Abstract

This paper follows van der Ploeg (Metroeconomica 37(2):221–230, 1985)’s research program in testing both its extension of Goodwin (in: Feinstein (ed) Socialism, capitalism and economic growth, Cambridge University Press, Cambridge, 4, 54–58, 1967) predator–prey model and the Minsky Financial Instability Hypothesis (FIH) proposed by Keen (J Post Keynes Econ 17(4):607–635, 1995). By endowing the production sector with CES technology rather than Leontief, van der Ploeg showed that the possible substitution between capital and labor transforms the close orbit into a stable focus. Furthermore, Keen (1995)’s model relaxed the assumption that profit is equal to investment by introducing a nonlinear investment function. His aim was to incorporate Minsky’s insights concerning the role of debt finance. The primary goal of this paper is to incorporate additional properties, inspired by van der Ploeg’s framework, into Keen’s model. Additionally, we outline possibilities for production technology that could be considered within this research program. Using numerical techniques, we show that our new model keeps the desirable properties of Keen’s model. However, we also demonstrate that when the economy is endowed with a class of CES production function that includes the Cobb–Douglas and the linear technology as limit cases, the unique stable equilibrium is an economically desirable one. Finally, we propose a modified extension that includes speculative component in the economy as in Grasselli and Costa-Lima (Math Financ Econ 6(3):191–210, 2012) and investigate its effect on the dynamics. We conclude that CES production function is a more suitable assumption for empirical purposes than the Leontief counterpart. Finally, we show, using numerical simulations, that under plausible calibration, the model endowed with CES production function eventually lose the cyclical property of Goodwin’s model with and without the speculative component.

Similar content being viewed by others

Notes

In the sense of the GDP at factor cost, where the income approach of the GDP is summarized as the distribution of wages and profits.

For a complete overview of Goodwin’s modern dynamics and its economic interpretation, we refer the reader to the paper of Grasselli and Costa-Lima [6].

The superscript k stands for Keen.

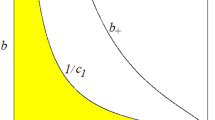

We confine ourselves to \(\eta \in ]0,+\infty [\) (that is an elasticity of substitution that lies in the set ]0, 1[). The reason is twofold: (i) such short term elasticity would imply an above unity substitution between capital and labor in a very short term that is very unlikely (see Klump et al. [10]); and (ii) such values values would break the predator–prey logic of the clockwise behavior suggested by Goodwin and shown by the data (Solow [17], Harvie [7], Mohun et al. [12], or Mc Isaac [11]).

Throughout the article, the consumption price is normalized to 1.

This minimal rationality argument is analogous to the assumption in Goodwin’s model that the allocation of capital and labor is always at the diagonal of the \((K^k,L^k)\)-plan, so that we have not only \(Y^k = \min \left( \frac{K^k}{\nu }, a L^k \right) \) but also \(Y^k = \frac{K^k}{\nu } = a L^k\).

See “Appendix A” for the computation.

Studying the consequences of dropping Say’s law will be the task of a forthcoming paper.

We note that according to Nguyen-Huu and Pottier [14], the channel of debt financing is not fully determined by the model. Indeed, it does not distinguish between loanable funds and endogenous money creation since both rationales induce the same set of equations.

Figure 5 includes the evolution of the capital-to-output ratio for benchmark parameters and \(\eta =100\).

In addition, it can be noticed that the equilibrium points differ slightly depending on the value of \(\eta \).

It can be shown that, with the simplest possible case of an affine function, a closed-form expression for the equilibrium is not available.

Thus, if the elasticity of substitution is too high, i.e. above that of Cobb–Douglas (as in the linear case e.g.), the Bad equilibrium is unstable.

See “Appendix B” for the details.

It can be noticed that the variation of \(\lambda \) is unbounded as \(\omega \rightarrow 1^-\). Therefore, it is very likely that the Lyapunov function shows unbounded variation making the variational domain be in \({\mathcal {D}}_{(\omega ,\lambda ,d)} = [0,1]\times [0,1]\times {\mathbb {R}}\). We leave the proof for further research. For more insights see Grasselli and Costa-Lima [6] or Costa-Lima and Ngyen-Huu [13].

The case \(\eta = 0.5\) is identified as being the closest to the Cobb–Douglas. However, as shown in “Appendix F”, when we derive the model with Cobb–Douglas production technology, we found that the wage share is no longer time-varying and equals, at all times, the output elasticity \(1-b\). Therefore, the original Goodwin prey–predator (between the employment rate and the wage share) logic does not hold anymore, as previously eluded.

Klump et al. [10] surveyed a number of studies intended for developed countries in various timeframes (ca. 1800–2000). Almost 75% of the estimated elasticities showed a value between 0.5 and 1.

Note that in Grasselli et al. [6], the growth rate of output equals that of capital, as \(\nu \) is constant. We chose to align the growth in speculation with the growth rate of capital, as its objects is precisely existing assets. However, aligning the speculation with output would have been equally compatible with Grasselli et al. [6].

For \(\eta <0\), \(\zeta _1\left( 0\right) \) takes high values (often above 1), so that the previous inequality holds.

This equivalence would be the opposite for a negative value of \(\eta \).

In the simulation, the value 0 would lead to numerical errors, therefore we choose the value 0.1 as the lowest value that does not show numerical error. Similarly, \(+\infty \) has been approached by \(10^{15}\) to show the behavior of the the model near the Leontief case.

References

Acurio Vasconez, V.M.: What if oil is less substitutable? A new-Keynesian model with oil, price and wage stickiness including capital accumulation. Documents de travail du Centre d’Economie de la Sorbonne 15041 (2015)

Freĭdlin, M.I., Wentzell, A.D.: Random perturbations of dynamical systems. Number 260 in Grundlehren der mathematischen. Wissenschaften. Springer (1998)

Goodwin, R.: A growth cycle In: Feinstein, C.H. (ed.) Socialism, Capitalism and Economic Growth. Cambridge University Press, Cambridge, (4):54–58 (1967)

Grasselli, M., Nguyen-Huu, A.: Inflation and speculation in a dynamic macroeconomic model. J. Risk Financ. Manag. 8, 285–310 (2015)

Grasselli, M., Nguyen-Huum, A.: Inventory growth cycles with debt-financed investment. Working papers chair energy and prosperity (2016)

Grasselli, M.R., Costa Lima, B.: An analysis of the keen model for credit expansion, asset price bubbles and financial fragility. Math. Financ. Econ. 6(3), 191–210 (2012)

Harvie, D.: Testing Goodwin: growth cycles in ten OECD countries. Camb. J. Econ. 24, 349–376 (2000)

Keen, S.: Finance and economic breakdown: modeling Minsky’s ’financial instability hypothesis’. J. Post Keynes. Econ. 17(4), 607–635 (1995)

Keen, S.: A monetary Minsky model of the great moderation and the great recession. J. Econ. Behav. Org. 86(C), 221–235 (2013)

Klump, R., McAdam, P., Willman, A.: The normalized CES production function: theory and empirics. J. Econ. Surv. 26(5), 769–799 (2012)

Mc Isaac, F.: Testing Goodwin with a stochastic differential approach—the united states (1948–2017). AFD Research Papers Series, (61) (2017)

Mohun, S., Veneziani, R.: Goodwin cycles and the U.S. economy, 1948–2004. MPRA Papers 30444. University Library of, Munich, Germany (2006)

Nguyen-Huu, A., Costa-Lima, B.: Orbits in a stochastic Goodwin–Lotka–Volterra model. J. Math. Anal. Appl. 419(1), 48–67 (2014)

Nguyen-Huu, A., Pottier, A.: Debt and investment in the keen model: a reappraisal. Chair energy and Prosperity working paper (2016)

Pomeau, Y., Manneville, P.: Intermittent transition to turbulence in dissipative dynamical systems. Commun. Math. Phys. 74(2), 189–197 (1980)

Solow, R.: A contribution to the theory of economic growth. Q. J. Econ. 70(1), 65–94 (1956)

Solow, R.: Nonlinear and multisectoral macrodynamics: essays in honour of Richard Goodwin, chapter Goodwin’s growth cycle: reminiscence and rumination, pp. 31–41. Palgrave Macmillan, UK, London (1990)

van der Ploeg, F.: Classical growth cycles. Metroeconomica 37(2), 221–230 (1985)

Author information

Authors and Affiliations

Corresponding author

Additional information

This work benefited from the financial support of the Chair Energy and Prosperity, under the aegis of the Fondation du Risque. The authors are grateful to the anonymous referee for its fruitful comments and suggestions. We are also grateful to Gaël Giraud, Matheus Grasselli, Ivar Ekeland, Adrien Nguyen-Huu, and Emmanuel Bovari for their generous comments. Any remaining errors are, of course, our own.

Appendices

Appendices

1.1 A Getting the reduced form of the system

We assume that the productive sector is endowed with CES technology so that

Additionally, we make the assumption that wages are set at marginal rate of productivity, so that:

For simplicity, we define \(L^e := e^{a_l t} L\), so that the following relationship holds

By taking the derivative of (13) and using (14)

with \(\omega \), the share of total real wages (\(W := \text {w}L\)) in the production:

Let \(a := Y/L\) be the labor productivity, one has \(\omega = \text {w}/a\). The growth rate of the wage share is given by

Using Eq. (15), one gets the following growth rate for labor productivity

Suppose that the growth rate of wages is given by a short-term Phillips Curve

The dynamic of the wage share is given by

The population grows according to

The employment rate is defined by \(\lambda := \frac{L}{N}\), while the capital-output ratio is given by \(\nu := \frac{K}{Y}\). Hence, the employment rate dynamic

The profit share in the production is given by

where r is the short-term interest rate set by the central bank, and paid by producers, while d is the ratio of real debt-to-production (i.e \(\frac{D}{Y}\)). The capital accumulation is given by

where \(\delta \) is the depreciation rate of capital, \(\kappa (\pi )\) is a function of the profit share, and \(\nu \) is the time-varying capital-to-output ratio. From the expression of \(\frac{\partial Y}{\partial K}\) and knowing that Y is homogeneous of degree one, we obtain

Its growth rate is given by

Therefore, the growth rate of employment is

The debt dynamic is the difference between investment and the profits made by the corporate sector, in other words

The growth rate of production is given by

Thus, the ratio of real debt on production is

Hence, its dynamic is

To wrap up, and for the sake of clarity, the tree-dimensional system is

1.2 B Parameter values

See Fig. 14.

The calibration is almost entirely borrowed from Keen [9] to the exception of the speculation function that is borrowed from Grasselli and Costa-Lima [6]. The time frequency between t and \(t+1\) is considered to be one year.

Phenomenological functions behaviors according to the parameters in Table 5

Phenomenological functions behaviors according to the parameters in Table 5

The same generalized exponential function is used for both the relationship between investment as a share of output, and the short term Phillips Curve

Figure 15 displays the behaviors of the phenomenological functions using the calibration given by Table 5.

1.3 C Proofs for Propositions 1 and 2

Proposition 1

The Good equilibrium exists if \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) < \zeta _1\left( 0\right) \).

Proof

The right hand side of Eq. (3) is a function of \(\omega _1\) that equals 0 at \(\omega _1 = 1\) and \(\zeta _1\left( 0\right) =\frac{a_l+\beta +\delta }{A}b^{\frac{1}{\eta }}\) at 0; while the left hand side equals \(\kappa _0\) for \(\omega _1=1\) and \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) \) for \(\omega _1=0\). Since both sides are continuous function of \(\omega \), it suffices that \(\kappa \left( 1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \right) < \zeta _1\left( 0\right) \) to ensure the existence of the Good equilibrium. As \(\eta >0\), \(1-\frac{r}{r-a_l-\beta }\left( 1-\zeta _1\left( 0\right) \right) \) is often negative \(\big (\)it is negative as long as \(\frac{a_l+\beta +\delta }{A}>\frac{1}{1-\zeta _1\left( 0\right) }\big )\), so that \(\kappa _0<\zeta _1\left( 0\right) \) ensures the existence of the equilibrium (because \(\kappa \) is increasing).Footnote 20 As \(\zeta _1\left( 0\right) \in \left[ 0;\frac{a_l+\beta +\delta }{A}\right] \) in this case, assuming e.g. \(\kappa \left( 0\right) =0\) is a sufficient condition for the existence of the Good equilibrium.

Proposition 2

\(\omega _1\) is positive if \(\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^\eta >b\).

Proof

As Eq. (3) rewrites \(\omega _1=1-b\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^{-\eta }\), one just needs that \(\left( \frac{A\zeta _1}{a_l+\beta +\delta }\right) ^\eta >b\) to ensure a positive \(\omega _1\). As \(\eta > 0\), this is equivalent to \(\zeta _1\) being above \(\frac{a_l+\beta +\delta }{A}b^{\frac{1}{\eta }}\).Footnote 21 Hence, as long as the image of \(\kappa \) is entirely on the right side of this value, \(\omega _1\) is positive. \(\square \)

1.4 D Numerical results for the stability of equilibrium

Table 6 displays the numerical eigenvalues of the Jacobian at the Good equilibrium point, where \((\omega _1, \lambda _1, d_1)\) are all finite. Remember, to be locally stable, the Jacobian matrix at this equilibrium point has to be negative definite. This would mean that the eigenvalues are all non-positive. In this exercise, they all show local stability at the Good equilibrium value.Footnote 22

For the sake of completeness, Tables 7 and 8 show respectively the eigenvalues of the Trivial and the Slavery equilibria. We observe that, as expected, non of these trials display a local stability for that equilibrium point.

The eigenvalues of the Bad equilibrium are shown in Table 9 and confirm that, whenever \(\eta \in ]-1;0[\), the only stable equilibrium that may be asymptotically globally stable is the good.

1.5 E Existence of the slavery equilibrium

Let us take the last two equations of the main system when \(\omega \rightarrow 0\).

At the equilibrium, whenever \(\lambda >0\), one finds, by injecting 16 into 17:

As \(\kappa \) is bounded, one can neglect the term in \(\omega \). Defining \(s=A b^{-\frac{1}{\eta }}\), \(e=r+\delta >0\) and \(z\left( d\right) =-\kappa \left( 1-rd\right) \in \left[ -1;0\right] \) one thus obtains

If \(s<e\), the left hand side is a continuous and non-negative function of d which passes through the origin and is equivalent to \(d\left( e-s\kappa _{0}\right) \) at \(+\infty \). Hence, the equation has a solution and \(s<e\) is a sufficient condition for the existence of a Slavery equilibrium.

For \(\eta <0\), s converges decreasingly towards 0 when \(\eta \) tends to 0, so there exists an interval \(]-\eta _{min};0[\) within which the existence of the equilibrium is insured.

Note that for \(\eta >0\), as \(b<1\), s decreases with \(\eta \) and converges towards A, so that if there is a substitutability \(\eta _{0}\) such that \(s_{\eta _{0}}<e=r+\delta \), the existence of the Slavery equilibrium is insured below this substitutability (for \(\eta >\eta _{0}\)). That being said, for the benchmark specification, this inequality does not hold. One can then derive a less restrictive sufficient condition: \(e-s\kappa _{0}>0\). Finally, if \(\kappa _{0}<\nicefrac {b^{\frac{1}{\eta }}\left( r+\delta \right) }{A}\), a Slavery equilibrium exists (with an equilibrium value for the debt potentially very high). For our benchmark specification with \(\eta =1\) (resp. \(\eta =\infty \), resp. \(\eta =-0.5\)), it suffices that \(\kappa _{0}<0.02\) (resp. \(\kappa _{0}<0.15\), resp. \(\kappa _{0}<8.2\)) for the equilibrium to exist.

1.6 F Getting the reduced form of the system with Cobb–Douglas production function

We assume that the productive sector is endowed with a constant return to scale Cobb–Douglas technology so that

Additionally, we make, as previously, the assumption that wages are set at marginal rate of productivity, so that:

For simplicity, we define \(L^e := e^{a_l t} L\), so that the following relationship holds

By taking the derivative of (13) and using (14)

with \(\omega \), the share of total real wages (\(W := \text {w}L\)) in the production:

Let \(a := Y/L\) be the labor productivity, one has \(\omega = \text {w}/a\). The growth rate of the wage share is given by

Using Eq. (20), one gets the following growth rate for labor productivity

Suppose that the growth rate of wages is given by a short-term Phillips Curve

The dynamic of the wage share is given by

The population grows according to

The employment rate is defined by \(\lambda := \frac{L}{N}\), while the capital-output ratio is given by \(\nu := \frac{K}{Y}\). Hence, the employment rate dynamic

The profit share in the production is given by

where r is the short-term interest rate set by the central bank, and paid by producers, while d is the ratio of real debt-to-production (i.e \(\frac{D}{Y}\)). The capital accumulation is given by

where \(\delta \) is the depreciation rate of capital, \(\kappa (\pi )\) is a function of the profit share, and \(\nu \) is the time-varying capital-to-output ratio. By dividing Eq. 18, by the output, Y, we are able to obtain

Its growth rate is given by

Therefore, the growth rate of employment is

The debt dynamic is the difference between investment and the profits made by the corporate sector, in other words

The growth rate of production is given by

Thus, the ratio of real debt on production is

Hence, its dynamic is

To wrap up, and for the sake of clarity, the three-dimensional system is

Rights and permissions

About this article

Cite this article

Bastidas, D., Fabre, A. & Mc Isaac, F. Minskyan classical growth cycles: stability analysis of a stock-flow consistent macrodynamic model. Math Finan Econ 13, 359–391 (2019). https://doi.org/10.1007/s11579-018-0231-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-018-0231-6

Keywords

- Prey–predator

- Goodwin model

- Keen model

- Minsky’s financial instability hypothesis

- Dynamical systems

- Speculation