Abstract

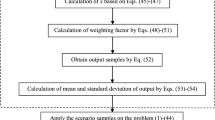

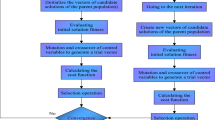

Renewable energy-based on virtual power plants (VPPs) has recently attracted considerable attention for participating in energy and reserve markets due to the disadvantages of thermal power plants (TPPs). The present paper aims to maximize the VPP profitability in distribution networks including thermal power plants, at minimum load cost, using a mathematical model for implementing the VPP and evaluating its role in the energy and reserve markets. The proposed model includes a series of probabilistic scenarios used to consider the uncertainty of wind/solar generation. Therefore in the first step, the lower bound of the problem, i.e., minimizing demand cost for all the units, should be calculated. It determines the status of VPP units based on the best-case scenarios. Afterward, the problem is cut to calculate the upper bound of the problem which is maximizing the profit of the VPP. The problem is evaluated in two cases: one is the presence of VPP only in the energy market and the other is the simultaneous presence of the VPP in the reserve and energy markets. The computation ends with the convergence of lower and upper bounds of the problem. Since the proposed method uses a piece-wise model of thermal units and the problem has nonlinear equations, Mixed Integer Programming (MIP) used to calculate the contribution of units by utilizing GAMS software. Finally, the VPP profitability calculated for the day-ahead energy and reserve market after determining the method for the participation of power plants in supply at the minimum cost. The proposed method was then applied to a sample system consisting of three thermal plants, three wind farms, two solar farms, and two energy storage systems, considering several situations to examine the impact of the resources and also the resulting profitability in the energy and reserve market. The final step was the analysis of the results.

Similar content being viewed by others

References

Pudjianto D, Ramsay C and Strbac G 2007 Virtual power plant and system integration of distributed energy resources. IET Renewable Power Generation 1: 10–16

Nosratabadi S M, Hooshmand R A and Gholipour E 2017 A comprehensive review on microgrid and virtual power plant concepts employed for distributed energy resources scheduling in power systems. Renewable and Sustainable Energy Reviews 67: 341–363

Braun M and Strauss P 2008 A review on aggregation approaches of controllable distributed energy units in electrical power systems. International Journal of Distributed Energy Resources 4: 297–319

El Bakari K and Kling W L 2010 Virtual power plants: An answer to increasing distributed generation. In: 2010 IEEE PES Innovative Smart Grid Technologies Conference Europe, pp. 1–6

Mashhour E and Moghaddas-Tafreshi S M 2010 Bidding strategy of virtual power plant for participating in energy and spinning reserve markets—Part I: Problem formulation. IEEE Transactions on Power Systems 26: 949–956

Mashhour E and Moghaddas-Tafreshi S M 2010 Bidding strategy of virtual power plant for participating in energy and spinning reserve markets—Part II: Numerical analysis. IEEE Transactions on Power Systems 26: 957–964

Soares J, Morais H, Sousa T, Vale Z and Faria P 2013 Day-ahead resource scheduling including demand response for electric vehicles. IEEE Transactions on Smart Grid 4: 596–605

Zamani A G, Zakariazadeh A and Jadid S 2016 Day-ahead resource scheduling of a renewable energy based virtual power plant. Applied Energy 169: 324–340

Rahmani-Dabbagh S and Sheikh-El-Eslami M K 2016 A profit sharing scheme for distributed energy resources integrated into a virtual power plant. Applied energy 184: 313–328

Ju L, Li H, Zhao J, Chen K, Tan Q and Tan Z 2016 Multi-objective stochastic scheduling optimization model for connecting a virtual power plant to wind-photovoltaic-electric vehicles considering uncertainties and demand response. Energy Conversion and Management 128: 160–177

Nosratabadi S M, Hooshmand R A and Gholipour E 2016 Stochastic profit-based scheduling of industrial virtual power plant using the best demand response strategy. Applied energy 164: 590–606

Luo F, Dong Z Y, Meng K, Qiu J, Yang J and Wong K P 2016 Short-term operational planning framework for virtual power plants with high renewable penetrations. IET Renewable Power Generation 10: 623–633

Ni E, Luh P B and Rourke S 2004 Optimal integrated generation bidding and scheduling with risk management under a deregulated power market. IEEE Transactions on Power Systems 19: 600–609

Zamani A G, Zakariazadeh A, Jadid S and Kazemi A 2016 Stochastic operational scheduling of distributed energy resources in a large scale virtual power plant. International Journal of Electrical Power & Energy Systems 82: 608–620

Kardakos E G, Simoglou C K and Bakirtzis A G 2015 Optimal offering strategy of a virtual power plant: A stochastic bi-level approach. IEEE Transactions on Smart Grid 7: 794–806

Wang Y, Ai X, Tan Z, Yan L and Liu S 2015 Interactive dispatch modes and bidding strategy of multiple virtual power plants based on demand response and game theory. IEEE Transactions on Smart Grid 7: 510–519

Dabbagh S R and Sheikh-El-Eslami M K 2015 Risk assessment of virtual power plants offering in energy and reserve markets. IEEE Transactions on Power Systems 31: 3572–3582

Walawalkar R, Apt J and Mancini R 2007 Economics of electric energy storage for energy arbitrage and regulation in New York. Energy Policy 35: 2558–2568

Qin J, Sevlian R, Varodayan D and Rajagopal R 2012 Optimal electric energy storage operation. In: 2012 IEEE Power and Energy Society General Meeting, pp. 1–6

Xu Z Y, Qu H N, Shao W H and Xu W S 2015 Virtual power plant-based pricing control for wind/thermal cooperated generation in China. IEEE Transactions on Systems, Man, and Cybernetics: Systems 46: 706–712

Bagen B and Billinton R 2008 Reliability cost/worth associated with wind energy and energy storage utilization in electric power systems. In; Proceedings of the 10th International Conference on Probablistic Methods Applied to Power Systems, pp. 1–7

Chedid R, Akiki H and Rahman S 1998 A decision support technique for the design of hybrid solar-wind power systems. IEEE Transactions on Energy Conversion 13: 76–83

Mashhour E and Moghaddas-Tafreshi S M 2010 Mathematical modeling of electrochemical storage for incorporation in methods to optimize the operational planning of an interconnected micro grid. Journal of Zhejiang University SCIENCE C. 11: 737–750

Palma-Behnke R, Vargas L S and Jofré A 2005 A distribution company energy acquisition market model with integration of distributed generation and load curtailment options. IEEE Transactions on Power Systems 20: 1718–1727

Carrión M and Arroyo J M 2006 A computationally efficient mixed-integer linear formulation for the thermal unit commitment problem. IEEE Transactions on Power Systems 21: 1371–1378

Seyyed Mahdavi S and Javidi M H 2014 VPP decision making in power markets using Benders decomposition. International Transactions on Electrical Energy Systems 24: 960–975

Karimyan P, Abedi M, Hosseinian S H and Khatami R 2016 Stochastic approach to represent distributed energy resources in the form of a virtual power plant in energy and reserve markets. IET Generation, Transmission & Distribution 10: 1792–1804

Pishgar-Komleh S H, Keyhani A and Sefeedpari P 2015 Wind speed and power density analysis based on Weibull and Rayleigh distributions (a case study: Firouzkooh county of Iran). Renewable and Sustainable Energy Reviews 42: 313–322

Najafi M, Ahmadi S and Dashtdar M 2019 Simultaneous Energy and Reserve Market Clearing with Consideration of Interruptible Loads as One of Demand Response Resources and Different Reliability Requirements of Consumers. International Journal of Emerging Electric Power Systems 20: 1–20

Dashtdar M, Najafi M and Esmaeilbeig M 2020 Calculating the locational marginal price and solving optimal power flow problem based on congestion management using GA-GSF algorithm. Electrical Engineering 102: 1–18

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dashtdar, M., Najafi, M. & Esmaeilbeig, M. Probabilistic planning for participation of virtual power plants in the presence of the thermal power plants in energy and reserve markets. Sādhanā 45, 93 (2020). https://doi.org/10.1007/s12046-020-01335-z

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12046-020-01335-z