Abstract

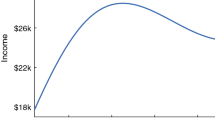

We derive the optimal portfolio for an investor with increasing relative risk aversion in a complete continuous-time securities market. The IRRA assumption helps to mitigate the criticism of constant relative risk aversion that it implies an unreasonably large aversion to large gambles, given reasonable aversion to small gambles. The model provides theoretical support for the common recommendation of financial advisors that older investors should reduce their allocations to risky assets, and it is consistent with empirical relations between age, wealth, and portfolios.

Similar content being viewed by others

Notes

IRRA preferences do not eliminate the concern entirely. Rabin [15] argues that it is a feature of expected utility in general that either aversion to small gambles is too small, or aversion to large gambles is too large.

The empirical relation of equity allocations to age is not entirely clear. Bodie and Crane [2] find that the allocation is decreasing in age. Also, Curcuru et al. [7] find that the allocation is decreasing in age for low-wealth individuals and hump-shaped for others. However, Ameriks and Zeldes [1] find that the allocation is increasing in age for individual investors, with the hump-shaped cross-sectional pattern being due to cohort effects.

There are different results in the literature regarding whether these utility functions are actually representative of individuals’ preferences. [3] argue that they are the most representative within the HARA class, based on experimental evidence. However, [4] argue that decreasing relative risk aversion is a better assumption, based on Swedish household portfolio data.

Huggett and Kaplan [8] document that there is substantial risk in labor income, though they estimate the value of the part that is spanned by asset markets to be less than 35% of the total value of human capital.

References

Ameriks, J., Zeldes, S.P.: How do Household Portfolio Shares Vary with Age. Technical report, working paper, Columbia University (2004)

Bodie, Z., Crane, D.B.: Personal investing: advice, theory, and evidence. Financ. Anal. J. 53, 13–23 (1997)

Brocas, I., Carrillo, J.D., Giga, A., Zapatero, F.: Risk Aversion in a Dynamic Asset Allocation Experiment. Working Paper (2014)

Calvet, L.E., Sodini, P.: Twin picks: disentangling the determinants of risk-taking in household portfolios. J. Finance 69, 867–906 (2014)

Canner, N., Mankiw, N.G., Weil, D.N.: An asset allocation puzzle. Am. Econ. Rev. 87, 181–191 (1997)

Cox, J.C., Huang, C.F.: Optimal consumption and portfolio policies when asset prices follow a diffusion process. J. Econ. Theory 49, 33–83 (1989)

Curcuru, S., Heaton, J., Lucas, D., Moore, D.: Heterogeneity and portfolio choice: theory and evidence. In: Aït-Sahalia, Y., Hansen, L.P. (eds.) The Handbook of Financial Econometrics, vol. 1, pp. 337–382. North Holland, Amsterdam, Netherlands (2010)

Huggett, M., Kaplan, G.: How large is the stock component of human capital. Rev. Econ. 22, 21–51 (2016)

Jagannathan, R., Kocherlakota, N.R.: Why should older people invest less stock than younger people? Fed. Reserve Bank Minneap. Q. Rev. 20, 11–23 (1996)

Kandel, S., Stambaugh, R.F.: Asset returns and intertemporal preferences. J. Monet. Econ. 27, 39–71 (1991)

Karatzas, I., Lehoczky, J.P., Shreve, S.E.: Optimal portfolio and consumption decisions for a “small investor” on a finite horizon. SIAM J. Control Optim. 25, 1557–1586 (1987)

Lakner, P., Nygren, L.M.: Portfolio optimization with downside constraints. Math. Finance 16, 283–299 (2006)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3, 373–413 (1971)

Nielsen, L.T., Vassalou, M.: The instantaneous capital market line. Econ. Theory 28, 651–664 (2006)

Rabin, M.: Risk aversion and expected-utility theory: a calibration theorem. Econometrica 68, 1281–1292 (2000)

Samuelson, P.A.: Lifetime portfolio selection by dynamic stochastic programming. Rev. Econ. Stat. 51, 239–246 (1969)

Sethi, S.P., Taksar, M.I.: A note on Merton’s “optimum consumption and portfolio rules in a continuous-time model”. J. Econ. Theory 46, 395–401 (1988)

Sethi, S.P., Taksar, M.I., Presman, E.L.: Explicit solution of a general consumption/portfolio problem with subsistence consumption and bankruptcy. J. Econ. Dyn. Control 16, 747–768 (1992)

Shin, Y.H., Lim, B.H., Choi, U.J.: Optimal consumption and portfolio selection problem with downside consumption constraints. Appl. Math. Comput. 188, 1801–1811 (2007)

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A. Proof of Proposition 1

The function

is strictly monotone and maps \([0,\infty )\) onto \([0,\infty )\). Thus, there is a unique \(\gamma \) such that

Let \(C^*\) denote \((\gamma X_t - \xi )^+\), and let C be any other nonnegative consumption process satisfying the budget constraint

By concavity,

so

The second term on the right-hand side is the sum of

and

The term (A.4) equals

The term (A.5) equals

the inequality being due to the fact that \(\xi \ge \gamma X_t\) when \(C^*_t=0\). Adding (A.6) and (A.7) and using (A.1) and (A.2) yields

Hence, (A.3) implies that \(C^*\) is optimal.

Because \(C^*\) is the optimal consumption process, the expression (12)–which equals \(f(t,X_t)\)—is the optimal wealth process. We have

Consider any constant \(\alpha \) and dates \(t<u\). Set \(\tau = u-t\). Using the definition of X and the fact that M is the geometric Brownian motion (5), we have

Therefore,

where \(\varepsilon =-(B_u-B_t)/\sqrt{u-t}\), which is a standard normal random variable. Furthermore,

where we set

Therefore,

Substituting (A.10) with \(\alpha = 1-\rho \) and \(\alpha =-\rho \) into (A.8) verifies (16).

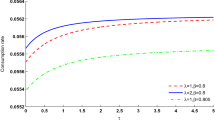

From the formula (16), it is straightforward to verify that f is continuously differentiable in t and twice continuously differentiable in x. Therefore, we can apply Itô’s formula to compute \(\mathrm {d}f\). We compute the optimal portfolio \(\pi \) by matching the stochastic part of \(\mathrm {d}f\) to \(W\pi \sigma \,\mathrm {d}B\), which is the stochastic part of \(\mathrm {d}W\) implied by the intertemporal budget constraint. The drift parts will then match due to the fact that

is a martingale (which implies that its drift is zero). From (A.9), X is a geometric Brownian motion with volatility \(\lambda /\rho \). Therefore, the stochastic part of \(\mathrm {d}f\) is \((\lambda /\rho )Xf_x \,\mathrm {d}B\). Matching this to \(W\pi \sigma \,\mathrm {d}B\), we see that

This verifies (17). The formula (16) for f and (17) directly imply (18).

If \(\xi =0\), then the definition (14) simplifies to

which equals xa(t), where \(a(\cdot )\) is the nonrandom function

Therefore, \(f(t,x) = xf_x(t,x)\) as claimed.

Appendix B. Negative consumption

Here we derive the optimum for an IRRA investor when negative consumption is allowed. The first order condition is

As before, define \(\gamma = \eta ^{-1/\rho }\) and define X as in (10). Then, the first order condition can be expressed as: \(C_t = \gamma X_t-\xi \). Optimal wealth is

Itô’s formula and the dynamics of M imply

Therefore,

It follows that

where

Define

This is the investor’s wealth plus the proceeds that would be obtained by selling a claim that pays \(\xi \) per unit of time from t to T. Equation (B.1) allows us to calculate \(\gamma \) from \(\widehat{W}_0\) as

The optimal consumption satisfies

The optimal portfolio \(\pi \) is such that \(W\pi \sigma \,\mathrm {d}B\) equals the stochastic part of \(\mathrm {d}W\), which is the stochastic part of \(\mathrm {d}\widehat{W}\), which is the stochastic part of

Thus,

This implies

Rights and permissions

About this article

Cite this article

Back, K., Liu, R. & Teguia, A. Increasing risk aversion and life-cycle investing. Math Finan Econ 13, 287–302 (2019). https://doi.org/10.1007/s11579-018-0228-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-018-0228-1