Abstract

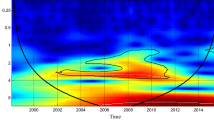

In this research, a continuous wavelet method is employed to investigate the dynamic time–frequency varying linkage of hot money, money supply (M2) and housing prices in China. In most time hot money has insignificant effect on M2 which indicates that the effectiveness of sterilization. On the other hand, M2 has a significant influence on hot money especially in the long term. M2 affects housing prices significantly in the long term. However, the effect of hot money on housing prices is pronounced mainly in short and medium terms. Therefore, hot money inflows have not weakened the monetary control in recent years, and both M2 and hot money are important leading forces in the rising housing prices in China. These findings provide implications for the government to formulate monetary policy and regulate the housing market and capital flows.

Similar content being viewed by others

Notes

Robustness test: in order to test whether our empirical results are robust, different measure of the variables which are not taken the natural logarithms is used to test the relationship between these series. The partial wavelet coherency and partial phase difference plots is not different from that in logarithmic form, which shows the robustness of the result. For reasons of length, we did not put it in the paper. Interested readers can get it by email.

References

Adalid, R., & Detken, C. (2007). Liquidity shocks and asset price boom/bust cycles. ECB working paper no. 732.

Aguiar-Conraria, L., & Soares, M. J. (2014). The continuous wavelet transform: moving beyond uni- and bivariate analysis. Journal of Economic Surveys,28(2), 344–375.

Aizenman, J., Chinn, M. D., & Ito, H. (2010). The emerging global financial architecture: Tracing and evaluating new patterns of the trilemma configuration. Journal of International Money and Finance,29(4), 615–641.

Bouvatier, V. (2010). Hot money inflows and monetary stability in China: How the People’s Bank of China took up the challenge. Applied Economics,42(12), 1533–1548.

Calvo, G., Leiderman, L., & Reinhart, C. (1996). Inflows of capital to developing countries in the 1990s. Journal of Economic Perspectives,10(2), 123–139.

Chang, C., Liu, Z., & Spiegel, M. M. (2015). Capital controls and optimal Chinese monetary policy. Journal of Monetary Economics, 74, 1–15.

Chivakul, M., Lam, M. R. W., Liu, X., Maliszewski, W., & Schipke, M. A. (2015). Understanding Residential Real Estate in China (No. 15-84). International Monetary Fund.

Chung, H. S., & Kim, J. H. (2004). Housing speculation and housing price bubble in Korea. KDI School of Pub policy and management paper no. 04-06.

Congdon, T. (2005). Money and asset prices in boom and bust. London: The Institute of Economic Affairs.

Dai, J. P., & Yin, X. Y. (2017). China’s monetary policy regulation effect and time-varying reaction characteristics: A test based on house prices and exchange rate. Journal of Zhongnan University of Economics and Law,5, 88–95.

Dreger, C., & Wolters, J. (2009). Liquidity and asset prices: How strong are the linkages. Review of Economics & Finance,1, 43–52.

Farhi, E., & Werning, I. (2014). Dilemma not trilemma? Capital controls and exchange rates with volatile capital flows. IMF Economic Review,62(4), 569–605.

Favilukis, J., Kohn, D., Ludvigson, S. C., & Van Nieuwerburgh, S. (2012). International capital flows and house prices: Theory and evidence. In Housing and the Financial Crisis (pp. 235–299). University of Chicago Press.

Feng, L., Lin, C. Y., & Wang, C. (2017). Do capital flows matter to stock and house prices? Evidence from china. Emerging Markets Finance and Trade,53(10), 2215–2232.

Guo, F., & Huang, Y. S. (2010). Does “hot money” drive China’s real estate and stock markets? International Review of Economics & Finance,19(3), 452–466.

Huang, X., Jin, T., & Zhang, J. (2017). Monetary policy, hot money and housing price growth across Chinese cities. Harvard University OpenScholar.

Khushk, A. G., Gilal, M. A., & Taherani, A. (2015). Capital movements and sterilization policies in Pakistan. Grassroots,49(2), 1–12.

Kim, S., & Yang, D. Y. (2009). Do capital inflows matter to asset prices? The case of Korea. Asian Economic Journal,23(3), 323–348.

Klarl, T. (2016). The nexus between housing and GDP re-visited: A wavelet coherence view on housing and GDP for the US. Economics Bulletin,36(2), 704–720.

Liu, T. Y., Su, C. W., Jiang, X. Z., & Chang, T. (2015). Is there excess liquidity in China? China & World Economy,23(3), 110–126.

Liu, M. P., Wei, S. X., & Yan, H. P. (2016). A theoretical analysis and empirical test of house price fluctuation from the viewpoint of money supply. Journal of Hainan University (Humanities & Social Sciences),4, 67–74.

Lu, X., & Dong, Z. (2016). Dynamic correlations between real estate prices and international speculative capital flows: An empirical study based on DCC-MGARCH method. Procedia Computer Science,91, 422–431.

Martin, M. F., & Morrison, W. M. (2008). China’s “hot money” problems. Congressional Research Service Reports, No. RS22921.

Ohno, S., & Xu, P. (2013). Hot money flow, money supply, mortgage credit and residential property prices in China. Retrieved from http://www.jeameetings.org/2013s/Gabstract/H-010abstract_PengXu.pdf.

Ouyang, A. Y., Rajan, R. S., & Willett, T. D. (2010). China as a reserve sink: The evidence from offset and sterilization coefficients. Journal of International Money and Finance, 29(5), 951–972.

Reinhart, C. M., & Reinhart, V. R. (2008). Capital flow bonanzas: An encompassing view of the past and present (No. w14321). National Bureau of Economic Research.

Rua, A. (2010). Measuring comovement in the time–frequency space. Journal of Macroeconomics,32(2), 685–691.

Su, C. W., Lu, L., Chang, H. L., & Zhao, Y. (2017a). Reserve accumulation and money supply in China: A time-varying analysis. Global Economic Review,46(1), 47–64.

Su, C. W., Wang, Z. F., Nian, R., & Zhao, Y. (2017b). Does international capital flow lead to a housing boom? A time-varying evidence from China. The Journal of International Trade & Economic Development,26, 851–864.

Su, C., Yin, X., Tao, R., Lobonţ, O. R., & Moldovan, N. C. (2018). Are there significant linkages between two series of housing prices, money supply and short-term international capital?—Evidence from China. Digital Signal Processing,83, 148–156.

Tao, S. G., & Zhang, S. Y. (2016). The effects of monetary policy changes on short-term international capital flow. International Business: Journal of Shanghai University Of International Business And Economic, (1), 98–108.

Tiwari, A. K., Bhanja, N., Dar, A. B., & Islam, F. (2015). Time–frequency relationship between share prices and exchange rates in India: Evidence from continuous wavelets. Empirical Economics,48(2), 699–714.

Torrence, C., & Compo, G. P. (1998). A practical guide to wavelet analysis. Bulletin of the American Meteorological Society,79(1), 61–78.

Tsai, I. C. (2015). Monetary liquidity and the bubbles in the US housing market. International Journal of Strategic Property Management,19(1), 1–12.

Tsai, I. C. (2017). The housing market and excess monetary liquidity in China. Empirical Economics,53(2), 599–615.

Wang, C. H., Hwang, J. T., & Chung, C. P. (2016). Do short-term international capital inflows drive China’s asset markets? The Quarterly Review of Economics and Finance,60, 115–124.

Wei, G. (2014). A study on the relation between hot money and Chinese Real Estate Price Index. Journal of Business Administration Research,3(2), 74–76.

Wen, X. C., & He, L. Y. (2015). Housing demand or money supply? A new Keynesian dynamic stochastic general equilibrium model on China’s housing market fluctuations. Physica A: Statistical Mechanics and its Applications,432, 257–268.

Xia, C. L. (2014). Comparison on determinants of short-term international capital flow in China. Technology Economics,33(5), 92–111.

Xu, X. E., & Chen, T. (2012). The effect of monetary policy on real estate price growth in China. Pacific-Basin Finance Journal,20(1), 62–77.

Yang, H. Z., & Ji, X. Y. (2017). Research on the correlation of China’s short-term cross-border capital flow with the volatility of RMB exchange rate and asset’s prices in China after the international financial crisis. Mathematics in Practice and Theory,47(8), 26–40.

Yang, Z., Wu, S., & Shen, Y. (2016). Monetary policy, house prices, and consumption in China: A national and regional study. International Real Estate Review,20(1), 23–49.

Yao, S., Luo, D., & Loh, L. (2013). On China’s monetary policy and asset prices. Applied Financial Economics,23(5), 377–392.

Yuan, S. M., & Fan, M. (2012). Does China’s monetary supply comes from international capital flow in recent years? World Economy Study,3, 28–33.

Zhang, Y., Hua, X., & Zhao, L. (2012). Exploring determinants of housing prices: A case study of Chinese experience in 1999–2010. Economic Modelling,29(6), 2349–2361.

Zhang, J. P., & Liu, X. G. (2016). Structural price increase: Money supply. CPI and Property Price. Economic Review,6, 55–69.

Zhao, H. Y., & Zhang, J. M. (2017). Adjustment of money supply structure and phased devaluation of RMB. Research on Financial and Economic Issues, (5), 37–43.

Zhao, Y., de Haan, J., Scholtens, B., & Yang, H. (2013). The dynamics of hot money in China. In BOFIT and City UHK Conference on “Renminbi and the Global Economy”.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yin, XC., Tao, R., Chai, KC. et al. A revisit on linkage of hot money, money supply and housing prices in China. J Hous and the Built Environ 35, 617–632 (2020). https://doi.org/10.1007/s10901-019-09704-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-019-09704-9