Abstract

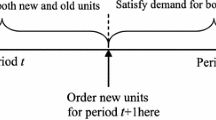

In business practice the misalignment between frequent inventory adjustments and a sticky price is common. Motivated by Pipi Milk, a diary manufacturer who commits its customer at a fixed price for a whole year meanwhile weekly replenishes its cheese product stock at a specific batch size, this paper develops an integrated constant pricing and inventory control model in a periodic-review system with batch order consideration. For such a system, our focus is on an (nQ, r)-p policy: the price p is determined and committed at the beginning of the planning horizon; inventories are managed based on an (nQ, r) policy with reorder level r and order quantities at non-negative integer multiples of batch size Q. With a fixed ordering cost included, we develop an efficient algorithm to compute the optimal policy parameters with the purpose to maximize the expected long-run average profit. We also numerically investigate the policy performance and verify its advantages by comparing to a sequential optimization of price and inventory decisions. Finally, managerial insights are generated.

Similar content being viewed by others

Notes

All data in the paper are twisted and protected for confidential purpose.

References

Blinder, A. S., Canetti, E., Lebow, D. E., & Rudd, J. B. (1998). Asking about prices: A new approach to understanding price stickiness. New York: Russell Sage Foundation.

Chen, W., & He, Y. (2017). Dynamic pricing and inventory control with delivery flexibility. Annals of Operations Research,. https://doi.org/10.1007/s10479-017-2555-7.

Chao, X., Gong, X., & Zheng, S. (2016). Optimal pricing and inventory policies with reliable and random-yield suppliers: characterization and comparison. Annals of Operations Research, 241, 35–51.

Chen, W., Feng, Q., & Seshadri, S. (2013). Sourcing from suppliers with random yield for price dependent demand. Annals of Operations Research, 208, 557–579.

Chen, X., & Simchi-Levi, D. (2004a). Coordinating inventory control and pricing strategies with random demand and fixed ordering cost: The finite horizon case. Operations Research, 52(6), 887–896.

Chen, X., & Simchi-Levi, D. (2004b). Coordinating inventory control and pricing strategies with random demand and fixed ordering cost: The infinite horizon case. Mathematics of Operations Research, 29(3), 698–723.

Chen, X., & Simchi-Levi, D. (2012). Coordinated pricing and inventory. Chapters management. In R. Phillips & O. OzalpThe (Eds.), Oxford handbook of pricing management (pp. 784–822). Oxford: Oxford University Press.

Chen, Y. F. (2000). Optimal policies for multi-echelon problems with batch ordering. Operations Research, 48(3), 376–389.

Chen, Y. F., Feng, Y., & Simchi-Levi, D. (2002). Uniform distribution of inventory positions in two-echelon periodic review systems with batch-ordering policies and interdependent demands. European Journal of Operational Research, 140, 648–654.

Chen, Y. F. (2005). Fractional programming approach to two stochastic inventory problems. European Journal of Operational Research, 160, 63–71.

Chen, Z. Y., Liu, Y. C., Yang, Y., & Zhou, Y. (2014). A Variant of \(L^{\natural }\)-convexity and its application to inventory models with batch ordering. Asia Pacific Journal of Operations Research, 31, 1450042. https://doi.org/10.1142/S0217595914500420.

Choi, T. M. (Ed.). (2012). Handbook of newsvendor problems: Models, extensions and applications. In Springer’s international series in operations research & management science. New York: Springer.

Fabiani, S., Druant, M., Hernando, I., Kwapil, C., Landau, B., Loupias, C., et al. (2006). What firms’ surveys tell us about price-setting behavior in the Euro area. International Journal of Central Banking, 2(3), 3–47.

Federgruen, A., & Meissner, J. (2009). Competition under time-varying demands and dynamic lot sizing costs. Naval Research Logistics, 56, 57–73.

Feng, Y., & Chen, Y. F. (2011). A computational approach for optimal joint inventory-pricing control in an infinite-horizon periodic-review system. Operations Research, 59(5), 1297–1303.

Gilbert, S. M. (1999). Coordination of pricing and production planning for constant priced goods. European Journal of Operational Research, 114, 330–337.

Gomez, N., & Kiessling, T. (2012). Joint inventory and constant price decisions for a continuous review system. International Journal of Physical Distribution & Logistics Management, 42(2), 174–202.

Güler, M. G., Bilgiç, T., & Güllü, R. (2015). Joint pricing and inventory control for additive demand models with reference effects. Annals of Operations Research, 226, 255–276. https://doi.org/10.1007/s10479-014-1706-3.

Hadley, G., & Whitin, T. M. (1961). A family of Inventory Models. Management Science, 7(4), 351–371.

Huh, W. T., & Janakiraman, G. (2012). On the optimal policies for inventory systems with batch ordering. Operations Research, 60(4), 797–802.

Huh, W. T., & Janakiraman, G. (2008). (s, S) Optimality in joint inventory-pricing control: An alternate approach. Operations Research, 56(3), 783–790.

Kunreuther, H., & Schrage, L. (1973). Joint pricing and inventory decisions for constant priced items. Management Science, 19(7), 732–738.

Levy, D., Bergen, M., Dutta, S., & Venable, R. (1997). The magnitude of menu costs: direct evidence from large US supermarket chains. Quarterly Journal of Economics, 112, 791–825.

Veinott, A. F. (1965). The optimal inventory policy for batch ordering. Operations Research, 13(3), 424–432.

Wei, Y., & Chen, Y. F. (2011). Joint determination of inventory replenishment and sales effort with uncertain market responses. International Journal of Production Economics, 134, 368–374.

Whitin, T. M. (1955). Inventory control and price theory. Management Science, 2, 61–68.

Yang, Y., Chen, Y. F., & Zhou, Y. (2014). Coordinating inventory control and pricing strategies under batch ordering. Operations Research, 62(1), 25–34.

Yang, Y., Quan, Y., Xue, W., & Zhou, Y. (2014). Analysis of batch ordering inventory models with setup cost and capacity constraint. International Journal Production Economics, 155, 340–350.

Zbaracki, M., Ritson, M., Levy, D., Dutta, S., & Bergen, M. (2004). Managerial and customer costs of price adjustment: Direct evidence from industrial markets. Review of Economics and Statistics, 86(2), 514–533.

Zheng, Y., & Chen, F. (1992). Inventory policies with quantized ordering. Naval Research Logistics, 39, 285–305.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Proposition 1

Proof

Given an (nQ, r)-p policy, if we can show \(\sum _{i=1}^{Q}a_{ij}(p)=1\) for any \(j\in \{1, 2,\ldots ,Q\}\), a uniform distribution, i.e., \(\theta (y)=\) constant, will then satisfy (2). Combining with \(\sum _{y=r+1}^{r+Q}\theta _t(y)=1\), the steady state distribution is \(\theta (y)=\frac{1}{Q}\), \(y \in \{r+1, \ldots ,r+Q\}\).

The following indicates \(\sum _{i=1}^{Q}a_{ij}(p)=1\) for any \(j\in \{1, 2,\ldots ,Q\}\). The one-step transition probability matrix is seen to be

The matrix \([a_{ij}(p)]\) is then doubly stochastic, since for any \(j\in I\),

This, in align with our previous argument, completes the proof. \(\square \)

1.2 Proof of Proposition 2

Proof

For a given dummy profit \(\beta <\pi ^*(nQ,r,p)\) and a given price \(p^i\), we first fix the maximal order-up-to level \(S_{\beta }^i\) and compare the policy \((r_{\beta }^i, S_{\beta }^i, p^i)\) to policy \((r_{\beta }^i+1, S_{\beta }^i, p^i)\).

The last inequality comes from the definition of the optimal parameters of \(r_{\beta }^i\) and \(S_{\beta }^i\). We then compare policy \((r_{\beta }^i, S_{\beta }^i, p^i)\) to policy \((r_{\beta }^i-1, S_{\beta }^i, p^i)\).

Next we fix the reorder point \(r_{\beta }^i\) and compare the policy \((r_{\beta }^i, S_{\beta }^i, p^i)\) to policy \((r_{\beta }^i, S_{\beta }^i+1, p^i)\).

We then compare policy \((r_{\beta }^i, S_{\beta }^i, p^i)\) to policy \((r_{\beta }^i, S_{\beta }^i-1, p^i)\).

Replacing \(Q_{\beta } \) with \(S_{\beta }^i -r_{\beta }^i\) and substituting it back into the above inequalities, we then complete the proof. \(\square \)

1.3 Proof of Corollary 1

Proof

Considering \(B(y,p^i)\) is unimodal in y given \(p^i\) and \(K \bar{\varPhi }_{S_{\beta }^i-r_{\beta }^i}(p^i) > 0\), the interval between the crossing points shrinks by increasing \(\beta \) to \( \beta +K \bar{\varPhi }_{S_{\beta }^i-r_{\beta }^i}(p^i)\). Thus, \( \hat{Q}^i_{\beta } \ge S_{\beta }^i-r_{\beta }^i\). We also have \( \bar{\varPhi }_{S_{\beta }^i-r_{\beta }^i}(p^i) \ge \bar{\varPhi }_{\hat{Q}_{\beta }}(p^i)\).

By definition of \(r_{\beta }^i\), \(B(r_{\beta }^i+1,p^i) \ge \beta +K \bar{\varPhi }_{S_{\beta }^i-r_{\beta }^i}(p^i) \ge \beta +K \bar{\varPhi }_{\hat{Q}_{\beta }}(p^i)\). Considering \(B(y,p^i)\) is increasing for \(y<y^i_0\) where \(y^i_0\) is the maximal y such that \(B(y,p^i)\) archives maximum, and \( \underline{r}_{\beta }^i+1\) is the minimal y such that \(B(y,p^i) \ge \beta +K \bar{\varPhi }_{\hat{Q}_{\beta }}(p^i)\), we thus have \(r_{\beta }^i \ge \underline{r}_{\beta }^i\).

Similarly, By definiton of \(S_{\beta }^i\), \(B(S_{\beta }^i,p^i) \ge \beta +K \bar{\varPhi }_{S_{\beta }^i-r_{\beta }^i}(p^i) \ge \beta +K \bar{\varPhi }_{\hat{Q}_{\beta }}(p^i)\). Considering \(B(y,p^i)\) is decreasing for \(y\ge y^i_0\) and \( \bar{S}_{\beta }\) is the maximal y such that \(B(y,p^i) \ge \beta +K \bar{\varPhi }_{\hat{Q}_{\beta }}(p^i)\), we thus have \(S_{\beta }^i \le \bar{S}_{\beta }^i\). \(\square \)

1.4 Proof of Lemma 3

Proof

By definition, both \(\underline{r}_{\beta _0}^i \le y_0\) and \(\underline{r}_{\beta }^i \le y_0\). Considering the increasing monotonicity of \(B(y,p^i)\) for \(y\le y_0^i\), \(\underline{r}_{\beta }^i \ge \underline{r}_{\beta _0}^i\) is straightforward since \(\beta \ge \beta _0\). Similarly, \(\bar{S}_{\beta }^i \le \bar{S}_{\beta _0}^i\) due to the monotonicity of \(B(y,p^i)\), in addition, \(y\ge y_0^i\) and \(\beta \ge \beta _0\). \(\square \)

1.5 Proof of Lemma 4

Proof

\(l_{\beta _1}(r,S,p^i) = \sum _{y=r+1}^{S}[B(y,p^i)-K\bar{\varPhi }_{y-r}(p^i)] - \beta Q +\beta Q-\beta _1Q = l_{\beta }(r,S,p^i) -(\beta _1-\beta )Q <0\). Thus, proved. \(\square \)

Rights and permissions

About this article

Cite this article

Wei, Y. Optimizing constant pricing and inventory decisions for a periodic review system with batch ordering. Ann Oper Res 291, 939–957 (2020). https://doi.org/10.1007/s10479-018-3057-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3057-y