the process of industry consolidation by sequences of mergers and acquisitions that create synergy gains to merging firms and may impose positive or negative externalities on the remaining firms in the industry. We allow firms to make acquisition offers that are conditional and unconditional on acceptances of target firms, instead of the usual conditional offers. We show that this expansion of the offer set results in faster and more economically efficient industry consolidations, as acquirers do not have to trade-off surplus extraction and efficiency. The acquirer can make surplus maximizing merger offers conditional to acceptances, and simultaneously capture efficiency gains by making unconditional offers to the remaining firms. We characterize the Markov perfect equilibrium and show that equilibrium always exists and is Pareto efficient. Finally, to illustrate the model and our main findings, we show that the equilibrium is unique in industries with three firms, and we derive the closed-form solution for the equilibrium value and the merger dynamics.

Similar content being viewed by others

Notes

Note that there are distinctions between the concept of conditional-unconditional offers studied in the takeover literature and our paper. In the takeover literature, unconditional offers are offers to shareholders to buy any or all their shares, where the acquirer agrees to buy however few or many shares are tendered; while conditional offers are conditional on the acquirer receiving at least some minimum number being tendered, typically a controlling interest, and if fewer shares are tendered, the acquirer is under no obligation to purchase any shares.

Interestingly, Bittlingmayer (1985) documents that after the passage of antitrust laws preventing price fixing and cartel formation, but before the introduction of antitrust merger laws preventing monopolization, as much as one-half of the U.S. manufacturing capacity took part in mergers frequently including most firms in an industry.

In that vein, Nocke and Whinston (2013) showed that an antitrust authority wishing to maximize expected consumer surplus should adopt an optimal merger policy imposing tougher standard on mergers involving firms with a larger premerger market share. In a context where acquirers can make conditional-unconditional offers to target firms, our results suggest that the antitrust authority might need to include even more stringent standards on merging firms to maximize consumer surplus.

We do not allow for the merged firm to breakdown or divest after a merger.

Note that games in partition function are more general than games in characteristic function, because they allow for the possibility of coalitions imposing externalities on other players. A characteristic function game satisfies \(v_{i}=v_{i}(\pi )=v_{i}(\pi ^{\prime })\) for all \(i\in \pi \cap \pi ^{\prime }\). Note that the assumption (1) is weaker than superadditivity requirement often imposed on the characteristic function.

This alternative assumption is made by Ray and Vohra (1999) who show that it has important implication in situations with positive externalities, as a player may strategically choose to leave the game.

Note that if i does not belong to \(S_{m}\) then i belong to \(S_{m+1}\backslash S_{m}\) given that \(S_{m+1}=\pi .\)

That is, firm \({i}\)’s conditional-unconditional offer is either \([\{i,j,k\}],\)\([\{i,j\},\{i,j,k\}],\) or \([\{i,k\},\{i,j,k\}].\)

For completeness we recall some basic concepts: Given any finite set of points \(V\subset \mathbb {R}^{3},\) we denote its conical hull by \(cone ( V) = \{ \sum _{i=1}^{n}\lambda _{i}v_{i}: \lambda _{i}\ge 0 \text { and }v_{i}\in V \} ;\) an extremal ray of a cone \(H\subset \mathbb {R}^{3}\) is any point \(\omega \in H,\)\(\omega \ne 0,\) such that there exists a vector \(p\in \mathbb {R}^{3}\) where p is a supporting hyperplane to the cone H, and \(H\cap \{ \phi \in \mathbb {R} ^{3}:p\cdot \phi =0 \} = \{\lambda \omega :\lambda \ge 0 \};\) a vector p defines a supporting hyperplane if for all \(\phi \in H\) then \(p\cdot \phi \le 0\); the set of all extremal rays of a cone H is denoted ext(H); the lineality space of a cone \(H= \{ \phi \in \mathbb {R} ^{3}:\Omega \cdot \phi =0 \}\) is equal to the linear space \(lineal ( H ) = \{ \phi \in \mathbb {R}^{3}:\Omega \cdot \phi =0 \} ,\) and the lineality of a cone is the dimension of the lineality space.

References

Bebchuk LA (1989) Takeover bids below the expected value of minority shares. J Financ Quant Anal 24(2):171–184

Bittlingmayer G (1985) Did antitrust policy cause the great merger wave? J Law Econ 28(1):77–118

Bloch F (1996) Sequential formation of coalitions in games with externalities and fixed payoff division. Games Econ Behav 14:90–123

Bloch F, Dutta B (2011) Formation of networks and coalitions. Handbook of social economics. North Holland, Amsterdam

Chatterjee K, Dutta B, Ray D, Sengupta K (1993) A noncooperative theory of coalitional bargaining. Rev Econ Stud 60:463–477

Compte O, Jehiel P (2010) The coalitional Nash bargaining solution. Econometrica 78(5):1593–1623

Dantzig G (1998) Linear programming and extensions. Princeton University Press

Eraslan H (2002) Uniqueness of stationary equilibrium payoffs in the Baron–Ferejohn model. J Econ Theory 103(1):11–30

Eraslan H, McLennan A (2013) Uniqueness of stationary equilibrium payoffs in coalitional bargaining. J Econ Theory 148(6):2195–2222

Esty B, Millett M (2005) Acquisition of Consolidated Rail Corp. Technical report, Havard Business School

Fauli-Oller R (2000) Takeover waves. J Econ Manag Strategy 9(2):189–210

Gomes A (2005) Multilateral contracting with externalities. Econometrica 73(4):1329–1350

Gowrisankaran G (1999) A dynamic model of endogenous horizontal mergers. RAND J Econ 30(1):56–83

Gul F (1989) Bargaining foundations of shapley value. Econometrica 57(1):81–95

Holmström B, Nalebuff B (1992) To the raider goes the surplus? A reexamination of the free-rider problem. J Econ Manag Strategy 1(1):37–62

Huang C-Y (2002) Multilateral bargaining: conditional and unconditional offers. Econ Theory 20(2):401–412

Kale JR, Noe TH (1997) Unconditional and conditional takeover offers: experimental evidence. Rev Financ Stud 10(3):735–766

Krishna V, Serrano R (1996) Multilateral bargaining. Rev Econ Stud 63(1):61–80

Miklós-Thal J, Rey P, Vergé T (2011) Buyer power and intraband coordination. J Eur Econ Assoc 9(4):721–741

Nilssen T, Sørgard L (1998) Sequential horizontal mergers. Eur Econ Rev 42(9):1683–1702

Nocke V, Whinston MD (2010) Dynamic merger review. J Polit Econ 118(6):1200–1251

Nocke V, Whinston MD (2013) Merger policy with merger choice. Am Econ Rev 103(2):1006–1033

Okada A (1996) A noncooperative coalitional bargaining game with random proposers. Games Econ Behav 16(1):97–108

Osborne M, Rubinstein A (1990) Bargaining and markets. Academic Press

Pesendorfer M (2005) Mergers under entry. RAND J Econ 36(3):661–679

Qiu LD, Zhou W (2007) Merger waves: a model of endogenous mergers. RAND J Econ 38(1):214–226

Ray D (2007) A game-theoretic perspective on coalition formation. Oxford University Press, Oxford

Ray D, Vohra R (1999) A theory of endogenous coalition structures. Games Econ Behav 26(2):286–336

Ray D, Vohra R (2014) Coalition formation. Handbook of game theory, vol 4. North Holland, Amsterdam

Seidmann D, Winter E (1998) A theory of gradual coalition formation. Rev Econ Stud 65(4):793–815

Shaked A, Sutton J (1984) Involuntary unemployment as a perfect equilibrium in a bargaining model. Econometrica 52(6):1351–1364

Sutton J (1986) Non-cooperative bargaining theory: an introduction. Rev Econ Stud 53(5):709–724

Thrall R, Lucas W (1963) n-person games in partition function form. Naval Res Logist Q 10:281–298

Ziegler G (1995) Lectures on polytopes. Springer, New York

Acknowledgements

The authors would like to thank the Associate Editor and an anonymous referee for their valuable comments and suggestions. Wilfredo Maldonado acknowledges the financial supports CNPq 306473/2018-6 and FAPDF 1295/2017.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Theorem 3.1

The arguments in Sect. 3, show that any MPE has strategies \(\sigma =( \sigma _{i}(\pi ))\) with probability distribution satisfying the support restrictions (5) and values \(\phi =( \phi _{i}(\pi ))\) satisfying (6)–(7): The associated equilibrium strategy is: (i) At any industry structure \(\pi ,\) firm \(i\in \pi\) proposes an offer \([S_{1}|\cdots |S_{m}]\) with price \(p_{j}=x_{j}(\pi S_{q-1}),\) for any \(j\in S_{q}\backslash S_{q-1},\) with probability \(\sigma _{i}(\pi )( [S_{1}|\cdots |S_{m}])\); (ii) Firm j’s best response strategy is to accept any offer \([S_{1}|\cdots |S_{m}]\), where \(j\in S_{q}\backslash S_{q-1}\), if and only if \(p_{j}\ge x_{j}(\pi S_{q-1}),\) for \(q=1,\ldots ,m,\) where \(S_{0}=\varnothing .\)

It remains to show that there exist probability distributions \(\sigma =( \sigma _{i}(\pi ))\) satisfying the support restrictions (5) and values \(x=( x_{i}(\pi ))\) satisfying (5)–(7). We define below a correspondence \(F:X\times \Sigma \rightrightarrows X\times \Sigma ,\) and show, using the Kakutani fixed point theorem, that such correspondence has a fixed point \(( x,\sigma ) \in F( x,\sigma )\) satisfying (5)–(7).

We start introducing the relevant definitions:

-

(i)

Let Z be the finite-dimensional Euclidean space composed of the payoffs \(x=(x_{i} ( \pi ) )\), where \(x_{i} ( \pi ) \in \mathbb {R}\), for all partitions \(\pi\) and \(i\in \pi\). Define by \(X\subset Z\) the subset of payoffs such that \(x_{i} ( \pi ) \ge \min _{ \pi ^{\prime }\ni i} \{ v_{i}(\pi ^{\prime }) \}\) and \(\sum _{i\in \pi }x_{i} ( \pi ) \le V.\) Clearly X is a convex and compact subset of the finite-dimensional Euclidean space Z.

-

(ii)

Define by \(\Delta _{i} ( \pi )\) the set of probability distributions over the (finite) conditional-unconditional offer set \([S_{1}|\cdots |S_{m}]\), for all possible sequences of distinct subsets \(\{ S_{1},\ldots ,S_{m}\} ,\) such that \(i\in S_{1}\subset \cdots \subset S_{m}\subset \pi\). Let \(\Sigma\) be the set of probability distributions \(\sigma =( \sigma _{i}( \pi ) ) ,\) where \(\sigma _{i}( \pi ) \in \Delta _{i}( \pi ) ,\) for all partitions \(\pi \in \Pi\) and \(i\in \pi\). Clearly, \(\Sigma\) is a convex and compact subset of a finite-dimensional Euclidean space.

-

(iii)

Define the following functions: the excess function e : X → Z by \(e( x) =( e_{i}(\pi )( x) ) ,\) where

$$\begin{aligned} e_{i}(\pi )\left( x\right) =\underset{i\in S_{1}\subset \cdots \subset S_{m}\subset \pi }{\max }\left\{ x_{S_{m}}(\pi S_{m})-\sum _{q=1}^{m}\sum _{j\in S_{q}\backslash S_{q-1}}x_{j}\left( \pi S_{q-1}\right) \right\} , \end{aligned}$$(13)

and the functions \(f:X\times \Sigma \rightarrow Z\), by \(f( x,\sigma ) =( f_{i}( \pi ) ( x,\sigma ) )\) where

and \(f_{i}^{j}(\pi ) ( x,\sigma )\) are given by,

Finally, consider the following correspondence \(\mathcal {F}:X\times \Sigma \rightrightarrows X\times \Sigma ,\) where \((y,\rho )\in \mathcal {F} ( x,\sigma )\) if and only if \(y= f ( x,\sigma )\) and \(\rho \in \Sigma\) satisfies the support restriction

A standard argument proves that all the conditions of the Kakutani fixed point theorem hold so that \(\mathcal {F}\) has a fixed point: \(\mathcal {F} ( X\times \Sigma ) \subset X\times \Sigma\), \(X\times \Sigma\) is a compact and convex finite dimension set, \(\mathcal {F}( x,\sigma )\) is convex (and non-empty), and \(\mathcal {F}\) has a closed graph (i.e., is upper hemi-continuous). Let \(( x,\sigma )\) be a fixed point of \(\mathcal {F}\), and define by \(\phi =( \phi _{i}(\pi ))\) the payoffs such that \(x_{i}(\pi )=\delta \phi _{i}(\pi )+( 1-\delta ) v_{i}( \pi ) ,\) where \(x=(x_{i}( \pi ) ).\) By construction, the probability distributions \(\sigma =( \sigma _{i}(\pi ))\) satisfy the support restrictions (5) and the values \(\phi =( \phi _{i}(\pi ))\) satisfy (5)–(7). By the single-period deviation principle, it follows that the associated equilibrium strategy, specified in the first paragraph, is a subgame perfect Nash equilibrium of the M&A game, and therefore a MPE. \(\square\)

Proof of Theorem 5.1:

Suppose that \(\phi _{i}\) is an MPE value. Without any loss of generality, we assume that \(v_{i}( \pi _{0}) =0\) for all \(i\in N,\) so that \(x_{i}=\delta \phi _{i}.\)

Define for each triple (i, j, k) , permutations of N, the set of eight cases (12) as

The set of all cases is given by \(\mathbb {Q},\) the union of all cases \(\mathbb {Q}(i,j,k),\) for all permutations (i, j, k) of N. It is straightforward to verify that the cases \(\mathbb {Q}\), there are a total of twenty-six distinct cases, include all possible configurations for the vectors \(( X_{i}-x_{i} ) _{i\in N}.\) Due to the symmetry of the problem we can concentrate on the analysis of the eight cases in \(\mathbb {Q} (i,j,k).\)

The discussion on Sect. 5 yields the following corollary of Theorem 3.1:

Corollary 6.1

Any MPE value \(\phi =\left( \phi _{i},\phi _{j},\phi _{k}\right)\) satisfies the following:

-

(1)

If \(X_{j}\ge \delta \phi _{j}\)and \(X_{k}\ge \delta \phi _{k}\)then \(\phi _{i}^{i}=V-\delta \phi _{j}-\delta \phi _{k}\), \(\phi _{j}^{i}=\delta \phi _{j},\)and \(\phi _{k}^{i}=\delta \phi _{k};\)

-

(2)

If \(X_{j}\le \delta \phi _{j}\)and \(X_{j}-\delta \phi _{j}<X_{k}-\delta \phi _{k}\)then \(\phi _{i}^{i}=V-\delta \phi _{k}-X_{j}\), \(\phi _{j}^{i}=X_{j},\)and \(\phi _{k}^{i}=\delta \phi _{k};\)

-

(3)

If \(X_{j}-\delta \phi _{j}=X_{k}-\delta \phi _{k}\le 0\)then \(\phi _{i}^{i}=V-X_{j}-\delta \phi _{k}\), \(\phi _{j}^{i}=\mu _{i}X_{j}+ ( 1-\mu _{i} ) \delta \phi _{j}\)and \(\phi _{k}^{i}= ( 1-\mu _{i} ) X_{k}+\mu _{i}\delta \phi _{k}\), where \(\mu _{i}\in [ 0,1 ] ;\)

-

(4)

The system of equations hold:

$$\begin{aligned} \phi _{i}=\frac{1}{3}\left( \phi _{i}^{i}+\phi _{i}^{j}+\phi _{i}^{k}\right) \quad \text {for all }i\in \left\{ 1,2,3\right\} , \end{aligned}$$(16)where \(\phi _{i}^{j}\)is i’s equilibrium value when j is the proposer.

The following lemma is the result of the separate analysis of each case in (12), and characterize the set of all values that can be MPE value of any game. We find it convenient to express the results in terms of the change of variable \(\omega\) defined in terms of the profits v by (17). The lemma yields specific convex regions of the profit v (explicitly given by the inequalities \(\Omega _{Q}\cdot \omega \le 0)\) and the associated equilibrium values \(\phi\) in each region.

Lemma 6.1

A vector \(\phi =[\phi _{i},\phi _{j},\phi _{k}]^{\prime }\)is an MPE equilibrium value of game v if and only if there exists a case \(Q\in \mathbb {Q}(i,j,k)\), such that

where \(\Phi _{Q}\)and \(\Omega _{Q}\)are matrices given explicitly in the proof below, \(\mathbf {1}\)is the unit vector \([1,1,1]^{\prime }\), and \(\omega =[\omega _{i},\omega _{j},\omega _{k}]^{\prime }\)is a function of v given by,

where X is as in definition (10).

Proof of Lemma 6.1:

We first provide an outline of the steps involved in the proof which are repeatedly used on all cases in (12). Necessity part: Assume that \(\phi _{i}\) is a MPE value. Then there is a case \(Q\in \mathbb {Q}(i,j,k)\) such that all inequalities in case Q hold. The conditions in Corollary 6.1 define explicit expressions for \(\phi _{j}^{i}\) as a function of \(\phi .\) Substituting these expressions for \(\phi _{j}^{i}\) into the system of equations (16) and solving for the system yields a unique solution that can be expressed as \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\). We then substitute this expression for the equilibrium value into the inequality restrictions that define case Q, resulting in a system of linear inequalities \(\Omega _{Q}\cdot \omega \le 0.\)Converse part: Suppose that the game v is such that \(\Omega _{Q}\cdot \omega \le 0\) and \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\) for any case \(Q\in \mathbb {Q} (i,j,k).\) Then, by the converse of Corollary 6.1, the payoff \(\phi\) is a MPE value.

Consider now each of the eight cases \(Q\in \mathbb {Q}(i,j,k)\).

- I.:

-

\(X_{1}-\delta \phi _{1}\ge 0\), \(X_{2}-\delta \phi _{2}\ge 0,\) and \(X_{3}-\delta \phi _{3}\ge 0.\)

The firms’ best response strategy (see Corollary 6.1) yield the following system of equilibrium payoffs,

where if all the inequalities are strict the unique best response strategy of all firms is to choose the offer to all firms conditional on N. The equilibrium payoffs satisfy the system of equations (16), whose unique solution is \(\phi _{i}=\frac{V}{3}\) for all i, (define \(\Phi _{I}=0)\). Moreover, the conditions that must be satisfied by the solution are \(X_{i}-\delta \phi _{i}\ge 0,\) which is equivalent to,

- II(i).:

-

\(X_{i}-\delta \phi _{i}\le 0\), \(X_{j}-\delta \phi _{j}\ge 0,\) and \(X_{k}-\delta \phi _{k}\ge 0.\)

The firms’ best response strategy (see Corollary 6.1) yield the following system of equilibrium payoffs,

where if all the inequalities are strict the unique best response strategy of firms j and k is to choose the offer to all firms conditional on \(\{j,k\},\) and that of firm i is to choose the offer to all firms conditional on N. The equilibrium payoffs satisfy the system of equations ( 16), whose unique solution is

which corresponds to \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\) where

This solution is an equilibrium if the system of inequalities, \(X_{i}-\delta \phi _{i}\le 0\), \(X_{j}-\delta \phi _{j}\ge 0,\) and \(X_{k}-\delta \phi _{k}\ge 0,\) holds. This system of inequalities corresponds, after simplifications, to

- III\(_{1}(i,j,k).\):

-

\(X_{i}-\delta \phi _{i}<X_{j}-\delta \phi _{j}\le 0\), and \(X_{k}-\delta \phi _{k}\ge 0.\)

The firms’ best response strategy (see Corollary 6.1) yield the following system of equilibrium payoffs

where if all the inequalities are strict the unique best response strategy of firms j and k is to choose the offer to all firms conditional on \(\{j,k\},\) and that of firm i is to choose the offer to all firms conditional on \(\{i,k\}.\) The equilibrium payoffs satisfy the system of equations (16), whose unique solution is

which corresponds to \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\) where

This solution is an equilibrium if the system of inequalities, \(X_{i}-\delta \phi _{i}<X_{j}-\delta \phi _{j}\le 0\), and \(X_{k}-\delta \phi _{k}\ge 0\) holds. This system of inequalities corresponds, after some simplifications, to

- III\(_{2} ( k) .\):

-

\(X_{i}-\delta \phi _{i}=X_{j}-\delta \phi _{j}<0\), and \(X_{k}-\delta \phi _{k}\ge 0.\)

The best response strategy of firm k is to choose an offer to all firms conditional on \(\{i,k\}\) with probability \(p\in [ 0,1 ]\) and to choose an offer to all firms conditional on \(\{j,k\}\) with probability \(( 1-p ) ,\) and that of firm j and i to choose, respectively, an offer to all firms conditional on \(\{j,k\}\) and \(\{i,k\}\). This result in the following system of equilibrium payoffs (see Corollary 6.1):

The equilibrium payoffs satisfy the system of equations (16), whose unique solution is

which corresponds to \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\) where

This solution is an equilibrium if the system of inequalities, \(X_{i}-\delta \phi _{i}=X_{j}-\delta \phi _{j}<0\), and \(X_{k}-\delta \phi _{k}\ge 0,\) and in addition \(p\in \left[ 0,1\right] .\) This system of inequalities corresponds, after some simplifications, to

- \(\mathrm{IV}_{1}(i,j,k).\):

-

\(X_{i}-\delta \phi _{i}<X_{j}-\delta \phi _{j}<X_{k}-\delta \phi _{k}\le 0.\)

This case is similar to the case \(\mathrm{III}_{1}(i,j,k)\) and has a similar best response strategy. Repeating the same reasoning we obtain that \(\phi =\frac{V }{3}+\Phi _{Q}\cdot \omega\) where \(\Phi _{\mathrm{IV}_{1}(i,j,k)}=\Phi _{\mathrm{III}_{1}(i,j,k)}.\) This solution is the equilibrium if the system of inequalities, \(X_{i}-\delta \phi _{i}<X_{j}-\delta \phi _{j}<X_{k}-\delta \phi _{k}\le 0,\) holds. This system of inequalities is equivalent to

- \(\mathrm{IV}_{2}(i)\).:

-

\(X_{i}-\delta \phi _{i}\le X_{j}-\delta \phi _{j}=X_{k}-\delta \phi _{k}<0.\)

The best response strategy of firm i is to choose an offer to all firms conditional on \(\{i,k\}\) with probability \(p\in \left[ 0,1\right]\) and to choose an offer to all firms conditional on \(\{i,j\}\) with probability \(\left( 1-p\right) ,\) and that of firm j and k to choose an offer to all firms conditional on \(\{j,k\}\). This result in the following system of equilibrium payoffs (see Corollary 6.1):

The system of equation (16) plus equation \(\delta \phi _{j}-X_{j}=\delta \phi _{k}-X_{k}\) have a unique solution,

which corresponds to \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\) where

This is the equilibrium of the game if the system of inequalities \(X_{i}-\delta \phi _{i}\le X_{j}-\delta \phi _{j}=X_{k}-\delta \phi _{k}<0\), and \(p\in \left[ 0,1\right]\) holds. This is equivalent to the system of inequalities,

- \(\mathrm{IV}_{3}\).:

-

\(X_{i}-\delta \phi _{i}=X_{j}-\delta \phi _{j}=X_{k}-\delta \phi _{k}<0\)

The best response strategy of firm i is to choose an offer to all firms conditional on \(\{i,k\}\) and \(\{i,j\}\) with probabilities \(p_{i}\) and \(\left( 1-p_{i}\right) ,\) the strategy of firm j is to choose an offer to all firms conditional on \(\{j,k\}\) and \(\{i,j\}\) with probabilities \(p_{j}\) and \(\left( 1-p_{j}\right) ,\) and the strategy of firm k is to choose an offer to all firms conditional on \(\{j,k\}\) and \(\{i,k\}\) with probabilities \(p_{k}\) and \(\left( 1-p_{k}\right) .\) This result in the following system of equilibrium payoffs (see Corollary 6.1):

where \(p_{i},p_{j}\) and \(p_{j}\) all belong to the interval \(\left[ 0,1\right] .\) The system of equation (16), implies that \(\phi _{i}+\phi _{j}+\phi _{k}=V.\) Imposing the condition \(\delta \phi _{i}-X_{i}=\delta \phi _{j}-X_{j}=\delta \phi _{k}-X_{k}\) we immediately get that there is unique solution equal to

which corresponds to \(\phi =\frac{V}{3}+\Phi _{Q}\cdot \omega\) where

We are now interested in solving the system of equations for \(p_{i},p_{j},\) and \(p_{k}\):

We can immediately verify that any vector \(p_{i},p_{j}\) and \(p_{k}\) is the unique solution of the system of linear equations:

Note that \(p_{i},p_{j}\) and \(p_{j}\) all belong to the interval \(\left[ 0,1 \right]\) (we must also have \(X_{i}+X_{j}+X_{k}<\delta V\)). Using the Fourier–Motzkin elimination method (see Dantzig 1998 and Ziegler 1995) we solve the system of inequalities and obtain that it is equivalent to

- \(\mathrm{IV}_{4}(k).\):

-

\(X_{i}-\delta \phi _{i}=X_{j}-\delta \phi _{j}<X_{k}-\delta \phi _{k}\le 0.\)

This case is similar to case \(\mathrm{III}_{2}(k)\) and has a similar best response strategy. Repeating the same reasoning we obtain that \(\phi =\frac{V}{3} +\Phi _{Q}\cdot \omega\) where \(\Phi _{\mathrm{IV}_{4}(k)}=\Phi _{\mathrm{III}_{2}(k)}.\) This solution is the equilibrium if the system of inequalities, \(X_{i}-\delta \phi _{i}=X_{j}-\delta \phi _{j}<X_{k}-\delta \phi _{k}\le 0,\) holds. This system of inequalities is equivalent to

The results we have just obtained from the analysis of all cases \(Q\in \mathbb {Q}(i,j,k)\) complete the prove of Lemma 6.1. \(\square\)

In order to establish the uniqueness of the equilibrium payoffs we must now show that for any given game \((v,\delta )\) belonging to two different cases Q and \(Q^{\prime }\) (i.e., \(\Omega _{Q}\cdot \omega \le 0\) and \(\Omega _{Q^{\prime }}\cdot \omega \le 0\), where \(\omega\) is the linear function of v given by (17)), it results that the payoffs coincide (i.e., \(\Phi _{Q}\cdot \omega =\Phi _{Q^{\prime }}\cdot \omega\) where the payoffs are given by Lemma 6.1). The proof now proceeds by first characterizing the set of games that satisfy \(\Omega _{Q}\cdot \omega \le 0\) and \(\Omega _{Q^{\prime }}\cdot \omega \le 0\) (Lemma 6.2) and then we show that all such games satisfy \(\Phi _{Q}\cdot \omega =\Phi _{Q^{\prime }}\cdot \omega\).

We obtain in Lemma 6.2 the characterization of the polyhedral cone

and \(H(Q)\cap H\left( Q^{\prime }\right)\) using the key representation result from the theory of polytopes (see Ziegler 1995): a polyhedral cone \(H=H(Q)\) represented in terms of a system of inequalities (or intersection of a finite number of half-spaces or the H-representation of the cone) with lineality zero can be represented as \(H=cone\left( ext(H)\right) ,\) the convex hull of its extremal rays (the V-representation of the cone).Footnote 10

We now define the set of points that are the candidates to be the extremal rays of the polyhedral cones H(Q). Define the set of points \(\mathbb {V}= {\cup }_{ ( i,j,k) \in \Pi } \{ a_{i},b_{i},c_{ijk},d_{ijk} \} \subset \mathbb {R}^{3}\) where,

and where \(e_{i}\in \mathbb {R}^{3}\) is the canonical ith unit vector. Associate each element \(Q\in \mathbb {Q}\) to a subset of \(\mathbb {V}\) (one-to-one correspondence) as follows:

We then have the following characterization of the polyhedral cones \(H(Q)\ \) and \(H\left( Q\right) \cap H\left( Q^{\prime }\right)\) (see definition (18)).

Lemma 6.2

For all cases \(Q\in \mathbb {Q}\), \(H\left( Q\right) =cone\left( Q\right)\)and Q (as in definition (19)) is the set of extremal rays of the cone \(H\left( Q\right) .\)Moreover, for any Q and \(Q^{\prime }\)in \(\mathbb {Q}\)with \(Q^{\prime }\ne Q\)then \(H\left( Q\right) \cap H\left( Q^{\prime }\right) =cone\left( Q\cap Q^{\prime }\right) .\)

Proof of Lemma 6.2:

We refer to \(Q\in \mathbb {Q}\), interchangeably, as a subset of \(\mathbb {V}\) using the one-to-one correspondence above. We use the following result in order to obtain the set of extremal rays of the cone \(H=\left\{ \omega :\Omega \cdot \omega \le 0\right\} :\) A vector \(\phi \in H\) is an extremal ray of the cone H if and only if \(\phi \in H\) and \(\Omega _{i}\phi =0\) and \(\Omega _{j}\phi =0\), for \(\Omega _{i}\) and \(\Omega _{j}\) two linearly independent row vectors of the matrix \(\Omega .\)

First note that any two \(\nu\) and \(\nu ^{\prime }\) in \(\mathbb {V}\) are linearly independent. This is true for all \(\delta \in ( 0,1)\) because \(\ - ( 3-\delta )<- ( 3-2\delta )<-3 ( 1-\delta )< ( 4\delta -3)<\delta <1\) for \(\delta \in ( 0,1 )\) and the definitions of \(\nu \in \mathbb {V}.\) Now, for all \(Q\in \mathbb {Q}\) the matrix \(\Omega _{Q}\) of the H-representation of the cones H(Q) have rank equal to 3 (full rank). Therefore, \(lineal ( H ( Q )) = \{ \phi \in \mathbb {R} ^{3}:\Omega _{Q}\cdot \phi =0 \} = \{ 0 \}\) and thus all cones H(Q) have lineality zero. Finally, one can easily verify, using the result stated in the previous paragraph, that Q is the set of extremal rays of the cone H(Q) for all \(Q\in \mathbb {Q} .\) Thus by the representation result for cones we have that \(H ( Q) =cone ( Q).\)

Claim Suppose that for any two cones \(H\left( Q\right) =cone\left( Q\right)\) and \(H\left( Q^{\prime }\right) =cone\left( Q^{\prime }\right) ,\) there exists a separating hyperplane H such that if \(\nu \in \left( Q\cup Q^{\prime }\right) \backslash \left( Q\cap Q^{\prime }\right)\) (see definition (19 )) then \(\nu \notin H.\)Therefore \(H\left( Q\right) \cap H\left( Q^{\prime }\right) =cone\left( Q\cap Q^{\prime }\right) .\)

Proof of Claim

Recall that any vector \(p\in \mathbb {R}^{3}\) can be associated with the hyperplane H, where \(H=\left\{ \omega :p.\omega =0\right\} .\) A hyperplane H is separating if and only if for all \(\omega \in H\left( Q\right)\) and \(\omega ^{\prime }\in H\left( Q^{\prime }\right)\) then \(p.\omega \le 0\) and \(p.\omega ^{\prime }\ge 0.\)

It is obvious that \(cone\left( Q\cap Q^{\prime }\right) \subset H\left( Q\right) \cap H\left( Q^{\prime }\right) .\) We need to prove that \(cone\left( Q\cap Q^{\prime }\right) \supset H\left( Q\right) \cap H\left( Q^{\prime }\right) .\) It is also clear that \(H\left( Q\right) \cap H\left( Q^{\prime }\right)\) is a cone and that \(H\left( Q\right) \cap H\left( Q^{\prime }\right) \subset cone\left( Q\cup Q^{\prime }\right)\). But the separating hyperplane H is such that \(H\left( Q\right) \cap H\left( Q^{\prime }\right) \subset H\) and all \(\nu \in \left( Q\cup Q^{\prime }\right) \backslash \left( Q\cap Q^{\prime }\right)\) are such that \(\nu \notin H,\) and thus \(\nu \notin H\left( Q\right) \cap H\left( Q^{\prime }\right) .\) Therefore, \(H\left( Q\right) \cap H\left( Q^{\prime }\right) \subset cone\left( Q\cap Q^{\prime }\right) .\)q.e.d. claim \(\square\)

It can be easily shown that for all pairs Q and \(Q^{\prime }\) in \(\mathbb {Q}\) with \(Q^{\prime }\ne Q\) there exists a separating hyperplane H (associated with a vector p) such that \(\nu \notin Q\cap Q^{\prime }\) implies that \(\nu \notin H.\) Using the claim, we have that \(H\left( Q\right) \cap H\left( Q^{\prime }\right) =cone\left( Q\cap Q^{\prime }\right) .\)q.e.d. lemma6.2\(\square\)

We now finalize the proof of Theorem 5.1 showing that if \(\omega \in H\left( Q\right) \cap H\left( Q^{\prime }\right)\) then \(\Phi _{Q}\cdot \omega =\Phi _{Q^{\prime }}\cdot \omega\) (i.e., the payoffs coincide at the common faces of any two different cases).

First, note that \(\Phi _{Q}\cdot \nu =\Phi \left( \nu \right)\) where,

for all extremal rays \(\nu \in Q\) and for all cases \(Q\in \mathbb {Q}\subset \mathbb {V}\).

Now suppose that there exists \(Q,Q^{\prime }\in \mathbb {Q}\) with \(Q\ne Q^{\prime }\) such that \(\omega \in H\left( Q\right) \cap H\left( Q^{\prime }\right) =cone(Q\cap Q^{\prime }).\) By Lemma 6.2 then \(\omega \in cone(Q\cap Q^{\prime })\) and thus \(\omega =\sum _{\nu \in Q\cap Q^{\prime }}\alpha _{\nu }\nu\) where \(\alpha _{\nu }\ge 0.\) But the linearity of \(\Phi _{Q}\) and \(\Phi _{Q^{\prime }}\) and the fact that \(\Phi _{Q}\cdot \nu =\Phi \left( \nu \right)\) for the extremal points imply that \(\Phi _{Q}\cdot \omega =\sum _{\nu \in Q\cap Q^{\prime }}\alpha _{\nu }\Phi \left( \nu \right) =\Phi _{Q^{\prime }}\cdot \omega ,\) for all \(\omega \in H\left( Q\right) \cap H\left( Q^{\prime }\right) .\)\(\square\)

Proof of Theorem 5.2

We take the limit when \(\delta \rightarrow 1\) of the expressions for \(\Phi _{Q}\) and \(\Omega _{Q}\) derived in the proof of Lemma 6.1 for all possible cases Q. Note that since \(\omega _{i}\rightarrow X_{i}-\frac{V}{3}\) the results of cases I and \(\mathrm{II}(i)\) immediately follows. Also, note that all cases \(\mathrm{III}_{1}(i,j,k),\)\(\mathrm{III}_{1}(j,i,k),\) and \(\mathrm{III}_{2}(k)\) have the same limit coalitional bargaining value and that case \(\mathrm{III} ( k)\) above is equivalent to \(H( \mathrm{III}_{1}(i,j,k)) \cup H ( \mathrm{III}_{1}(j,i,k)) \cup H( \mathrm{III}_{2}(k) )\). Equivalently, case \(\mathrm{III}( k ) ,\) which is associated with the polyhedral cone

satisfies \(H( \mathrm{III}( k) ) =H( \mathrm{III}_{1}(i,j,k)) \cup H( \mathrm{III}_{1}(j,i,k)) \cup H( \mathrm{III}_{2}(k)) ,\) where

We first show that \(H( \mathrm{III}_{1}(i,j,k)) \cup H( \mathrm{III}_{1}(j,i,k)) \cup H( \mathrm{III}_{2}(k)) \subset H( \mathrm{III}( k) ) .\) Suppose that \(\omega \in H( \mathrm{III}_{1}(i,j,k)) \cup H( \mathrm{III}_{1}(j,i,k)) \cup H( \mathrm{III}_{2}(k)) .\) If \(\omega \in H( \mathrm{III}_{1}(i,j,k))\) then \(2\omega _{i}+4\omega _{j}\le 0\) and \(-3\omega _{j}\le 0,\) which imply \(2\omega _{i}+\omega _{j}\le 0\) and thus \(\omega \in H( \mathrm{III}_{2}(k))\) (a similar argument holds for \(\mathrm{III}_{1}(j,i,k)).\) Obviously, if \(\omega \in H( \mathrm{III}_{2}(k))\) then \(\omega \in H( \mathrm{III}(k)) .\) Now we show that \(H( \mathrm{III}( k) ) \subset H( \mathrm{III}_{1}(i,j,k)) \cup H( \mathrm{III}_{1}(j,i,k)) \cup H( \mathrm{III}_{2}(k)) .\) Suppose that \(\omega \in H( \mathrm{III}( k) ) .\) Then we have either \(\omega _{j}\le 0\) or \(\omega _{j}\ge 0,\) and either \(\omega _{k}\le 0\) or \(\omega _{k}\ge 0\). If either \(\omega _{j}\ge 0\) or \(\omega _{k}\ge 0\) holds then either \(\omega\) belongs either to case \(\mathrm{III}_{1}(i,j,k)\) or to case \(\mathrm{III}_{1}(j,i,k)\). Otherwise, we must have both \(\omega _{j}\le 0\) and \(\omega _{k}\le 0\), which then imply that \(\omega\) belongs to case \(\mathrm{III}_{2}(k)\).

Finally, all the different polyhedral cones of type IV collapse into the polyhedral cone \(H( \mathrm{IV}_{3})\): \(H( \mathrm{IV}_{1}(i,j,k)) \cup H( \mathrm{IV}_{2}(i) )\cup H( \mathrm{IV}_{4}(k)) \subset H( \mathrm{IV}_{3})\). The unique limit case IV is simply determined by one linear inequality \(\omega _{1}+\omega _{2}+\omega _{3}\le 0,\) which is equivalent to \(X_{1}+X_{2}+X_{3}\le V.\) Now take the limit when \(\delta \rightarrow 1\) of the firms’ best response strategies derived in the proof of Lemma 6.1 for all possible cases Q. Cases I and \(\mathrm{II}(i)\) immediately follows.

Consider case \(\mathrm{III}(k)\) which by the results of Theorem 5.2 is equal to \(\mathrm{III}(k)=H( \mathrm{III}_{1}(i,j,k)) \cup H( \mathrm{III}_{1}(j,i,k)) \cup H( \mathrm{III}_{2}(k)) .\) For all \(\omega \in H( \mathrm{III}(k))\) the strategies of firms i and j are to make an offer to all firms conditional on \(\{i,k\}\) and \(\{j,k\},\) respectively. If \(\omega \in H( \mathrm{III}_{1}(i,j,k))\) then the probability that firm k choose an offer conditional on \(\{j,k\}\) is equal to 1, and if \(\omega \in H( \mathrm{III}_{1}(i,j,k))\) then the probability that firm k choose an offer conditional on \(\{i,k\}\) is equal to 1. Also, whenever \(\omega \in H( \mathrm{III}_{2}(k))\) then the probability that firm k choose an offer conditional on \(\{i,k\}\) converges to,

and similarly for the probability that firm k choose an offer conditional on \(\{j,k\}\). Replacing the value of \(X_{i}\) as a function of v yields the desired result.

Finally, consider the case where \(\omega \in H ( \mathrm{IV}_{3}) .\) From the analysis of case \(\mathrm{IV}_{3}\) in the proof of Lemma 6.1 we have that the probability that the offer conditional on \(\{i,j\}\) is chosen converges to

Proceeding similarly for the other pairs we conclude the proof. \(\square\)

Rights and permissions

About this article

Cite this article

Gomes, A., Maldonado, W. Mergers and acquisitions with conditional and unconditional offers. Int J Game Theory 49, 773–800 (2020). https://doi.org/10.1007/s00182-020-00720-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-020-00720-6