Abstract

Building on the Knowledge Spillover Theory of Entrepreneurship (KSTE) and the Digital Entrepreneurial Ecosystem (DEE) approach, this paper investigates the relationship between the local availability of digital knowledge (i.e., digital knowledge spillovers and digital skill endowment) and the creation of digital innovative start-ups in Italian NUTS3 regions. The obtained results show that both elements are significant for the creation of digital innovative start-ups at the province level, and a two-fold contribution has been made: from a theory perspective, an extension of KSTE to digital settings has been used to assess the relevance of geographical issues, while, from a DEE perspective, the study contributes by empirically analyzing the specific characteristics of the local ecosystem that can affect the creation of digital innovative start-ups. Finally, we discuss the implications for entrepreneurship and technology policy at the local level.

Plain English Summary

Digital knowledge spillovers and digital skill endowment support the creation of digital innovative start-ups. The rapid diffusion of digital technologies has generated new opportunities for developing innovative entrepreneurship, which is essential for employment growth, new job creation, and socio-economic wealth. Therefore, investigating the enabling conditions of digital innovative start-up creation is essential to define appropriate support policies. This paper, by processing data related to Italian NUTS3 regions, analyses the role that digital knowledge spillovers and digital skill endowment play in supporting the creation of digital innovative start-ups. The obtained results highlight that both the components considered to describe the local availability of digital knowledge (i.e., knowledge on digital technologies) play a central role in the creation of digital innovative start-ups at the province level. The main implications of this study are important at both a research and a policy level: the former concerns the extension of the Knowledge Spillover Theory of Entrepreneurship to digital settings, whereas the latter regards possible insights and suggestions to enrich institutional policies in order to develop and diffuse digital entrepreneurship processes within a region.

Similar content being viewed by others

1 Introduction

Entrepreneurship, i.e., the process by which new enterprises are founded and become viable, is recognized as the key engine of economic activities – both for stagnant economies to recover and for emerging ones to sustain growth – as it is essential for employment growth and job creation, wage growth, and wealth creation. However, a new category of entrepreneurship, namely digital entrepreneurship, has recently gained momentum (e.g., Elia et al., 2020; Sahut et al., 2021). This is a relevant socio-economic and technological phenomenon as it embraces “new ventures and the transformation of existing businesses by creating and using novel digital technologies … to improve business operations, invent new (digital) business models, sharpen business intelligence, and engage with customers and stakeholders through new (digital) channels”.Footnote 1

The digitalization of the economy favors the emergence of a new breed of entrepreneurs who, unlike their pre-Internet predecessors, can leverage on digital technologies, innovation, and online communities to support most of the key processes within a company (Bryniolfsson & McAfee, 2014). Consequently, we are witnessing a peak of initiatives across the globe to foster the acceleration of digital entrepreneurial activities related to the creation and development of digital start-ups. Some emerging cases of pure digital environments that support the incubation of digital start-ups (e.g., F6s.com, Angel.co, Startupcompete.co) have demonstrated the feasibility of shaping digital entrepreneurial ecosystems in which participants can share knowledge, information, and experiences to create new companies. Such examples encourage scholars to further investigate this phenomenon in order to provide new perspectives for developing digital entrepreneurship processes at the regional level, as some recently published studies have confirmed (e.g., Du et al., 2018; Elia et al., 2020; Nambisan, 2017). On a parallel ground, a wide body of literature has investigated the relationship between entrepreneurial dynamics and economic development at the regional level (Dejardin & Fritsch, 2011; Pietrzak et al., 2017). In this stream of literature, both theoretical and empirical analyses have been conducted to identify the characteristics and attributes of the local socio-economic systems that can have an impact on the formation of new firms (Audretsch & Fritsch, 1994; Colombelli, 2016; Fritsch, 1997). The Knowledge Spillover Theory of Entrepreneurship (henceforth KSTE) has emerged as the leading theory to explain the interdependence between knowledge and entrepreneurial activity formation (Audretsch, 1995; Audretsch et al., 2015). KSTE has recently been extended to refine the understanding of the role that contexts play in shaping entrepreneurial knowledge appropriation and exploitation dynamics (Acs et al., 2009, 2013; Colombelli & Quatraro, 2018; Ghio et al., 2015).

Because of the pervasive diffusion of digital technologies that have created new business opportunities, enhanced knowledge spillovers derived from the intense usage of such technologies (Audretsch et al., 2020b), and which have expanded the scale and the scope of knowledge flows (Fossen & Sorgner, 2019), the current knowledge spillovers mainly occur within online environments (Audretsch et al., 2020b) that operate as digital entrepreneurial ecosystems (Song, 2019). In this vein, this paper investigates the extension of the KSTE to digital settings, by focusing on two key drivers that influence KSTE in the digital era, which are “digital knowledge spillovers” and “digital skill endowment”. These two elements refer to the availability of knowledge on digital technologies and the presence of digitally-skilled individuals, respectively, both of which are crucial for the creation of digital start-ups (Bonaccorsi et al., 2014; Helsper & Eynon, 2013).

The aim of this paper has been to investigate this theme by analyzing the relationship between the availability of digital knowledge and digital skills within local economic systems and the creation of digital innovative start-ups, with the ultimate goal of deriving and suggesting key policy implications. More specifically, with the term “digital innovative startups”, we refer those new-created companies that incorporate novel technology as a vital component of their business models and operations (Elia et al., 2020). In order to define the core dimensions of digital knowledge within local ecosystems that may influence the creation of digital innovative start-ups, we grounded the study on KSTE (Acs et al., 2009; Audretsch & Belitski, 2013; Audretsch & Lehmann, 2005) and on Digital Entrepreneurial Ecosystem (DEE) (Du et al., 2018; Elia et al., 2020; Li et al., 2017; Sussan & Acs, 2017), which have already been explored in the literature, but without any reciprocal linkages.

The empirical analysis has focused on Italian NUTS3 regions and used data on the creation of digital innovative start-ups within the framework of the Italian Startup Act, which is aimed at promoting the creation of new innovative digital firms. This appeared to be an appropriate context for the empirical analysis as many of the innovative start-ups created under this legislative pillar are in fact of a digital nature. Unlike other studies focused on innovative start-ups in Italy, this research has used a multisource dataset built upon original and qualified databases managed by institutional actors, and combined with primary data, which allow analyzing different dimensions of digital knowledge spillovers and digital skill endowment at the NUTS 3 level of analysis.

The obtained results show that digital knowledge spillovers and digital skill endowment are both significant for the creation of digital innovative start-ups at the province level, and they provide a two-fold contribution: from the KSTE perspective, they contribute to investigating a possible extension of such a theory in the digital settings, as it has been found that geographical aspects are not relevant for entrepreneurial success. Instead, from a DEE perspective, the study contributes by empirically analyzing the specific characteristics of the local ecosystem that can affect the creation of digital innovative start-ups.

The rest of the paper is structured as it follows. The theoretical framework, which builds upon the concepts of KSTE and DEE, and articulates the hypotheses on the relationship between the features of the local ecosystem and the creation of digital innovative start-ups, is presented in Sect. 2. Section 3 illustrates the research method and provides details on the context of the study, the data, the considered variables, and the adopted econometric model. Sections 4 describes the findings of the study, whereas Sect. 5 presents the discussion and the main implications. Finally, Sect. 6 ends the study by illustrating the main limitations and new topics for future research.

2 Theoretical framework

2.1 KSTE and the drivers of the creation of new firms

The linkages between the creation of new firms and regional economic development have already been emphasized by scholars in the entrepreneurship and regional economics fields (Fritsch, 2013). New firms in fact appear to be geographically clustered, so that the local economy is likely to benefit from a self-enforcing process that shapes a regional comparative advantage (Feldman, 2001; Feldman et al., 2005). Two main perspectives arise from this literature.

On the one hand, a certain stream of literature has focused on the effects of entry dynamics on regional economic performances. In this respect, the formation of new firms has been considered as a determinant of regional growth, cross-regional differences, and regional employment dynamics (Fritsch, 2013; Fritsch & Schindele, 2011). Moreover, the regional socio-economic environment plays a key role in the relationship between the formation of new firms and regional development (Fritsch & Mueller, 2004). Among all the local factors, cultural and organizational factors have been found to be crucial for regional development (Boschma, 2005; Saxenian, 1996). According to this perspective, the effects of the formation of new firms on regional development can be either direct (e.g., making the entry of new capacities or new jobs creation easy) or indirect (e.g., stimulating the incumbents’ efficiency and structural changes, or enhancing innovation and technological variety) (Fritsch & Mueller, 2004).

Another stream has instead focused on the effects of the characteristics of local socio-economic systems on the regional rates of entrepreneurship. Reynolds et al., (1994) found that such factors as unemployment, population density, and the local industrial structure affect regional variations in the creation rates of new firms. Feldman, (2001) stressed the importance of the local availability of funds, supportive social capital, research universities, and supporting services to stimulate and cultivate entrepreneurship. Lee et al., (2004), drawing upon the notion of Jacobs externalities, investigated the importance of social diversity, human capital and creativity to create new firms. Similarly, Audretsch et al., (2012), following the Marshallian intuition, showed that the local atmosphere (e.g. entrepreneurial culture) shapes the entrepreneurship process. In the same direction, Delgado et al., (2010) and Qian et al., (2013) carried out empirical analyses on the role of knowledge and agglomeration in regional entrepreneurial dynamics. In the same vein, the empirical analyses conducted by Colombelli, (2016), and Colombelli & Quatraro, (2018) revealed that the local knowledge composition affects the creation of innovative start-ups. Such studies can be framed in the KSTE conceptualized of Audretsch, (1995) and Audretsch & Lehmann, (2005), which provides the theoretical foundation for the link between knowledge spillovers and new firm formation. According to KSTE, new knowledge and ideas created endogenously within firms or research laboratories result in knowledge spillovers (Acs et al., 2009), and can be sources of entrepreneurial opportunities that are exploited by entrepreneurs (Acs & Armington, 2006; Audretsch et al., 2006). Thus, KSTE suggests that the creation of a new firm is an endogenous response to opportunities that stem from knowledge that has been generated but not commercially exploited by incumbent firms or academic research institutions (Acs et al., 2013). The existing literature has shown that the key drivers that expand new knowledge and technological opportunities, which lead to the creation of new firms, are represented by several elements, such as: the explicit and implicit knowledge stocks, the complementarity of knowledge bases, the diversity of knowledge sources, the lack of localized competition, the presence of incumbent firms in knowledge-based industries, the thickness of knowledge filters within firms, and the legislative and administrative regulations (Acs et al., 2009; Ghio et al., 2015; Kirschning & Mrożewski, 2023; Plummer & Acs, 2014; Shu et al., 2020).

Thus, by leveraging on KSTE, it emerges that economic growth is not only driven by large incumbents, but also by entrepreneurial ventures that may find their source of innovation in unexploited knowledge stocks (Audretsch, 2007; Audretsch & Belitski, 2013), as well as through the generation of new innovations and improvements in a firm’s productivity (Audretsch & Belitski, 2020). This phenomenon is geographically concentrated in industries where the actors of knowledge that generates inputs are in close proximity (Audretsch & Feldman, 1996). The reciprocal exchange of knowledge among co-located actors engaged in innovation can in fact reduce uncertainty and explain the clustering of innovative activities, which depend on the availability of new knowledge (Carlino & Kerr, 2015). Such places attract individuals who acquire skills by interacting with other people (especially older and more skilled workers) who live and work in close proximity, and this in turn favors intellectual flows and the generation of new knowledge that may contribute to nurturing and developing innovative activities (Glaeser, 1999). However, in order to ensure effective knowledge externalities that may induce firms to generate an innovative performance, geographical proximity needs to be combined with a certain level of cognitive proximity so that interactive learning takes place, as well as with other forms of proximity (i.e., organizational, institutional, and social) that may bring together actors within and between organizations, thus avoiding the risk of excessive lock-ins, and a lack of openness and flexibility (Boschma, 2005). In such a way, local knowledge spillovers can embrace a wide variety of knowledge transmission mechanisms that may help spread ideas and expertise while keeping the innovation process bound in space (Breschi & Lissoni, 2001).

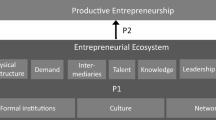

2.2 A digital entrepreneurial ecosystem as lever of KSTE

Entrepreneurship and the system in which it takes place feed off each other (Neck et al., 2004). Attempts have recently been made to develop a more comprehensive framework for the analysis of the dimensions of the context of entrepreneurship (Autio et al., 2015). The entrepreneurial ecosystem approach has been articulated by borrowing from biology (Cho et al., 2021; Isenberg, 2010; Spigel, 2017). The theoretical underpinnings of this new approach go back to a wide and heterogeneous stream of literature that ranges from research on innovation systems (Brusoni & Prencipe, 2013; Cooke et al., 1997; Fritsch, 2001), clusters (Delgado et al., 2010; Feldman et al., 2005; Porter, 1998), networks (Hoang & Antoncic, 2003; Nijkamp, 2003; Stuart & Sorenson, 2005), and entrepreneurial systems (Iansiti & Levien, 2004; Neck et al., 2004; Spilling, 1996; Van de Ven, 1993).

Entrepreneurial ecosystems shape environments that are supportive of innovation-based and adopt a systemic approach to fostering entrepreneurship processes by integrating investment capital, business incubators, universities and research centers, a supportive entrepreneurial culture, a strong business infrastructure, supporting services and facilities, and public policies that incentivize the formation of new firms through appropriate regulatory and normative pillars (Audretsch et al., 2012, 2021a; Isenberg, 2010; Kenney & Patton, 2005; Neck et al, 2004; Stam, 2015). These features affect the creation and growth of local start-ups by enabling inter-firm cooperation, information sharing, knowledge spillovers, opportunity recognition, and financial endowments (Spigel, 2017) with the goal of contributing to regional economic development (Audretsch & Belitski, 2021).

The rapid advancement of digitization (Fossen & Sorgner, 2019) has influenced the dynamics and flows of entrepreneurial ecosystems. In this respect, Sussan and Acs (2017), who introduced the concept of DEE by presenting a framework based on four dimensions i.e., digital infrastructure governance, digital user citizenship, digital entrepreneurship, and digital marketplace, made a key contribution to the literature. According to these authors, DEE “is composed of Schumpeterian entrepreneurs creating digital companies and innovative products and services for many users and agents in the global economy” (Sussan & Acs, 2017).

Digital technologies within DEE are both the subjects and the drivers of the entrepreneurial process as they encompass entrepreneurial opportunities based on digital technologies, and support the discovery, evaluation, and exploitation of such opportunities (Song, 2019).

In such a way, DEE provides a collective and collaborative contribution, which complements the resources of a single firm and, thus, sustains the creation of digital start-ups (Du et al., 2018; Li et al., 2017) that operate at both the local and global level (Cavallo et al., 2019).

In other words, DEE can be considered a kind of collective intelligence system, a sort of a self-organizing community of interdependent entrepreneurial agents that are able to capture and develop entrepreneurial opportunities by leveraging on the existence of digital knowledge, digital technologies, and digital skills that are available at both the local and global level (Elia et al., 2020).

In line with this approach, this study has focused on two dimensions of DEE, that is, “digital knowledge spillovers” and “digital skill endowment”. These dimensions are particularly important since they represent the way digital start-ups can acquire new knowledge from universities and firms to shape and develop new entrepreneurial opportunities within the ecosystem in which they operate. The empirical analyses that were conducted were aimed at investigating the relationship between these dimensions, with respect to the creation of a specific typology of start-ups, named “digital innovative start-ups”. Such a typology of companies was first introduced in Italy in 2012, and there now exists a national roster (i.e., “Registro Imprese”) that contains a list of all the digital innovative start-ups in Italy. These companies have a set of similar characteristics: they were created over a period of less than 48 months, they provide digital-based innovative products or services, and have a turnover of less than 5 million euros. Moreover, such companies have to fulfil other criteria dedicated to the research context, which are illustrated in the next section. In the following section, we discuss the hypotheses tested in the empirical analysis.

2.3 Hypothesis development

No systematic investigations have been found in the literature whereby the phenomenon of digital entrepreneurship is connected to local knowledge spillovers. The rapid diffusion of digital technologies in the last decade has increased the number of knowledge spillovers originating from the usage of such technologies (Audretsch et al., 2020b), which need to be integrated with internal innovation practices and associated with internal and external knowledge investments (Enkel et al., 2009) to contribute toward the creation of new entrepreneurial activities.

Two key drivers that have influenced KSTE in the digital era are “digital knowledge spillovers” and “digital skill endowment”. The former refers to the knowledge on digital technologies that is incorporated in human capital and which makes individuals more capable of recognizing the commercial value of a new innovative firm (Bonaccorsi et al., 2014). The latter instead refers to the employees’ skills on digital technologies, which are important to explain the engagement of people with Information and Communication Technology (ICT) solutions (Helsper & Eynon, 2013).

Since digital technologies have accelerated and expanded the scale and the scope of collaboration, as well as information exchange among the involved actors, knowledge spillovers currently largely occur within online environments (Audretsch et al., 2020b) that operate as digital entrepreneurial ecosystems (Song, 2019).

We therefore extend the main hypothesis of KSTE to digital domains. We expect that new knowledge generated within a local ecosystem in ICT domains is particularly important for the creation of digital innovative start-ups. Thus, the following hypothesis can be advanced:

-

H1. The presence of digital knowledge spillovers is positively associated with the creation of digital innovative start-ups in a focal province.

KSTE suggests that new knowledge represents a source of entrepreneurial opportunities, and that the entrepreneurial actions of appropriating the value of such opportunities can lead to the creation of new firms. Qian & Acs, (2013) argued that the formation of new firms depends not only on the speed of knowledge creation, or the level of new knowledge, but also on the prospective entrepreneurs’ ability to acquire new external knowledge. Thus, new knowledge does not necessarily lead to entrepreneurship, and the extent to which the market value of new knowledge is discovered and exploited depends on the capability of prospective entrepreneurs of recognizing such opportunities and of mobilizing resources to introduce new inventions onto the market. In this context, workers in firms become one of the mechanisms through which external knowledge is acquired to create new start-ups. In other words, companies, and thus the workers that work in such companies and then became entrepreneurs, are the mechanisms through which a start-up can be created. In this way, workers are “prospective entrepreneurs” who are able to merge the knowledge of a firm with ICT knowledge to create new companies. In this direction, a lack of adaptation of the educational system and training policies for technological changes may lead to a skill deficiency (Arendt, 2008). Therefore, companies need to invest in enhancing Information Technology (IT) skills, which have been proved to be crucial to access and share data and information at a global level, thus contributing to the creation of knowledge spillovers in entrepreneurial ecosystems. Consequently, any training employees receive enhances their digital skills, their awareness about the digital transformation phenomena and their ability to use IT solutions, which in turn leas to the need for new IT solutions (Saunders & Brynjolfsson, 2016). Additionally, the enhancement of the digital skills of employees determines a proliferation of user-centred innovation, as more users develop new products and services for themselves and for other users (von Hippel, 2006). Some of these users may develop new products or services in a process of intense interactions with their community and become entrepreneurs themselves (Autio et al., 2013; Shah & Tripsas, 2007; Sussan & Acs, 2017). They often develop an idea when they are users and discuss their knowledge and creativity with the community and other users before commercializing such ideas (Shah & Tripsas, 2007). In view of this argument, the following hypothesis can be advanced:

-

H2. Digital skill endowment is positively associated with the creation of digital innovative start-ups in a focal province.

3 Data and methodology

3.1 Research context

At the end of 2012, the Italian Ministry of Economic Development approved a Law Decree on “Further urgent measures for Italy’s economic growth” (named “Decreto Crescita 2.0”) with the aim of providing specific measures to foster the creation and development of innovative start-ups. The decree recognizes that start-ups are an engine of economic growth, technological development, and new job creation, and it is aimed at creating a favorable context to develop entrepreneurial opportunities by strengthening the links between universities and businesses, and by attracting investments and talented people. By the summer of 2017, more than 5,000 innovative start-ups had been registered in the “Registro Imprese”, i.e., the Italian national roster that contains a list of innovative start-ups.

According to the aforementioned Law Decree, in order to benefit from governmental measures, a start-up needs to fulfil certain requirements: it needs to be a corporation that is not listed and which is subject to Italian tax laws. Moreover, it should have a turnover of less than 5 million euros, have been active for less than 48 months, be owned directly, for at least 51%, by physical subjects, and, more importantly, it should have the social aim of developing innovative products or services with a high technological content.

In order to satisfy this latter requirement and to be defined as innovative, such a start-up needs to fulfil at least one of the following three criteria: either 15% of its costs should be related to R&D activities; at least one third of the team should be made up of highly qualified membersFootnote 2; the enterprise should be the holder, depositary or licensee of a registered patent or the owner of an original registered computer program. Registered “innovative start-ups” benefit from certain government incentives, such as more flexible labor regulations, bureaucratic and administrative simplification, ad-hoc incentives, and a “fail fast” procedure. Therefore, this context appeared to be an appropriate for the empirical analysis conducted in this paper as many of the new firms created under this law are in fact of a digital nature.

3.2 Data

The empirical analysis was focused on the patterns of new firm formation in the digital domain of Italian NUTS 3 regions (i.e., the province level). The empirical analysis involved using data on the creation of innovative start-ups within the framework of the Italian regulations illustrated in Sect. 3. We matched data on digital innovative start-ups, aggregated at the NUTS3 level of analysis, with information on the socio-economic features of the Italian provinces, to discover what factors of local ecosystems were the most conducive to the creation of digital start-ups.

Unlike other studies that focused on innovative start-ups in Italy, this research has used a multisource dataset, built upon original and qualified databases managed by institutional actors, combined with primary data. The matching between two main sources makes our dataset novel: the special section on “Innovative startups” of Registro Imprese and data from the "Information and Communication Technology (ICT) detection in companies—Year 2016" survey. This combination of original data allows analyzing different dimensions of digital knowledge spillovers and digital skill endowment at the NUTS 3 level of analysis and has not previously used by the entrepreneurship literature.

The data gathering process involved three steps. First, we classified the 5,000 innovative start-ups registered in the Italian “Registro Imprese”Footnote 3 by identifying whether they were of a digital nature or not. A start-up was considered as being of a digital nature whenever it provided products or services by leveraging on new digital technologies. Moreover, in order to define whether the innovative start-up was digital or not, we searched for the goals and mission of each start-up on their web-sites or in other authoritative Internet sources and verified whether their products or services were of a digital nature. For example, we considered a product or a service as being digital if it was related to the use and/or generation of digital platforms, software, 3D printing, algorithms, or digital scanning. Several reviewers were involved in the classification of the digital start-ups, and double checks were conducted to verify the appropriateness of the classification.

Among all the classified digital start-ups, we selected those that were registered in the “Registro Imprese” in 2016. This choice was due to the availability of data from the Italian Institute for Statistics (ISTAT) for the year 2016, since a subset of the data used for testing the research framework was only available for the considered year.Footnote 4 A total of 1,805 start-ups were found to satisfy this criterion. Out of these, 929 start-ups were identified as not being digital, while 876 were considered to be digital.

The second step involved gathering data on the two key dimensions of DEE, as identified in Sect. 2 (i.e., “digital knowledge spillovers” and “digital skill endowment”), which are supposed to influence the creation of digital start-ups. We used several data sources to collect information on both the four key dimensions of an ecosystem and the control variables included in our model. We collected data from ISTAT (the Italian Institute for Statistics), Banca d’Italia (the Central Bank of Italy), PATSTAT (the worldwide patent statistical database), INFOCAMERE (the IT agency of the Italian Chambers of Commerce), EUROSTAT (the European Institute for Statistics), and MIUR (the Italian Ministry of Education, Universities and Research). Data from the "Information and Communication Technology (ICT) detection in companies—Year 2016" survey conducted by ISTAT, the Italian National Statistical Office, are key to analyze the key dimensions of the DEE. The survey is part of the European Community statistics on the information society following the Commission Regulation No 808/2004, which establishes the legal basis for harmonized statistics on ICT usage in enterprises. ICT survey is also one of the major sources of data for the Digital Agenda Scoreboard measuring progress of the European digital economy.

The third step was related to creating the final database. This involved merging the two databases and conducting econometric analyses. Our final database included information on 110 Italian NUTS3 regions. Figure 1 shows the distribution of the digital innovative start-ups across the Italian provinces in 2016. The majority of these start-ups are located in the provinces of Milan, Rome, Bologna, Turin and Padua.

3.3 Variables

3.3.1 The dependent variable

The number of digital innovative start-ups in the Italian NUTS3 regions was taken into consideration to implement the empirical analysis. In line with previous works on the determinants of new firm formation (Audretsch & Lehmann, 2005; Bonaccorsi et al., 2013, 2014; Colombelli, 2016), this dependent variable was used to represent the number of digital innovative start-ups (DIG_SU) in a focal province.

3.3.2 The independent variables

The analyses conducted in this paper to test the hypotheses formulated in Sect. 2 required the use of several variables to capture different facets of the four dimensions identified in our research framework. These variables allowed the features of the entrepreneurial system in which the digital innovative start-ups operated to be measured.

The first key dimension was the presence of “digital knowledge spillovers”. This is a common measure that has been used in the extant literature to proxy for knowledge spillovers, and it refers to the number of graduates within a region. This measure accounts for the knowledge embodied in skilled human capital and has proved to be positively correlated with new firm creation in a geographical area. Skilled individuals are in fact more likely to recognize the commercial value of untapped knowledge and to create new innovative firms (Astebro et al., 2012; Bonaccorsi et al., 2014; Shane, 2000). Since we were specifically interested in knowledge spillovers in digital domains, we included graduates in ICT topics as a proxy of this dimension as it represents the supply, by the educational system, of ICT-related courses (Steedman et al., 2003). The supply of these types of courses, which create new knowledge and ideas, in a particular province can create more opportunities for the creation of digital start-ups. We operationalized the “ICT skills through education” (ICT_EDUC) variable by the percentage of graduates over the population in ICT topics at the province level.

We also included the “Local knowledge stock” (LKS) variable in the first key dimension. We used an output variable which was calculated by using patent applications. This is the most frequently used proxy for technological knowledge (Colombelli, 2016). LKS was calculated by applying the permanent inventory method and using a rate of obsolescence of 15% per annumFootnote 5:

where hi,t is the flow of ICT patent applications and δ is the rate of obsolescence, and, once again, i is the province and t is the time period. To avoid endogeneity concerns and to consider the time it takes for an invention to be commercialized, a 3-years lag was applied to this explanatory variable.

The second key dimension was “digital skill endowment”. We considered the enterprises that employed people with ICT skills as a proxy of this dimension, since it represents the skills of the users of solutions proposed by digital innovative start-ups, and since digital skills are important to explain the engagement with ICT solutions. Helsper & Eynon, 2013 also proposed digital innovative start-ups for this purpose. The variable called “ICT specialists” (ICT_SPEC) was operationalized by the percentage of enterprises that employed ICT specialists at the province level (number of companies that employed ICT specialists/number of companies).

Moreover, we also considered companies that provided training on ICT topics to employees with ICT skills to operationalize the second key dimensions (Smallbone et al., 2000). This is a variable that represents the way companies update their ICT skills. This variable, called “ICT training” (ICT_TR), was operationalized by the percentage of companies that provided ICT training to employees with ICT specialization at the province level (number of companies that provided ICT training/number of companies). It is based on confident and critical usage of ICT for work and communication.

Details about the dimensions, names, and descriptions of the variables as well as the data sources are provided in Table 1.

3.3.3 Control variables

We controlled for several factors, which, according to the extant literature, were likely to affect the creation of a new firm. First, the effects of agglomeration economies (POP_DENS), proxied by the population density, were controlled at the NUTS 3 level by dividing the total population in province i by the land use area:

Second, since the creation of new firms can be the outcome of an “escape from unemployment” strategy, the unemployment rate (UNEMPL) at the NUTS 3 level, calculated as the ratio between the number of unemployed people and the number of individuals in the labor force in the region, was also included in the controls.

Third, the number of incubators (INC) in each province was calculated. Business incubators in fact represent a key resource for the creation of start-ups, as they provide the necessary conditions for successful undertakings and increase the likelihood of survival (Auricchio et al., 2014; Colombo & Delmastro, 2002).

Fourth, we considered the entrepreneurial culture of the province as an additional control variable, since it is expected that the higher the entrepreneurial culture of a province is, the higher the rate of the creation of digital start-ups. This variable was operationalized as the percentage of self-employed workers per province (SELF_EMPL) (the number of self-employed workers/population).

Finally, limited access to financial resources can hamper an entrepreneurial process (Blumberg & Latterie, 2008). Credit rationing is the result of information asymmetries, according to which banks may find it difficult to understand the real value of new innovative firms. This engenders a supply shortage for prospective entrepreneurs who cannot rely on personal wealth (Evans & Jovanovic, 1989; Johansson, 2000; Stiglitz & Weiss, 1981). In line with this reasoning, a variable (FIN_SYSTEM) that took into consideration the quality of the financial markets in the NUTS 3 province, and which was proxied by the rate of the decay of investments, was included in the econometric model. The indicator was in fact based on the ratio between the number of entities that entered into situations of serious insolvency in each period as a proportion of the total number of other entities involved in the system. Moreover, the number of bank branches (BANKS) per province was included as a control variable. Banks are key sources of financing in the Italian system and they have recently started to propose international acceleration programs for innovative start-ups whereby the most promising ones are selected and prepared for market benchmarking, which allows them to meet innovation ecosystem actors. Details about the control variables, their descriptions, and the data source are shown in Table 2.

3.4 Methodology

Testing our hypotheses required modelling the DIG_SUi,t dependent variable as a function of the independent variables shown above (ICT_EDUC, LKS, ICT_SPEC, ICT_TR). The baseline specification of our estimating equation, where t refers to the year 2016 and t-1 to the year 2015, was therefore:

As the features of local environments may take some time to exert an effect on entrepreneurial dynamics and to mitigate endogeneity concerns, a 1-year lag was applied for the explanatory variables. In the equation shown above, \(\sum {C}_{i,t-1}\) represents the set of control variables described above.

Because of the discrete and non-negative nature of the dependent variable, Eq. (1) wase estimated using count models, as they have proved more appropriate to deal with nonnegative integers. In other words, Eq. (1) was estimated by means of either a Poisson or a negative binomial model. Since the dependent variable is over-dispersed, and since its variance is far larger than the mean, the negative binomial estimator seems to be more appropriate (Greene, 2003). We acknowledge that there might be a potential endogeneity issue due to reverse causality affecting the presence of digital start-ups and ICT EDU. Specifically, where the number of digital firms is large, individuals may decide to graduate in ICT topics because they expect to have more chance to find a job there. In this case, the number of digital start-ups will determine the number of ICT graduates. To mitigate this issue, in our model we use lagged independent variables.

4 Results

Table 3 reports the descriptive statistics concerning the variables used in the analysis, while Table 4 shows the correlation matrix. As expected, the correlations between the independent variables are relatively high. This is true especially in the case of the different proxies for the same key dimension of the ecosystem. For example, the ICT_TR and ICT_SPEC variables are highly correlated and belong to the same dimension, “DSE”. We tested the correlation of one independent variable on the dependent variable in each model.

The variance-inflation factor (VIF) was checked for each covariate to help detect multicollinearity among the covariates. A high value of VIF indicates the presence of multicollinearity. The VIF in our data was always lower than 10,Footnote 6 that is, the accepted cut-off value (Neter et al., 1990). Thus, the obtained results show that our estimations were not affected by multicollinearity.

Furthermore, the results of the econometric estimation of Eq. (1) are reported in Table 5. Each model contains the effect of each independent variable considered separately. This allowed the effects of the two dimensions of local ecosystems for digital start-ups to be identified. Therefore, we ran a total of five models.

Considering Table 5, it can be observed that Model M1 only contains the control variables. The population density (POP_DENS) has a positive impact on the creation of digital innovative start-ups at the province level, as do the number of incubators (INC) and the entrepreneurial culture (SELF_EMPL) of the province, as expected. Instead, the results show that the rate of unemployment (UNEMPL) is not significantly correlated with the creation of new innovative start-ups. This result is interesting as, in addition to simply confirming that unemployment does not affect the formation of innovative start-ups, it shows that such companies are not subject to the escape from unemployment hypothesis. This result indicates that the founders of innovative digital start-ups should be considered Schumpeterian entrepreneurs and not necessity entrepreneurs (Vivarelli, 2004).

It should be recalled that we tested Eq. (1) by including one independent variable at a time. In Model M2 and Model M3, we tested Hypothesis 1, according to which the presence of digital knowledge spillovers enhances the creation of digital innovative start-ups in a focal province. The ICT_EDUC and the LKS coefficients are actually positive and statistically significant, thus providing support to Hypothesis 1. This means that the larger the digital knowledge stock available in local contexts is, the larger the number of digital start-ups that are created in a province.

When the relationship between digital skill endowment and the creation of digital innovative start-ups in a focal province was tested (Model M4 and Model M5), the percentage of companies that employ ICT specialists (ICT_SPEC) was found to be positively associated with the creation of digital innovative start-ups, as was the percentage of companies that provide ICT training to employees with ICT skills (ICT_TR). Therefore, these results confirm Hypothesis 2. Overall, the econometric results support both of the hypotheses developed and tested in this study. In a nutshell, they suggest that the creation of digital innovative start-ups emerges under particular ICT related conditions.

4.1 Additional analyses

After verifying the two hypotheses formulated in our study, we investigated the existence of the effects of the presence of digital knowledge spillovers and digital skill endowment on the creation of non-digital innovative start-ups. In this way, we were able to understand whether they could be applied to all start-ups or just to digital ones. Following the arguments put forward in our theoretical background, we expect that the proxies for the DEE are more relevant for digital start-ups than for non-digital ones. The number of non-digital innovative start-ups in the Italian NUTS3 regions was taken into consideration to implement the additional models. This dependent variable is the number of non-digital innovative start-ups (NO_DIG_SU) in a focal province, and it was obtained by subtracting the total number of digital innovative start-ups in a focal province from the total number of innovative start-ups. We used the same models as the ones considered for the digital start-ups, but included the number of non-digital start-ups as dependent variable:

The results of the econometric estimation of Eq. (2) are reported in Table 6. Each model contains the effects of each independent variable considered separately. Therefore, we ran another five models.

When considering the effects of the control variables on the creation of non-digital innovative start-ups, we found the same relationships as those of the models with the number of digital innovative start-ups considered as the dependent variable. These results confirm that there are no significant differences between digital and non-digital innovative start-ups with respect to the traditional dimensions of entrepreneurial ecosystems.

When considering the presence of digital knowledge spillovers, the results highlighted that the availability of graduates in ICT topics is also positively associated with the creation of non-digital innovative start-ups, while local knowledge spillovers are not. However, by comparing the ICT_EDUC coefficient in Model M2 and Model M7, it appeared that there is a higher correlation between this variable and the creation of digital innovative start-ups than for the non-digital ones. This result confirms that ICT skilled human capital is of greater importance for digital innovative start-ups than for their counterparts.

Conversely, the creation of digital innovative start-ups is driven by the ICT knowledge stock available in a province, as measured by the ICT patent stock, although this is not the case for non-digital innovative start-ups. Instead, when considering digital skill endowment, we did not find any significant impact of ICT specialists or of ICT training on the creation of non-digital innovative start-ups.

5 Discussion

This paper has investigated the relationship between the local availability of digital knowledge and the creation of digital innovative start-ups in Italy. By building on the Knowledge Spillover Theory of Entrepreneurship and the Digital Entrepreneurship Ecosystem approach, we identified two dimensions of a local entrepreneurial ecosystem – namely digital knowledge spillovers and digital skill endowment – and tested their relevance on the creation of digital innovative start-ups. Our analyses have shed light on the dimensions that characterize an entrepreneurial ecosystem as key levers for the creation and development of digital innovative start-ups. The achieved results contribute toward enhancing the body of knowledge on KSTE, as we tested whether knowledge spillovers and skill endowment also remained valid in digital settings, regardless of the province, which could influence the level of digital culture of a territory. Indeed, cultivating digital knowledge within educational contexts and mastering digital skills in working settings contribute significantly to overcoming the limits that can hinder the collection of both tangible and intangible resources, thus facilitating the execution of the main steps of the entrepreneurial process. Such an extension of the traditional KSTE approach fuels further attempts in complementary directions, including the spatial perspective (Iftikhar et al., 2020, 2022) and firm-level perspective (Audretsch et al., 2021b).

Moreover, knowledge spillovers and skill endowment related to digital technologies, in combination with other elements, such as the presence of professional support services, an easy access to the markets, the proximity of relationships with both research centers and multinational companies, and information about financial capital and investment sources, could play a relevant role for supporting the creation of digital innovative start-ups, which are considered a mechanism for the systemic growth of territories (Cornet et al., 2022; Thomas et al., 2019), thus reinventing the way through which value is created, delivered, and captured (Autio et al., 2018).

We have focused on these aspects since the rapid advancement of digitization (Fossen & Sorgner, 2019) has called for a deeper understanding of the interrelation between the entrepreneurial and the digital ecosystem approaches. In so doing, this study has extended the literature on the digital entrepreneurship ecosystem (Elia et al., 2020), as it has demonstrated that that new knowledge generated within a local ecosystem in the ICT domain is of particular importance for the creation of digital start-ups, and has also highlighted that ICT workers play the role of “prospective entrepreneurs” who are able to merge firm knowledge and ICT knowledge to allow the creation of new digital innovative companies.

This study has also investigated the use of digital technologies to support the diffusion and sharing of knowledge within a network of digital skilled actors capable of interacting and collaborating in the shaping and development of digital innovative start-ups. Such a process allows local territorial development to be sustained within a global context, thus reducing the relevance of distance in the local development dynamics. Moreover, in such a perspective, digitization becomes a central process of knowledge spillover (Proeger & Runst, 2020), as it helps territories to overcome their peripheral position by supporting and establishing direct connections with the key entrepreneurial players in order to stimulate and nurture the creation of digital innovative start-ups.

Indeed, by looking at the relevant phenomenon of inner area development through start-up incubation, this study contributes to exploring new perspectives whereby data and information can be shared by leveraging on digital technologies through their communication potential and collaboration features. In this way, marginal areas can have more opportunities to participate in the global flows of territorial development through the sharing of knowledge assets (Moretto et al., 2022) and by using digital technologies to exploit the relational proximity that characterizes the emerging form of digital entrepreneurial ecosystems (Elia et al., 2020). Moreover, by leveraging on digital technologies, Proeger and Runst (2020) observed that digitization efforts in one domain may lead to the adoption of additional knowledge in other domains, thus overall stimulating entrepreneurial dynamics within a territory. Such a process contributes to creating and consolidating the “missing link” (Braunerhjelm et al., 2010) between knowledge production in research institutions and its effective valorization in regional economies by exploiting the potential of digital technologies (Proeger & Runst, 2020).

We have provided empirical evidence that shows how entrepreneurs can leverage on different dimensions of the ecosystem to generate and use digital technologies and, in turn, give rise to new digital companies. This entrepreneurial process is sustained by the presence of different agents within the ecosystem who contribute to both the generation and the demand of new digital knowledge. Accordingly, interdependent entrepreneurs who are able to capture technology-based opportunities by leveraging on the existence of the digital knowledge and technologies available at the local level may be capable of creating a digital start-up.

By comparing the antecedents of the creation of digital and non-digital innovative start-ups, we have found that the availability of graduates in ICT topics has an impact on the creation of innovative start-ups, regardless of whether they are digital or not. This result might be due to the fact that ICT skilled human capital is of key importance, not only for the generation of new digital firms, but also for the adoption of digital technologies in new non-digital firms. We have also found that ICT specialists as well as ICT training on the creation of non-digital innovative start-ups are not so peculiar for the creation of not digital start-ups, thereby highlighting that other types of skills are required for their creation. This result suggests that future research could investigate the mechanisms under which digital and non-digital innovative start-ups are created, as well as other common or unique factors that might be involved.

This study has a policy/practitioner value. It offers important implications for technology and entrepreneurship policies at the regional level. Technology policy represents one of the key levers that policymakers can use to trigger local development (Bala Subrahmanya, 2017; Friar et al., 2003), in the strategic view of establishing knowledge spillovers enhanced by digitization, so that firms can play a central role by leveraging on their absorptive capacities as well as their openness to technology, motivation toward innovation, and alertness (Proeger & Runst, 2020). Such policies, appropriately combined with complementary policies targeted toward attracting talented people, and developing entrepreneurial competencies and skills in technical profiles, could provide tax incentives for both start-ups and their investors, create spaces where people with ideas could meet to enhance and test innovative solutions, and could play a significant role in activating the antecedents conducive to the creation of innovative start-ups (Audretsch et al., 2020a).

Because of the collective and systemic nature of innovation activities, the choice of the correct policy mix is of crucial importance. The results of this paper suggest that the diffusion of digital knowledge in universities and companies can encourage the creation of digital start-ups. In order to strengthen this effect, policy makers could adopt non-financial support measures, such as “access to skills”, which have been proved to be effective in many countries (Audretsch et al., 2020a). Moreover, transversal training courses could be incentivized at the local level to introduce digital competences to all the students in the area and not only in those who attend ICT related courses. In this way, ICT related investments on education programs could have a significant effect at the local level by leveraging on technology transfer initiatives. Furthermore, lifelong learning programs could also be incentivized at the local level. In such a way, workers could continuously receive ICT-related training to become a vehicle to boost the creation of digital innovative start-ups at the local level. However, when it comes to innovative entrepreneurship policies, the usual mantra of “one size does not fit all” is pertinent. This means that such measures should be combined with complementary initiatives, such as ecosystem-centred subsidies and investments in infrastructure, which should be launched simultaneously.

6 Conclusion

This paper, by conducting empirical analyses on a dataset of 1,805 innovative start-ups in the Italian NUTS3 region, has provided evidence on the entrepreneurial dynamics of Italian provinces and has suggested that the creation of digital innovative start-ups in local contexts appears to be triggered by the combination of two key dimensions of an ecosystem enabled by digital technologies, that is, the availability of knowledge on digital technologies (i.e., digital knowledge spillovers) and the presence of digitally-skilled individuals (i.e., digital skill endowment). We have also demonstrated that these dimensions have a different impact on digital innovative start-ups from that of non-digital ones. In other words, digital skill endowment has a positive impact on the creation of digital innovative start-ups, while it does not affect the creation of non-digital innovative start-ups. On the other hand, digital knowledge spillovers positively affect the creation of both digital and non-digital innovative start-ups, although the impact is higher for digital start-ups. No significant differences have been found between digital and non-digital innovative start-ups with respect to the traditional dimensions of entrepreneurial ecosystems. These findings reveal the key role of the competencies accumulated in the past on the future development of an ecosystem and points out the importance of path-dependence in regional development processes. Indeed, dynamic irreversibility, due to local technological specialization in digital domains, can generate technological advantages for certain regions that may be difficult to replicate in other geographical areas.

The analyses have also shed light on the local features of an ecosystem that are conducive to the formation of new firms in the digital domain, thus opening new avenues for future research. Indeed, entry on its own is not enough for an entrepreneur to become a driver of economic development and job creation. The growth processes of new digital firms also deserve further investigation. Hence, some open research questions are: What is the impact of new digital technologies on the growth of digital innovative start-ups? What are the drivers of innovation and growth for digital innovative start-ups within local ecosystems? What are the mechanisms and processes that can explain the contextual influences (e.g., social, institutional, technology, policy, regional) on the growth of digital innovative start-ups? What are the policy measures that should be introduced to provide the labour market with the necessary digital skills to foster the creation and growth of digital innovative start-ups? The understanding of these dynamics is timely and necessary, and could provide useful insights for the policy agenda of both developed and emerging countries. Furthermore, future research could operationalize “ICT specialists” as the percentage of employees in ICT domains instead of the percentage of enterprises with ICT specialists. At a more general level, future research could be also devoted to including some of the conditions considered by the general, systemic, and digital framework of the EIDES model – European Index of Digital Entrepreneurship Systems (Autio et al., 2020) in analyses, in order to complement the country-level analysis of the digital entrepreneurship phenomenon.

Finally, future studies could be dedicated to investigating the connections between the KSTE and digital entrepreneurship literature with open innovation research, thus contributing to integrating endogenous entrepreneurship, as KSTE was initially conceived (Acs et al., 2009), with exogenous entrepreneurship (Audretsch & Keilbach, 2007).

Despite the importance of the results achieved in this research, the study suffers from some limits. First, the time range of the collected data could be extended to observe the complete evolution of digital innovative start-ups, which often require many years to demonstrate their actual market value and entrepreneurial potential. Second, other variables could be added to complement those considered in this study, such as relational proximity with investors and large companies: the former could provide newly created digital innovative start-ups with financial support, whereas the latter could offer more commercial and market-oriented support. Third, there might be a potential endogeneity issue due to reverse causality affecting the presence of digital start-ups and the percentage of graduates in ICT topics, even though we applied some methodological choices for avoiding it. Finally, the start-ups creation rate is likely to be determined by regional differences (Parker, 2018), which are quite relevant in Italy; therefore, another limit is the lack of geographical controls in the regressions to explain the effect of the local environment.

From such limits, future research can arise to investigate the effects of the creation of digital start-ups on the growth of the territories, which is an outcome not considered in the study. Moreover, future studies could also consider how the quantity of local firms can affect the creation of start-ups. Furthermore, since the Knowledge Spillover theory points out that firms’ capacity to absorb external knowledge depends on firms’ investment in internal knowledge, such as R&D expenditures, and this is particularly true for innovative, the amount of internal R&D expenditures is another crucial ecosystem dimension could be considered when studying Knowledge Spillover for innovative firms in future research. Finally, future research could investigate the mechanisms under which there is the creation of digital and non-digital innovative start-ups as well as other common or unique factors.

Notes

“Fuelling Digital Entrepreneurship in Europe”, European Commission.

By the term “highly qualified members”, the Law intends all those individuals who either hold a PhD qualification or are PhD candidates at an Italian or foreign university, or those who have conducted research over at least three years. Alternatively, two thirds of the total workforce should have a Master’s degree.

The data were made available by the Chamber of Commerce.

The data used in this work were taken from ISTAT and are related to the "Information and Communication Technology (ICT) detection in companies—Year 2016" survey. The elaborations were carried out at the ISTAT Economic Data Analysis Laboratory, in compliance with the legislation on the protection of statistical confidentiality and personal data protection. The results and conducted analyses are the sole responsibility of the author and do not constitute official statistics.

The most common value used in the literature, since it was first introduced by Hall et al., (2005), is 15%.

In our estimations, VIF assumed values of between 1.43 and 1.73.

References

Acs, Z. J., & Armington, C. (2006). Entrepreneurship, geography, and American economic growth. Cambridge University Press.

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774. https://doi.org/10.1007/s11187-013-9505-9

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. https://doi.org/10.1007/s11187-008-9157-3

Arendt, L. (2008). Barriers to ICT adoption in SMEs: How to bridge the digital divide? Journal of Systems and Information Technology, 10(2), 93–108. https://doi.org/10.1108/13287260810897738

Astebro, T., Bazzazian, N., & Braguinsky, S. (2012). Start-ups by recent university graduates and their faculty: Implications for university entrepreneurship policy. Research Policy, 41(4), 663–677. https://doi.org/10.1016/j.respol.2012.01.004

Audretsch, D. B. (1995). Innovation, growth and survival. International Journal of Industrial Organization, 13(4), 441–457. https://doi.org/10.1016/0167-7187(95)00499-8

Audretsch, D. B. (2007). Entrepreneurship capital and economic growth. Oxford Review of Economic Policy, 23(1), 63–78. https://doi.org/10.4337/9781783476923.00011

Audretsch, D. B., & Belitski, M. (2013). The missing pillar: The creativity theory of knowledge spillover entrepreneurship. Small Business Economics, 41(4), 819–836. https://doi.org/10.1007/s11187-013-9508-6

Audretsch, D. B., & Belitski, M. (2020). The role of R&D and knowledge spillovers in innovation and productivity. European Economic Review, 123, 103391. https://doi.org/10.1016/j.euroecorev.2020.103391

Audretsch, D. B., & Belitski, M. (2021). Towards an entrepreneurial ecosystem typology for regional economic development: The role of creative class and entrepreneurship. Regional Studies, 55(4), 735–756. https://doi.org/10.1080/00343404.2020.1854711

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. The American Economic Review, 86(3), 630–640.

Audretsch, D. B., & Keilbach, M. C. (2007). The localisation of entrepreneurship capital: Evidence from Germany. Papers in Regional Science, 86, 351–365. https://doi.org/10.1111/j.1435-5957.2007.00131.x

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202. https://doi.org/10.1016/j.respol.2005.03.012

Audretsch, D. B., Belitski, M., & Cherkas, N. (2021). Entrepreneurial ecosystems in cities: The role of institutions. PloS one, 16(3), e0247609. https://doi.org/10.1371/journal.pone.0247609

Audretsch, D. B., Belitski, M., & Caiazza, R. (2021). Start-ups, innovation and knowledge spillovers. The Journal of Technology Transfer, 46(6), 1995–2016. https://doi.org/10.1007/s10961-021-09846-5

Audretsch, D. B., Belitski, M., Caiazza, R., & Lehmann, E. E. (2020). Knowledge management and entrepreneurship. International Entrepreneurship and Management Journal, 16, 373–385. https://doi.org/10.1007/s11365-020-00648-z

Audretsch, D. B., Falck, O., Feldman, M. P., & Heblich, S. (2012). Local entrepreneurship in context. Regional Studies, 46(3), 379–389. https://doi.org/10.1080/00343404.2010.490209

Audretsch, D. B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219–230. https://doi.org/10.1007/s11187-014-9600-6

Audretsch, D. B., Keilbach, M. C., & Lehmann, E. E. (2006). Entrepreneurship and economic growth. Oxford University Press.

Audretsch, D., Colombelli, A., Grilli, L., Minola, T., & Rasmussen, E. (2020b). Innovative start-ups and policy initiatives. Research Policy, 49(10), 104027. https://doi.org/10.1016/j.respol.2020.104027

Audretsch, D. B., & Fritsch, M. (1994). The geography of firm births in Germany. Regional Studies, 28(4), 359–365. https://doi.org/10.1080/00343409412331348326

Auricchio, M., Cantamessa, M., Colombelli, A., Cullino, R., Orame, A., & Paolucci, E. (2014). Business Incubators in Italy. Questioni di Economia e Finanza, No. 216, Bank of Italy.

Autio, E., Dahlander, L., & Frederiksen, L. (2013). Information exposure, opportunity evaluation, and entrepreneurial action: An investigation of an online user community. Academy of Management Journal, 56(5), 1348–1371 https://doi.org/10.5465/amj.2010.0328

Autio, E., Kenny, M., Mustar, P., Siegel, D. S., & Wright, M. (2015). Entrepreneurial innovation: The importance of context. Research Policy, 43, 1097–1108. https://doi.org/10.1016/j.respol.2014.01.015

Autio, E., Nambisan, S., Thomas, L. D. W., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95. https://doi.org/10.1002/sej.1266

Autio, E., Szerb, L., Komlósi, É., Tiszberger, M. (2020) EIDES 2020: The European Index of Digital Entrepreneurship Systems, Nepelski, D. editor(s), EUR 30250 EN, Publications Office of the European Union, Luxembourg.

BalaSubrahmanya, M. H. (2017). How did Bangalore emerge as a global hub of tech start-ups in India? Entrepreneurial ecosystem—Evolution, structure and role. Journal of Developmental Entrepreneurship, 22(01), 1750006. https://doi.org/10.1142/S1084946717500066

Blumberg, B. F., & Letterie, W. A. (2008). Business starters and credit rationing. Small Business Economics, 30(2), 187–200. https://doi.org/10.1007/s11187-006-9030-1

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2013). University specialization and new firm creation across industries. Small Business Economics, 41(4), 837–863. https://doi.org/10.1007/s11187-013-9509-5

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2014). The impact of local and external university knowledge on the creation of knowledge-intensive firms: Evidence from the Italian case. Small Business Economics, 43(2), 261–287. https://doi.org/10.1007/s11187-013-9536-2

Boschma, R. (2005). Proximity and innovation: A critical assessment. Regional Studies, 39(1), 61–74. https://doi.org/10.1080/0034340052000320887

Braunerhjelm, P., Acs, Z. J., Audretsch, D. B., & Carlsson, B. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125. https://doi.org/10.1007/s11187-009-9235-1

Breschi, S., & Lissoni, F. (2001). Knowledge spillovers and local innovation systems: A critical survey. Industrial and Corporate Change, 10(4), 975–1005. https://doi.org/10.1093/icc/10.4.975

Brusoni, S., Prencipe, A. (2013). The organization of innovation in ecosystems: Problem framing, problem solving, and patterns of coupling. In Collaboration and Competition in Business Ecosystems (pp. 167–194). Advances in Strategic Management, Emerald Group Publishing Limited. https://doi.org/10.1108/S0742-3322(2013)0000030009

Bryniolfsson, E., & MCAfee, A. (2014). The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. W. W. Norton & Company.

Carlino, G., & Kerr, W. R. (2015). Agglomeration and innovation. Handbook of Regional and Urban Economics, 5, 349–404. https://doi.org/10.1016/B978-0-444-59517-1.00006-4

Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: Present debates and future directions. International Entrepreneurship and Management Journal, 15, 1291–1321. https://doi.org/10.1007/s11365-018-0526-3

Cho, D. S., Ryan, P., Buciuni, G. (2021). Evolutionary entrepreneurial ecosystems: A research pathway. Small Business Economics, 1865–1883. https://doi.org/10.1007/s11187-021-00487-4

Colombelli, A. (2016). The impact of local knowledge bases on the creation of innovative start-ups in Italy. Small Business Economics, 47(2), 383–396. https://doi.org/10.1007/s11187-016-9722-0

Colombelli, A., & Quatraro, F. (2018). New firm formation and regional knowledge production modes: Italian evidence. Research Policy., 47(1), 139–157. https://doi.org/10.1016/j.respol.2017.10.006

ColomboDelmastro, M. G. M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31, 1103–1122. https://doi.org/10.1016/S0048-7333(01)00178-0

Cooke, P., Uranga, M. G., & Etxebarria, G. (1997). Regional innovation systems: Institutional and organisational dimensions. Research Policy, 26(4–5), 475–491. https://doi.org/10.1016/S0048-7333(97)00025-5

Cornet, D., Bonnet, J., Bourdin, S. (2022). Digital entrepreneurship indicator (DEI): An analysis of the case of the greater Paris metropolitan area. The Annals of Regional Science, 1–28. https://doi.org/10.1007/s00168-022-01175-1

Dejardin, M., & Fritsch, M. (2011). Entrepreneurial dynamics and regional growth. Small Business Economics, 36(4), 377–382. https://doi.org/10.1007/s11187-009-9258-7

Delgado, M., Porter, M. E., & Stern, S. (2010). Clusters and entrepreneurship. Journal of Economic Geography, 10(4), 495–518. https://doi.org/10.1093/jeg/lbq010

Du, W., Pan, S. L., Zhou, N., & Ouyang, T. (2018). From a marketplace of electronics to a digital entrepreneurial ecosystem (DEE): The emergence of a meta-organization in Zhongguancun. China. Information Systems Journal, 28(6), 1158–1175. https://doi.org/10.1111/isj.12176

Elia, G., Margherita, A., & Passiante, G. (2020). Digital entrepreneurship ecosystem: How digital technologies and collective intelligence are reshaping the entrepreneurial process. Technological Forecasting and Social Change, 150, 119791. https://doi.org/10.1016/j.techfore.2019.119791

Enkel, E., Gassmann, O., & Chesbrough, H. (2009). Open R&D and open innovation: Exploring the phenomenon. R & D Management, 39(4), 311–316. https://doi.org/10.1111/j.1467-9310.2009.00570.x

Evans, D. S., & Jovanovic, B. (1989). An Estimated Model of Entrepreneurial Choice under Liquidity Constraints. Journal of Political Economy, 97, 808–827.

Feldman, M. (2001). The entrepreneurial event revisited: Firm formation in regional context. Industrial and Corporate Change, 10, 861–891. https://doi.org/10.1093/icc/10.4.861

Feldman, M., Francis, J., & Bercovitz, J. (2005). Creating a cluster while building a firm: Entrepreneurs and the formation of industrial clusters. Regional Studies, 39(1), 129–141. https://doi.org/10.1080/0034340052000320888

Fossen, F. M., & Sorgner, A. (2019). Digitalization of work and entry into entrepreneurship. Journal of Business Research, 125, 548–563. https://doi.org/10.1016/j.jbusres.2019.09.019

Friar, J. H., & Meyer, M. H. (2003). Entrepreneurship and start-ups in the Boston region: Factors differentiating high-growth ventures from micro-ventures. Small Business Economics, 21, 145–152. https://doi.org/10.1023/A:1025045828202

Fritsch, M. (2001). Co-operation in regional innovation systems. Regional Studies, 35(4), 297–307.

Fritsch, M. (2013). New business formation and regional development: A survey and assessment of the evidence. Foundations and Trends in Entrepreneurship, 9, 249–364. https://doi.org/10.1561/0300000043

Fritsch, M., & Mueller, P. (2004). Effects of new business formation on regional development over time. Regional Studies, 38(8), 961–975. https://doi.org/10.1080/0034340042000280965

Fritsch, M., & Schindele, Y. (2011). The Contribution of New Businesses to Regional Employment-An Empirical Analysis. Economic Geography, 87, 153–180. https://doi.org/10.1111/j.1944-8287.2011.01113.x

Fritsch, M. (1997). New firms and regional employment change. Small Business Economics, 9(5), 437–448. https://doi.org/10.1023/A:1007942918390

Ghio, N., Guerini, M., Lehmann, E. E., & Rossi-Lamastra, C. (2015). The emergence of the knowledge spillover theory of entrepreneurship. Small Business Economics, 44(1), 1–18. https://doi.org/10.1007/s11187-014-9588-y

Glaeser, E. L. (1999). Learning in cities. Journal of Urban Economics, 46(2), 254–277. https://doi.org/10.1006/juec.1998.2121

Greene, W. H. (2003). Econometric Analysis. Prentice Hall.

Hall B., Jaffe A., Trajtenberg M. (2005).Market Value and Patent Citations. The RAND Journal of Economics, 36(1), 16–38. https://www.jstor.org/stable/1593752. Accessed Jan 2021.

Helsper, E. J., & Eynon, R. (2013). Distinct skill pathways to digital engagement. European Journal of Communication, 28(6), 696–713. https://doi.org/10.1177/0267323113499113

Hoang, H., & Antoncic, B. (2003). Network-based research in entrepreneurship: A critical review. Journal of Business Venturing, 18(2), 165–187. https://doi.org/10.1016/S0883-9026(02)00081-2

Iansiti, M., & Levien, R. (2004). The keystone advantage: what the new dynamics of business ecosystems mean for strategy, innovation, and sustainability. Harvard Business Press.

Iftikhar, M. N., Ahmad, M., & Audretsch, D. B. (2020). The knowledge spillover theory of entrepreneurship: The developing country context. International Entrepreneurship and Management Journal, 16, 1327–1346. https://doi.org/10.1007/s11365-020-00667-w

Iftikhar, M. N., Justice, J. B., Audretsch, D. B. (2022). The knowledge spillover theory of entrepreneurship: An Asian perspective. Small Business Economics, 59, 1401–1426. https://doi.org/10.1007/s11187-021-00577-3

Isenberg, D. J. (2010). How to start an entrepreneurial revolution. Harvard Business Review, 88(6), 40–50.

Johansson, E. (2000). Self-employment and liquidity constraints: Evidence from Finland. The Scandinavian Journal of Economics, 102(1), 123–134. https://doi.org/10.1111/1467-9442.00187

Kenney, M., & Patton, D. (2005). Entrepreneurial geographies: Support networks in three high-technology industries. Economic Geography, 81(2), 201–228. https://doi.org/10.1111/j.1944-8287.2005.tb00265.x

Kirschning, R., & Mrożewski, M. (2023). The role of entrepreneurial absorptive capacity for knowledge spillover entrepreneurship. Small Business Economics, 60(1), 105–120. https://doi.org/10.1007/s11187-022-00639-0

Lee, S. Y., Florida, R., & Acs, Z. (2004). Creativity and Entrepreneurship: A Regional Analysis of New Firm Formation. Regional Studies, 38, 879–891. https://doi.org/10.1080/0034340042000280910

Li, W., Du, W., & Yin, J. (2017). Digital entrepreneurship ecosystem as a new form of organizing: The case of Zhongguancun. Frontiers of Business Research in China, 11(1), 1–21. https://doi.org/10.1186/s11782-017-0004-8

Moretto, V., Elia, G., & Ghiani, G. (2022). Leveraging knowledge discovery and knowledge visualization to define the “inner areas”: An application to an Italian province. Journal of Knowledge Management. (forthcoming). https://doi.org/10.1108/JKM-10-2021-0773

Nambisan, S. (2017). Digital entrepreneurship: Toward a digital technology perspective of entrepreneurship. Entrepreneurship Theory and Practice, 41(6), 1029–1055. https://doi.org/10.1111/etap.12354

Neck, H. M., Meyer, G. D., Cohen, B., & Corbett, A. C. (2004). An entrepreneurial system view of new venture creation. Journal of Small Business Management, 42(2), 190–208. https://doi.org/10.1111/j.1540-627X.2004.00105.x

Neter, J., Wasserman, W., & Kunter, M. H. (1990). Applied Linear Statistical Models: Regression, Analysis of Variance, and Experimental Design (3rd ed.). Homewood, IL.

Nijkamp, P. (2003). Entrepreneurship in a modern network economy. Regional Studies, 37(4), 395–405. https://doi.org/10.1080/0034340032000074424

Parker, S. C. (2018). The economics of entrepreneurship. Cambridge University Press.

Pietrzak, M. B., Balcerzak, A. P., Gajdos, A., Arendt, Ł. (2017). Entrepreneurial environment at regional level: the case of Polish path towards sustainable socio-economic development. Entrepreneurship and Sustainability Issues, 5(2), 190–203. https://hal.archives-ouvertes.fr/hal-01703293. Accessed Jan 2021.

Plummer, L. A., & Acs, Z. J. (2014). Localized competition in the knowledge spillover theory of entrepreneurship. Journal of Business Venturing, 29(1), 121–136. https://doi.org/10.4337/9781784718053.00016

Porter, M. (1998). The cluster and competition: New agenda for companies, governments and institutions. Harvard Business Review Books.

Proeger, T., & Runst, P. (2020). Digitization and knowledge spillover effectiveness - evidence from the “German Mittelstand.” Journal of the Knowledge Economy, 11(4), 1509–1528. https://doi.org/10.1007/s13132-019-00622-3

Qian, H., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics., 40(2), 185–197. https://doi.org/10.1007/s11187-011-9368-x

Qian, H., Acs, Z. J., & Stough, R. R. (2013). Regional systems of entrepreneurship: The nexus of human capital, knowledge and new firm formation. Journal of Economic Geography, 13(4), 559–587. https://doi.org/10.1093/jeg/lbs009

Reynolds, P., Storey, D., & Westhead, P. (1994). Cross-national comparison of the variation in new firm formation rates. Regional Studies, 28, 443–456. https://doi.org/10.1080/00343409412331348386

Sahut, J. M., Iandoli, L., & Teulon, F. (2021). The age of digital entrepreneurship. Small Business Economics, 56(3), 1159–1169. https://doi.org/10.1007/s11187-019-00260-8

Saunders, A., Brynjolfsson, E. (2016). Valuing Information Technology Related Intangible Assets. MIS Quarterly, 40(1), 83–110. https://www.jstor.org/stable/26628385. Accessed Jan 2021.

Saxenian, A. (1996). Regional networks: industrial adaptation in Silicon Valley and Route 128. Cambridge, MA: Harvard University Press.