Abstract

The attractiveness of insurance saving products is driven by dividend payments to policyholders and participation in profits. These are mainly constrained by regulatory disposals on profit-sharing on the basis of statutory accounts. Moreover, since both prudential (Solvency II) and financial reporting (IFRS 17) regulations require market consistent best estimate measurement of insurance liabilities, cash-flow projection models have to be used in order to derive the underlying financial incomes. In most cases, such models are based on Monte-Carlo techniques, which simulate future accounting profit and losses needed for profit-sharing mechanisms. In this paper, we deal with modelling future impairment losses on equity securities for financial portfolios. As a matter of fact, if impairment losses are determined on an instrument-by-instrument basis, projection models deal with model points of financial instruments (e.g. groups of shares). Since individual depreciation mechanisms are non-linear, projecting is quite a challenge for model designers. Our motivation is to describe the joint distribution of market value and impairment provision of a book of equity securities, with regard to the French accounting rules for depreciation. The derived results can more effectively represent such an asymmetric mechanism by using our results. Formally, an impairment loss is recognized for an equity instrument if there has been a significant and prolonged decline in its market value below the carrying cost (acquisition value). Such constraints are formalized using an assumption about the dynamics of the equity, and lead to a complex option-like pay-off. Using this formulation, we propose analytical formulas for some quantitative measurements related to the impairment losses of a financial equities book. These are derived from a general framework and some tractable examples are illustrated. We also investigate the operational implementation of these formulas and compare theircomputational time to a basic simulation approach.

Similar content being viewed by others

Notes

Let’s note that there is a mistake in Corollary 2 (He et al. 1998) and t is sometimes missing

If ρ = 0, then

References

Azzaz J, Loisel S, Thérond P-E (2015) Some characteristics of an equity security next-year impairment. Rev Quant Finan Acc 45(1):111–135

Bennemann C, Hennig C (2010) Impairment estimates of equity portfolios represented by model points. Belgian Act Bullet 9(1):43–49

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Escobar M, Hernandez J (2014) A note on the distribution of multivariate brownian extrema. International Journal of Stochastic Analysis

Gobet E (2000) Weak approximation of killed diffusion using euler schemes. Stoch Process Appl 87(2):167–197

Harrison MJ (1985) Brownian Motion and Stochastic Flow Systems. Wiley, New York

He H, Keirstead W, Rebholz J (1998) Double lookbacks. Math Financ 8 (3):201–228

Keller JB (1953) The scope of the image method. Commun Pure Appl Math 6 (4):505–512

Thérond P-E (2016) About Market Consistent Valuation in Insurance. In: Laurent J-P, Norberg R, Planchet F (eds) Modelling in Life Insurance: A Management Perspective, chapter 2. Springer, pp 43–60

Vedani J, El Karoui N, Loisel S, Prigent JL (2017) Market inconsistencies of market-consistent European life insurance economic valuations: pitfalls and practical solutions. European Actuarial Journal 7(1)

Wüthrich M (2016) Market-Consistent Actuarial Valuation. Springer, Berlin

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work has been supported by the BNP Paribas Cardif Chair ”Data Analitycs and Models in Insurance”. The views expressed in this document are the authors owns and do not necessarily reflect those endorsed by BNP Paribas Cardif.

Appendices

Appendix A Comonotonic securities

In order to prove our results, we shall need the joint distribution of a Brownian motion with drift and its supremum. This can be easily derived using Harrison (1985).

Proposition 6

Let Xt = μt + σBt, and Mt = supu ∈[0, t]Xu where B is a standard Brownian motion. Then, the probability \({\mathbb P}(X_{t}\leq y, M_{t}\geq x)\) is given by:

On the other hand, the c.d.f. \(\mathbb {P}\left (M_{t}\leq x \right )\) is given by:

where ϕ is the c.d.f of a standard Gaussian r.v.

We easily deduce

Another useful result is the following :

Proposition 7

Let \(\alpha ,\beta , w,c\in {\mathbb {R}}\) and X is a standard Gaussian random variable, i.e. \(X\sim {\mathcal {N}}(0,1)\) with distribution function ϕ. Then

where Φ(U, V ; 𝜃) is the joint c.d.f. of two correlated Gaussian r.v.s U and V with a given correlation coefficient 𝜃.

Proof

If one considers two correlated random variables X1 and X2 with correlation coefficient ρ such that \(X_{i}\sim {\mathcal {N}}(\mu _{i}, \sigma _{i})\), i = 1, 2 then the distribution of X2 conditionally on X1 can be written as follows:

Thus, we can write the joint distribution of X1 and X2 in the following form

which can also be given in terms of the joint distribution Φ of two standard Gaussian r.v.’s with a given correlation coefficient. Therefore, we can write for any a, b, c and w

which is the desired result. □

1.1 A.1 Proof of Proposition 1

The cases x < 0 and x ≥ ai are obvious. Remark that on \(\{\tilde {S}^{i}_{t}\leq \alpha a_{i} \}\), \(a_{i}(1-\alpha )\leq a_{i}-{S^{i}_{t}}\). Hence, for x < ai(1 − α),

We then use the Markov property of Si and Proposition 6.

For ai(1 − α) ≤ x < ai, we have

Using the Markov property of Si, we get

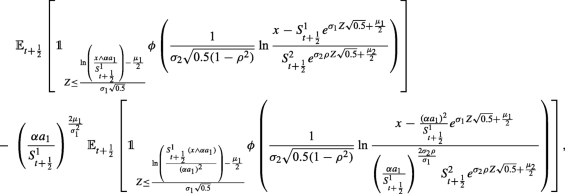

where B is a standard Brownian motion independent of W. We firstly use Proposition 6 to compute the conditional expectation and secondly we remark that \(S^{i}_{t-\frac {1}{2}}={S^{i}_{s}}e^{X_{\delta -\frac {1}{2}}}\) where \(X_{\delta -\frac {1}{2}}=\mu _{i}(\delta -\frac {1}{2})+\sigma _{i}\sqrt {\delta -\frac {1}{2}}X\) where X is a standard Gaussian random variable independent of \(\mathcal {F}_{s}\), with distribution function ϕ(⋅). We easily obtain

This result could be enhanced as the expectations involved in the formulas of p1 and p2 can be explicitly computed using Eq. 1.2.

1.2 A.2 Proof of Proposition 2

We remark that \({\mathbb P}_{s}({\Gamma }_{t}>0)=1-{\mathbb P}_{s}({\Gamma }_{t}=0)=1-{\mathbb P}_{s}(\tilde {S}_{t}>\alpha \max (a_{1}{\dots } a_{n}))\) and we conclude as in the proof of Proposition 1 that \(\mathbb {P}_{s}({\Gamma }_{t}>0)=1-p_{1}(\max (a_{1}{\dots } a_{n}), S_{s})\), which is the desired result.

1.3 A.3 Proof of Proposition 3

We notice that the expected impaired amount for a single share S with an acquisition cost ai can be computed as follows

The first term \({\mathbb P}_{s}({\widetilde {S}}_{t}\leq a_{i}\alpha )=1-p_{1}(a_{i}, S_{s})\). The second term can be expressed, using the Markov property, in the following form:

which needs the density \(\mathbb {P}\left (X_{t}\in dx, \sup _{u\in [0,t]}X_{u}\leq a\right )\). Now, using this density we can write that \(\mathbb {E}_{t-\frac {1}{2}}(\dots )\) equals

Finally, using the fact that \(S_{t-\frac {1}{2}}=S_{s}e^{\mu (\delta -\frac {1}{2})+\sigma \sqrt {\delta -\frac {1}{2}} X}\), with δ = t − s and X a standard normal r.v. independent of \(\mathcal {F}_{s}\), together with the identity in Eq. 1.2 leads to the desired formula.

1.4 A.4 Proof of Proposition 4.1

To find the joint probability \(\mathbb {P}_{t}\left ({\Gamma }_{t+1}\leq y, {\Sigma }_{t+1}\leq x \right )\), we will need the following technical lemma (to prove it, we use Eq. 1.2).

Lemma A.1

Leta > 0, β, γandαbe some constants, then fors, t ≥ 0 we have the following

Similarly, we have

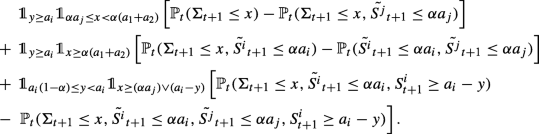

Let n ≥ 1, we are concerned with the computation of the conditional joint c.d.f. of (Γt+ 1,Σt+ 1):

In the above equation, the probability conditional on \(\mathcal F_{t+\frac {1}{2}}\) can be decomposed in the following form:

It is easily seen that the term (1.3) can be written as

\({\mathbb P}_{t+\frac {1}{2}}\left ({\widetilde {S}}_{t+1}\leq a_{1}\alpha , \frac {1}{n}({\sum }_{i=1}^{n}a_{i}-y)\leq S_{t+1}\leq \frac {x}{n}\wedge a_{1}\alpha \right ),\)

and similarly the term (1.4) as

\({\mathbb P}_{t+\frac {1}{2}}\left (a_{j}\alpha < {\widetilde {S}}_{t+1}\leq a_{j+1}\alpha , \frac {1}{n-j}({\sum }_{i=j+1}^{n}a_{i}-y)\leq S_{t+1}\leq \frac {x}{n}\wedge a_{j+1}\alpha \right ).\)

Moreover, we use Markov property and Proposition 6 to write the term (1.5) in the following form

On \(\{\frac {1}{n}({\sum }_{i=1}^{n}a_{i}-y)\leq \frac {x}{n}\wedge a_{1}\alpha \}\), the term (1.3) is equal to:

On \(\{\frac {1}{n-j}({\sum }_{i=1+j}^{n}a_{i}-y)\leq \frac {x}{n}\wedge a_{j+1}\alpha \}\) the term (1.4) is equal to:

We conclude the proof using Theorem A.1 to compute the expectations conditional to \( {\mathcal {F}}_{t}\).

B Correlated securities

In order to prove our results in the correlated case, we shall need the joint distribution of two correlated Brownian motions with drift and their suprema. The joint distribution is obtained by making the following change of variables x2 = M2 − σ2r sin 𝜃 and \(x_{1}=M_{1}-\sigma _{1}r(\rho \sin \theta +\sqrt {1-\rho ^{2}}\cos \theta )\) in Lemma 3 and Remark 4 from He et al. (1998).

Proposition 8

Let \(X^{i}=\mu _{i}t+\sigma _{i}{W^{i}_{t}}\), where \(\mu _{i}\in {\mathbb {R}}\), σi > 0 and Wi two correlated Brownian motions with correlation coefficient ρ ∈] − 1, 1[. For x1 ≤ M1, x2 ≤ M2 with M1, M2 ≥ 0, we have :

\({\mathbb P}({X^{1}_{t}}\in dx_{1}, {X^{2}_{t}}\in dx_{2}, sup_{u\leq t}{X^{1}_{u}}\leq M_{1} , sup_{u\leq t}{X^{2}_{u}}\leq M_{2})=p(r,r_{0}, \theta , \theta _{0}, t ; M_{1},M_{2})drd\theta \)

\({\mathbb P}(\tilde {X^{1}}_{0\rightarrow t}\leq M_{1} , \tilde {X^{2}}_{0\rightarrow t}\leq M_{2})=q(r_{0}, \theta _{0}, t ; M_{1}, M_{2})\), wherep andq are given in Definition 4.1 and

For some special correlation values, the function q may be written in a simpler form (see Corollary 2 in He et al. 1998). We easily obtain the following resultsFootnote 1 :

Lemma B.1

Under the assumptions of Proposition 8, if\(\rho _{n}=-\cos \frac {\pi }{n}\), we have :

2.1 B.1 Proof of Proposition 5

We remark that

Markov property, Proposition 8 and writing \( S^{1}_{t-1/2}={S^{1}_{s}}e^{\mu _{1}(\delta -1/2)+\sigma _{1}\sqrt {\delta -1/2}X}\) with \(X\sim {\mathcal {N}}(0,1)\) lead to the desired formula.

We need some technical results in order to find the joint law of Γ and Σ.

Lemma B.2

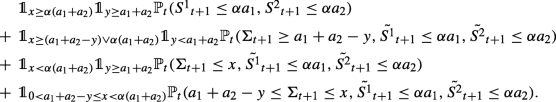

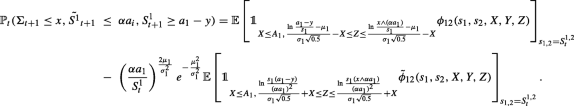

Letx > 0. The c.d.f of the aggregate dynamics Σ of two correlated shares is given by

where X is a standard Gaussian r.v. We denote this probability by \(f({S^{1}_{t}}, {S^{2}_{t}}, x)=\mathbb {P}_{t}({\Sigma }_{t+1}\geq 0).\)

Proof

Since W1 and W2 are two correlated Brownian motions with correlation coefficient ρ, then \(W^{2}=\rho W^{1} +\sqrt {1-\rho ^{2}}W\) with W1 and W two independent BM. Hence :

where X and Z are two independent standard Gaussian r.v. We integrate with respect Z and the conclusion holds. □

Lemma B.3

Let\({X^{i}_{t}}=\mu _{i}t+\sigma _{i}{W^{i}_{t}}\), where\(\mu _{i}, \sigma _{i}\in {\mathbb {R}}\)andWitwo correlated BM withcorrelation coefficientρ ∈] − 1, 1[. Then forM1 > 0, \(x_{1}, x_{2}\in \mathcal {R}\)

where

Proof

Without loss of generality we consider σi = 1, i = 1, 2 (we then replace x1, M1, x2 by \(\frac {x_{1}}{\sigma _{1}}, \frac {M_{1}}{\sigma _{1}}, \frac {x_{2}}{\sigma _{2}}\)). Since

and \(W^{2}=\rho W^{1} +\sqrt {1-\rho ^{2}}W\) with W1 and W two independent BM, we can write for ρ≠ 0Footnote 2

The derivative of the first term is 0. For the second term, we integrate with respect to the law of Wt and then we use Proposition 6. Finally the derivative with respect to x1 and x2 leads to the desired result. □

We easily deduce the following :

Corollary B.3.1

Under the assumptions of Lemma B.3 letR1, R2, x, w, M1 > 0. Then

where X is a standard Gaussian r.v.

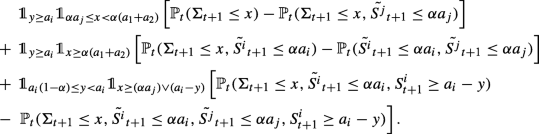

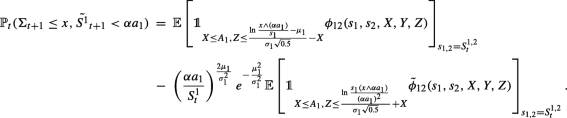

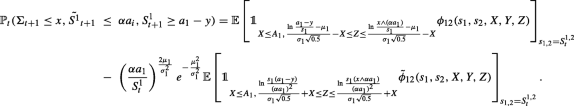

2.2 B.2 Proof of Proposition 4.2

The joint c.d.f

can be decomposed in the following form :

- Step 1 - Probabilities decomposition :

-

-

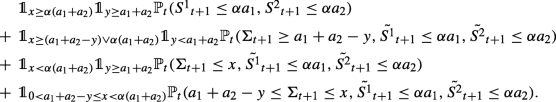

The first term \(C_{1}({S^{1}_{t}}, {S^{2}_{t}})={\mathbb P}_{t}\left (S^{1}_{t+1} +S^{2}_{t+1}\leq x, \tilde {S^{1}}_{t+1}>\alpha a_{1}, \tilde {S^{2}}_{t+1}>\alpha a_{2} \right )\) may be written as :

Recall that \(S^{1}_{t+1} +S^{2}_{t+1}={\Sigma }_{t+1}\). Note that on {x ≥ α(a1 + a2)},

$${\mathbb P}_{t}\left( S^{1}_{t+1} +S^{2}_{t+1}\leq x, \tilde{S^{1}}_{ t+1}\leq\alpha a_{1}, \tilde{S^{2}}_{t+1}\leq\alpha a_{2} \right)=\mathbb{P}_{t}\left( \tilde{S^{1}}_{t+1}\leq\alpha a_{1}, \tilde{S^{2}}_{t+1}\leq\alpha a_{2} \right).$$Hence,

-

The second term \(C_{2}({S^{i}_{t}}, {S^{j}_{t}}, a_{i},a_{j})={\mathbb P}_{t}\left (S^{1}_{t+1} +S^{2}_{t+1}\leq x, \tilde {S^{i}}_{t+1}\!\leq \!\alpha a_{i}, \tilde {S^{j}}_{t+1}\!>\!\alpha a_{j}, S^{i}_{t+1}\geq a_{i}-y \right )\) equals to :

-

The last term \(C_{3}({S^{1}_{t}}, {S^{2}_{t}})={\mathbb P}_{t}\left (a_{1}+a_{2}-y\leq S^{1}_{t+1} +S^{2}_{t+1}\leq x, \tilde {S^{1}}_{t+1}\leq \alpha a_{1}, \tilde {S^{2}}_{ t+1} \leq \alpha a_{2} \right )\) may be written as :

-

- Step 2 - Grouping of terms :

-

Remark that for the term \( C_{2}({S^{i}_{t}}, {S^{j}_{t}}, a_{i},a_{j})\), we may use Markov property and Proposition 8. Hence we can write (consider for example the case i = 1 and j = 2) :

where \({X^{i}_{t}}=\mu _{i}t+\sigma _{i}{B^{i}_{t}}\) where Bi are two correlated BM independent of \(\mathcal {F}_{t+\frac {1}{2}}\), and D1 given before.

The same reasoning allows to write \({\mathbb P}_{t}({\Sigma }_{t+1}\leq x, \tilde {S^{1}}_{t+1}\leq \alpha a_{1}, \tilde {S^{2}}_{t+1}\leq \alpha a_{2}, S^{2}_{t+1}\geq a_{2}-y)\), \({\mathbb P}_{t}({\Sigma }_{t+1}\geq a_{1}+a_{2}-y, \tilde {S^{1}}_{t+1}\leq \alpha a_{1}, \tilde {S^{2}}_{t+1}\leq \alpha a_{2})\), \(\mathbb {P}_{t}({\Sigma }_{t+1}\leq x, \tilde {S^{1}}_{ t+1}\leq \alpha a_{1}, \tilde {S^{2}}_{t+1}\leq \alpha a_{2})\) and \(\mathbb {P}_{t}(a_{1}+a_{2}-y\leq {\Sigma }_{t+1}\leq x, \tilde {S^{1}}_{t+1}\leq \alpha a_{1}, \tilde {S^{2}}_{t+1}\leq \alpha a_{2})\) in a similar form with D2, D3(a1 + a2 − y), D3(x) and D3(x) − D3(a1 + a2 − y).

Hence, we have

- Step 3 - Final calculation :

-

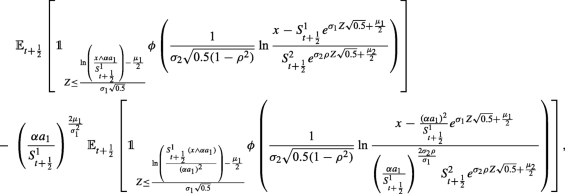

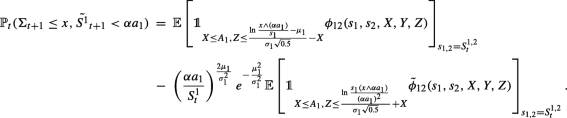

Remark that \({\mathbb P}_{t}(\tilde {S^{1}}_{t+1}\leq \alpha a_{1}, \tilde {S^{2}}_{t+1}\leq \alpha a_{2})=Q({S^{1}_{t}}, {S^{2}_{t}}, 1)\) with Q given in Proposition 5. Also, the conditional law of Σ, i.e. \(\mathbb {P}_{t}({\Sigma }_{t+1}\leq x)\), is given in Theorem B.2. Since the calculation method is the same for all the other terms, we only detail here the probability \(\mathbb {P}_{t}({\Sigma }_{t+1}\leq x, \tilde {S^{1}}_{t+1}<\alpha a_{1})\). Thus, Markov property gives

where \(X^{i}_{\frac {1}{2}}=\frac {\mu _{i}}{2}+\sigma _{i}B^{i}_{\frac {1}{2}}\), Bi two correlated BM independent of \(\mathcal {F}_{t+\frac {1}{2}}\). Next, using Corollary B.3.1, we find that \(\mathbb {P}_{t+\frac {1}{2}}\left (S^{1}_{t+\frac {1}{2}} e^{X^{1}_{\frac {1}{2}}}+S^{2}_{t+\frac {1}{2}} e^{X^{2}_{\frac {1}{2}}}\leq x, \tilde {X}^{1}_{ \frac {1}{2}}<\ln \frac {\alpha a_{1}}{S^{1}_{t+\frac {1}{2}}} \right )\) equals

where Z is a standard Gaussian r.v. independent of \(\mathcal {F}_{t+\frac {1}{2}}\).

We conclude writing \(S^{1}_{t+\frac {1}{2}}={S^{1}_{t}}+\frac {\mu _{1}}{2}+\sigma _{1}\sqrt {0.5}X\) (resp. \(S^{2}_{t+\frac {1}{2}}={S^{2}_{t}}+\frac {\mu _{2}}{2}+\sigma _{2}\sqrt {0.5}Y\)) with X, Y two correlated standard Gaussian r.v’s, that:

We also find

Remark that on I1, x > αa1, so :

$$ \begin{array}{@{}rcl@{}} &&{\mathbb P}_{t}({\Sigma}_{t+1}\leq x, \tilde{S^{1}}_{t+1}<\alpha a_{1})+ {\mathbb P}_{t}({\Sigma}_{t+1}\leq x, \tilde{S^{1}}_{t+1}\leq\alpha a_{i}, S^{1}_{t+1}\geq a_{1}-y)\\ &&= {\mathbb{E}}\left[ J_{1}(s_{1},s_{2},X,Z)\phi_{12}(s_{1}, s_{2},X,Y,Z)\right]\\ &&\quad-\left( \frac{\alpha a_{1}}{{S^{1}_{t}}}\right)^{\frac{2\mu_{1}}{{\sigma^{2}_{1}}}}e^{-\frac{{\mu^{2}_{1}}}{{\sigma^{2}_{1}}}}\mathcal{E}\left[ J_{2}(s_{1},s_{2},X,Z)\tilde{\phi}_{12}(s_{1}, s_{2},X,Y,Z)\right]. \end{array} $$This completes the proof.

C Additional Figures

Joint distribution function. The joint probability \(\mathbb P_{t}({\Gamma }_{t+1}<y, {\Sigma }_{t+1}\leq x )\) in Proposition 4.1 (left) and Proposition 4.2 (right), for t = 0 with n = 2. The input parameters are as follows α = 80%, r = 1%. Comonotonic shares: acquisition values \(S^{1}_{t_{1}}=80\) and \(S^{1}_{t_{2}}=90\) and initial value \({S^{1}_{0}}=120\)

Rights and permissions

About this article

Cite this article

Dorobantu, D., Salhi, Y. & Thérond, PE. Modelling Net Carrying Amount of Shares for Market Consistent Valuation of Life Insurance Liabilities. Methodol Comput Appl Probab 22, 711–745 (2020). https://doi.org/10.1007/s11009-019-09729-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-019-09729-1