Abstract

Many retailers nowadays operate in an Internet-enabled dual-channel supply chain setting, referred to as “click and mortar”. In such a structure, products and services are delivered through both online B2C (business-to-consumer e-tail) and offline B2C (traditional brick and mortar retail) channels. In this paper, we develop and present a unified modeling approach that reflects a real-world dual-channel supply chain in the food retail industry. Motivated by the actual business operations of a case study, we incorporate the spatial locations of customers, as well as other logistics and operational costs, into the service provider’s pricing and the customers’ channel choice decisions. We develop two models, namely the benchmark and proposed models, and conduct extensive numerical experiments with parameter values centered on actual values. The results reveal that the ratio of online and offline profit to the total dual-channel profit vary significantly, depending on the locations of customers and the values of the logistics costs. In addition, our statistical and visual analysis suggest that by jointly optimizing the logistics and operational processes, the service provider can achieve a considerably high profit through both channels, without necessarily expanding the size of its geographical service areas.

Similar content being viewed by others

Notes

Foodora (https://www.foodora.com.au).

This case is represented by the benchmark model and discussed in detail in Sect. 4.3.

This case is represented by the proposed model and discussed in detail in Sect. 4.4.

For the sake of brevity and to concentrate on the dual-channel setting, the resulting properties of two basic models (offline-only and online-only), where either in-store or online service is active, are provided in “Appendix A”.

Here, the mathematical symbol shown as the long vertical line refers to evaluation of the expression at the two given points and taking their difference.

Details on parameters’ values can be provided by the corresponding author upon request.

These value ranges are given in “Appendix B” (Tables 3, 5), where the estimated values for the input parameters are shown as central values in bold.

Similar analyses were conducted to explore the effects of the delivery charge pd and offline service cost Coff (together with other parameters) on the supply chain structure, and can be provided by the lead author upon request.

References

Amrouche, N., & Yan, R. (2016). A manufacturer distribution issue: How to manage an online and a traditional retailer. Annals of Operations Research,244(2), 257–294.

Asian, S., & Nie, X. (2014). Coordination in supply chains with uncertain demand and disruption risks: Existence, analysis, and insights. IEEE Transactions on Systems, Man, and Cybernetics: Systems,44(9), 1139–1154.

Australian Food & Grocery Council. (2017). State of the industry. Retrieved February 25, 2018, from https://www.afgc.org.au/wp-content/uploads/AFGC-2017-State-of-the-Industry-Report.pdf. https://bit.ly/2zAa2Tq.

Cai, G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing,86(1), 22–36.

Cai, G., Zhang, Z. G., & Zhang, M. (2009). Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. International Journal of Production Economics,117(1), 80–96.

Chen, T.-H. (2015). Effects of the pricing and cooperative advertising policies in a two-echelon dual-channel supply chain. Computers & Industrial Engineering,87, 250–259.

Chen, J., Liang, L., Yao, D.-Q., & Sun, S. (2017). Price and quality decisions in dual-channel supply chains. European Journal of Operational Research,259(3), 935–948.

Chen, X., Wang, X., & Chan, H. K. (2016). Channel coordination through subsidy contract design in the mobile phone industry. International Journal of Production Economics,171, 97–104.

Choi, T.-M., Chow, P.-S., & Xiao, T. (2012). Electronic price-testing scheme for fashion retailing with information updating. International Journal of Production Economics,140(1), 396–406.

Ertek, G., & Griffin, P. M. (2002). Supplier-and buyer-driven channels in a two-stage supply chain. IIE transactions, 34(8), 691–700.

de Kervenoael, R., Yanık, S., Bozkaya, B., Palmer, M., & Hallsworth, A. (2015). Trading-up on unmet expectations? Evaluating consumers’ expectations in online premium grocery shopping logistics. International Journal of Logistics Research and Applications,19(2), 83–104.

Duffey, K. J., Gordon-Larsen, P., Shikany, J. M., Guilkey, D., Jacobs, D. R., Jr., & Popkin, B. M. (2010). Food price and diet and health outcomes: 20 years of the CARDIA study. Archives of Internal Medicine,170(5), 420–426.

El-Taweel, T. A., & Haridy, S. (2014). An application of fractional factorial design in wire electrochemical turning process. The International Journal of Advanced Manufacturing Technology,75(5), 1207–1218.

Faghih-Roohi, S., Ong, Y.-S., Asian, S., & Zhang, A. N. (2016). Dynamic conditional value-at-risk model for routing and scheduling of hazardous material transportation networks. Annals of Operations Research,247(2), 715–734.

Fernández, P., Pelegrín, B., Lančinskas, A., & Žilinskas, J. (2017). New heuristic algorithms for discrete competitive location problems with binary and partially binary customer behavior. Computers & Operations Research,79, 12–18.

Giri, B. C., Chakraborty, A., & Maiti, T. (2017). Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. Journal of Manufacturing Systems,42, 104–123.

Guo, X., & Zheng, X. (2017). Examination of restaurants online pricing strategies: A game analytical approach. Journal of Hospitality Marketing & Management,26(6), 659–673.

Han, S., Fu, Y., Cao, B., & Luo, Z. (2016). Pricing and bargaining strategy of e-retail under hybrid operational patterns. Annals of Operations Research. https://doi.org/10.1007/s10479-016-2214-4.

Haridy, S., Gouda, S. A., & Wu, Z. (2011). An integrated framework of statistical process control and design of experiments for optimizing wire electrochemical turning process. The International Journal of Advanced Manufacturing Technology,53(1), 191–207.

Haridy, S., Wu, Z., Khoo, M. B. C., & Yu, F.-J. (2012). A combined synthetic and np scheme for detecting increases in fraction nonconforming. Computers & Industrial Engineering,62(4), 979–988.

Hayel, Y., Quadri, D., Jiménez, T., & Brotcorne, L. (2016). Decentralized optimization of last-mile delivery services with non-cooperative bounded rational customers. Annals of Operations Research,239(2), 451–469.

He, Z., Cheng, T. C. E., Dong, J., & Wang, S. (2016). Evolutionary location and pricing strategies for service merchants in competitive O2O markets. European Journal of Operational Research,254(2), 595–609.

Hsiao, L., & Chen, Y.-J. (2014). Strategic motive for introducing internet channels in a supply chain. Production and Operations Management,23(1), 36–47.

Hua, G., Wang, S., & Cheng, T. C. E. (2010). Price and lead time decisions in dual-channel supply chains. European Journal of Operational Research,205(1), 113–126.

Huang, H., Ke, H., & Wang, L. (2016). Equilibrium analysis of pricing competition and cooperation in supply chain with one common manufacturer and duopoly retailers. International Journal of Production Economics,178, 12–21.

Intermedia. (2018). Eating out in australia 2017: Fast food to fine dining—State of the industry. Available for purchase under: https://subscriptions.intermedia.com.au/product/eating-out-in-australia-2017-report/. https://bit.ly/2LgucGK.

Kalyanaram, G., & Winer, R. S. (1995). Empirical generalizations from reference price research. Marketing Science,14(3), G161–G169.

Kressmann, J. (2017). Takeout food helps drive ecommerce growth in Australia. Accessed July 8, 2018, from https://retail.emarketer.com/article/takeout-food-helps-drive-ecommerce-growth-australia/58b2f9589c13e50de431c9e8. https://bit.ly/2KCKpXr.

Lagura, E., Norman, P., Richmond, M., & Watling, R. (2011). The public transport usage of two melbournes. In: Australasian Transport Research Forum 2011 proceedings, September 28–30, 2011, Adelaide, Australia.

Li, B., Hou, P.-W., Chen, P., & Li, Q.-H. (2016). Pricing strategy and coordination in a dual channel supply chain with a risk-averse retailer. International Journal of Production Economics,178, 154–168.

Loiacono, S. (2007). Choosing winners in the click-and-mortar game. Retrieved February 26, 2018, from https://www.forbes.com/2007/06/08/retailers-amazon-netflix-pf-education-sl_in_0608investopedia_inl.html#29cfde3183d1. https://goo.gl/AcBfC3.

Lu, D., Asian, S., Erteke, G., & Sevinç, M. (2018a). Mind the perception gap: An integrative performance management framework for service supply chain performance. International Journal of Physical Distribution & Logistics Management. https://doi.org/10.1108/IJPDLM-09-2017-0302.

Lu, D., Ding, Y., Asian, S., & Paul, S. K. (2018b). From supply chain integration to operational performance: The moderating effect of market uncertainty. Global Journal of Flexible Systems Management,19, 3–20.

Lu, Q., & Liu, N. (2015). Effects of e-commerce channel entry in a two-echelon supply chain: A comparative analysis of single- and dual-channel distribution systems. International Journal of Production Economics,165, 100–111.

Mangiaracina, R., Marchet, G., Perotti, S., & Tumino, A. (2015). A review of the environmental implications of B2C e-commerce: A logistics perspective. International Journal of Physical Distribution & Logistics Management,45, 565–591.

Matsui, K. (2017). When should a manufacturer set its direct price and wholesale price in dual-channel supply chains? European Journal of Operational Research,258(2), 501–511.

Morganti, E., Seidel, S., Blanquart, C., Dablanc, L., & Lenz, B. (2014). The impact of e-commerce on final deliveries: Alternative parcel delivery services in France and Germany. Transportation Research Procedia,4, 178–190.

Paul, S. K., Asian, S., Goh, M., & Torabi, S. A. (2017). Managing sudden transportation disruptions in supply chains under delivery delay and quantity loss. Annals of Operations Research. https://doi.org/10.1007/s10479-10017-12684-z.

Pauwels, K., Srinivasan, S., & Franses, P. H. (2007). When do price thresholds matter in retail categories? Marketing Science,26(1), 83–100.

Plunkett Research. (2017). Global food industry statistics and market size overview, business and industry statistics. Retrieved February 25, 2018, from https://www.plunkettresearch.com/statistics/Industry-Statistics-Global-Food-Industry-Statistics-and-Market-Size-Overview/. https://goo.gl/BZwK9q.

Pu, X., Gong, L., & Han, X. (2017). Consumer free riding: Coordinating sales effort in a dual-channel supply chain. Electronic Commerce Research and Applications,22, 1–12.

Saarijärvi, H., Mitronen, L., & Yrjölä, M. (2014). From selling to supporting—Leveraging mobile services in the context of food retailing. Journal of Retailing and Consumer Services,21(1), 26–36.

Sensis. (2017). Sensis e-business report 2017: The online experience of small and medium enterprises. Retrieved July 8, 2018, from https://irp-cdn.multiscreensite.com/535ef142/files/uploaded/Sensis%20eBusiness%20Report%202017.pdf. https://bit.ly/2Nyj5qU.

Soleimani, F., Arshadi Khamseh, A., & Naderi, B. (2016). Optimal decisions in a dual-channel supply chain under simultaneous demand and production cost disruptions. Annals of Operations Research,243(1), 301–321.

Somarin, R. A., Asian, S., Jolai, F., & Chen, S. (2018). Flexibility in service parts supply chain: A study on emergency resupply in aviation MRO. International Journal of Production Research,56(10), 3547–3562.

Wang, W., Li, G., & Cheng, T. C. E. (2016). Channel selection in a supply chain with a multi-channel retailer: The role of channel operating costs. International Journal of Production Economics,173, 54–65.

Wang, Z., Yao, D.-Q., & Yue, X. (2017). E-business system investment for fresh agricultural food industry in China. Annals of Operations Research,257(1), 379–394.

Werner, D., Sascha, A., & Martin, G. (2002). The impact of electronic commerce on logistics service providers. International Journal of Physical Distribution & Logistics Management,32(3), 203–222.

Xiao, T., & Qi, X. (2016). A two-stage supply chain with demand sensitive to price, delivery time, and reliability of delivery. Annals of Operations Research,241(1–2), 475–496.

Xu, H., Liu, Z. Z., & Zhang, S. H. (2012). A strategic analysis of dual-channel supply chain design with price and delivery lead time considerations. International Journal of Production Economics,139(2), 654–663.

Xu, X., Munson, C. L., & Zeng, S. (2017). The impact of e-service offerings on the demand of online customers. International Journal of Production Economics,184, 231–244.

Yao, D.-Q., & Liu, J. J. (2005). Competitive pricing of mixed retail and e-tail distribution channels. Omega,33(3), 235–247.

Yao, Y., & Zhang, J. (2012). Pricing for shipping services of online retailers: Analytical and empirical approaches. Decision Support Systems,53(2), 368–380.

Yeo, V. C. S., Goh, S.-K., & Rezaei, S. (2017). Consumer experiences, attitude and behavioral intention toward online food delivery (OFD) services. Journal of Retailing and Consumer Services,35, 150–162.

Yeung, W.-K., Choi, T.-M., & Cheng, T. C. E. (2011). Supply chain scheduling and coordination with dual delivery modes and inventory storage cost. International Journal of Production Economics,132(2), 223–229.

Yu, Y., Han, X., Liu, J., & Cheng, Q. (2015). Supply chain equilibrium among companies with offline and online selling channels. International Journal of Production Research,53(22), 6672–6688.

Zhang, F., & Ma, J. (2016). Research on the complex features about a dual-channel supply chain with a fair caring retailer. Communications in Nonlinear Science and Numerical Simulation,30(1), 151–167.

Zhang, L., & Wang, J. (2017). Coordination of the traditional and the online channels for a short-life-cycle product. European Journal of Operational Research,258(2), 639–651.

Acknowledgements

We sincerely thank the guest editors and anonymous reviewers for their valuable suggestions and comments. We thank the founding manager of Roza’s Kitchen for initiating the joint industry project and providing information, data, and continuous support throughout the study. This research was supported by the National Natural Science Foundation of China (71471109), the Doctoral Innovation Foundation of Shanghai Maritime University (No. 2017ycx074), and the Shanghai Science and Technology Commission (16040501800). This research was also supported by a Social Research Platform Grant from La Trobe University.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

1.1 A1: Offline-only model

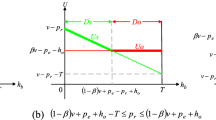

Under the offline-only setting, the customer service area is modeled as a circle with the restaurant at the center. Following Eq. (A1), the customer area is a circle with a radius denoted as lu, such that the purchase proportion is equal to 0 at a distance of lu:

As shown in Eq. (A2), the potential demand for the offline channel can be calculated through integrating over the circle of service with radius lu:

The offline profit function Πoff for this offline-only setting then can be derived, as in Eq. (A3).

To find the optimal price for the offline-only setting, we take the derivative of the offline profit function Πoff with respect to the offline price poff, as shown in Eq. (A4):

When this equation is solved for price, the optimal offline price \( p_{\text{off}}^{*} \) for the offline-only setting is found in Eq. (A5), where purchase proportion is non-negative:

The customers’ travel costs can be obtained through integrating over the potentially infinite circular service area, as given in Eq. (A6):

1.2 A2: Online-only model

In the online-only setting, customers can only order online and receive delivery of the product ordered from the service provider, but not visit the restaurant. This setting is particularly suitable for customers who have limited meal time (e.g. office staff) and prefer their meals to be delivered to their locations.

In the online-only setting, the maximum online delivery distance is limited to lm. In other words, the online demand is 0 for customers at a distance of lm. The value of lm can accordingly be obtained through Eq. (A7):

Online demand is calculated by integrating the online-only demand over the service area with a radius of lm, as given in Eq. (A8):

Substituting demand, price, and delivery costs into Eq. (A9), the online profit can be calculated:

Total delivery cost and an alternative form of online profit function are derived in Eqs. (A10) and (A11), respectively:

Finally, the optimal online price is derived in Eq. (A12), when purchase proportion is non-negative:

Appendix B

Rights and permissions

About this article

Cite this article

Wei, C., Asian, S., Ertek, G. et al. Location-based pricing and channel selection in a supply chain: a case study from the food retail industry. Ann Oper Res 291, 959–984 (2020). https://doi.org/10.1007/s10479-018-3040-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3040-7