Abstract

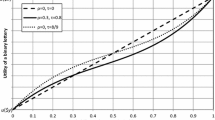

When you are indifferent between two options, it’s rationally permissible to take either. One way to decide between two such options is to flip a fair coin, taking one option if it lands heads and the other if it lands tails. Is it rationally permissible to employ such a tie-breaking procedure? Intuitively, yes. However, if you are genuinely risk-averse—in particular, if you adhere to risk-weighted expected utility theory (Buchak in Risk and rationality, Oxford University Press, 2013) and have a strictly convex risk-function—the answer will often be no: the REU of deciding by coin-flip will be lower than the REU of choosing one of the options outright (so long as at least one of the options is a nondegenerate gamble). This turns out to be a significant worry for risk-weighted expected utility theory. I argue that it adds real bite to established worries about diachronic consistency afflicting views, like risk-weighted expected utility theory, that violate Independence. And that, while these worries might be surmountable, surmounting them comes at a price.

Similar content being viewed by others

Notes

Presented this way, EUT sounds like a view about how one ought to rank their options given facts about one’s utilities and credences. And some might balk at characterizing the view—at least presented in this way—as orthodoxy given that many decision theorists understand EUT to be primarily a view about what it is for one’s ordinal preferences (over both outcomes and gambles) to be consistent and thus understand facts about one’s “utilities" to be derivable from—or perhaps just shorthand for—facts about one’s ordinal preferences over gambles. There are various positions regarding the relationship between one’s preferences and one’s utilities (see Dreier (1996) for a helpful discussion), but nothing I argue for here turns on which is correct. I’ve presented EUT as I have in order to highlight the ways in which it differs from REUT. Both views can be re-interpreted as views about what consistency constraints to place on one’s ordinal preferences, but doing so complicates the presentation in unhelpful ways. Thanks to an anonymous reviewer for pressing this point.

It might be worried that, because REUT deviates from the traditional view by jettisoning the Independence Axiom (or, in Savage’s framework, the Sure-Thing Principle), the agent will fail to have a cardinal utility function, u, that’s well-defined. Independence (and the like) is what ensures that the value an outcome contributes to the value of a gamble is separable: it doesn’t depend on which other outcomes might result from from the gamble. Separability plays an important role in the representation of an agent’s preferences with a cardinal utility function because, very roughly, it allows us to identify an outcome’s utility with how much the agent would risk to secure it. And so it might be worried that without separability we aren’t warranted in representing the agent’s non-instrumental preferences with a cardinal utility function. This is a legitimate worry, but one that can be assuaged. Buchak (2013, ch. 3) (drawing on the work of Köbberling & Wakker, 2003; Machina & Schmeidler, 1992) proves a representation theorem for REUT, which shows that, if one’s preferences satisfy a number of constraints (ones collectively weaker than those underlying the representation theorems for EUT), there will be a unique credence function, a unique risk function, and a unique (up to positive affine transformations) utility function such that one can be represented as maximizing risk-weighted expected utility relative to those functions. The result illustrates that full separability isn’t necessary for an agent’s utility function to be well-defined; instead, REUT only requires separability to hold among comonotonic gambles (i.e., ones that rank all events the same way), so that the contribution that an outcome \(x_i\) makes to the value of a gamble doesn’t depend on which other outcomes might result unless those outcomes affect the relative ranking \(x_i\) occupies in the gamble. (Thanks to an anonymous reviewer for raising this worry.)

Consider, for example, the oft-touted financial advice to diversify one’s portfolio. The wisdom behind the advice is that diversifying—i.e., spreading one’s money among various different investments—reduces risk. And, indeed, because equally dividing a fixed amount of wealth between independently and identically distributed investments results in a portfolio with the same expected monetary return but a lower variance than those of the individual investments it contains, in many cases, diversifying reduces risk (Markowitz, 1952, 1959). (See Samuelson (1967) for a different and more general account of how, and under what circumstances, diversification is beneficial to risk-averse agents.) Because investments (in virtue of paying out different sums of money in different scenarios) are gambles, diversification might seem akin to taking their “mixture”. One important difference, however, is that in classic cases of diversification, by purchasing some percentage of each investment, you might benefit from positive returns from all. The probabilistic mixture of some gambles, on the other hand, affords you no such possibility—unlike a diverse portfolio, you aren’t taking some percentage of each gamble, but instead making it such that there’s some chance of getting the entirety of one.

Nearly all textbooks in finance, risk management, and the like include discussions of variance (and its close cousin, standard deviation) as a measure of risk. This is undoubtedly due in part to the popularity of Modern Portfolio Theory (Markowitz, 1952, 1959) which employs a “mean-variance framework" for evaluating investment portfolios. On this approach, an investment is evaluated along two dimensions: its expected return and its degree of risk (which is captured by its variance). Given this framework, Markowitz derives the set of optimal investment portfolios for different levels of risk. Markowitz’s approach has been robustly criticized. Some of the criticism is to its use of variance as the measure of a gamble’s riskiness; some to the assumption that the value of a gamble can be neatly factored into its mean and its riskiness—however it’s measured (see, for example, Oddie & Milne, 1991, p. 58–9). In particular, Borch (1969) argued that, because two-dimensional mean-variance indifference curves do not exist (they cannot represent the preferences of a rational agent), the mean-variance framework is logically incoherent. For a fascinating critical discussion of these issues, see Johnstone and Lindley (2013).

For the calculations and further discussion, see “Appendix A”.

See, for example, Rothschild and Stiglitz (1970, p. 241–2) and further discussion in “Appendix A”.

Mean-preserving spreads were first explored in Rothschild and Stiglitz (1970), whose major contribution involved proving that the following three properties are equivalent: (1) \(EU\left( X\right) \succeq EU\left( Y\right) \), for all concave utility-functions; (2) Y has more weight in its tails than X; (3) The outcomes of Y are distributed just like X’s plus noise.

Having more potential outcomes is consistent with being less risky. Consider, for example, the following gambles with the same mean. The first has three potential outcomes: a 99% chance of $50, a 0.5% chance of $49.99, and a 0.5% chance of $50.01. The other has only two: a 50% chance of $0 and a 50% chance of $100. The former is clearly less risky than the latter despite having more potential outcomes.

Given its insensitivity to the gambles’ probabilities, range is at best a very limited indicator of riskiness. A gamble with a probability distribution concentrated around its mean might, in virtue of having some very low probability outliers, have a wider range—but be less risky—than one with a probability distribution concentrated in its tails.

The reasoning here appears to appeal to something like the Principle of Indifference which is controversial (see, for example, Hajek, 2003, p. 187–188). I don’t think the argument turns on the truth of this principle in its full generality, however. For my purposes, it’s enough that it be reasonable for someone like Reu to assign credences to her future actions in the way described above. It needn’t be the case that she must—on the pains of irrationality—do so, only that this is an epistemically reasonable reaction to her situation. Given that Reu has no more reason to think she’ll pick any of the options over any of the others, it isn’t unreasonable for her to distribute her credence uniformly. That said, one could argue that, in a case like this, (i) Reu is radically uncertain about what she might go on to pick and (ii) the uniquely epistemically rational response to radical uncertainty is to adopt imprecise probabilities over the various possibilities. Seidenfeld (1988b, p. 310–311), discussing a closely related problem, advocates representing “this uncertainty with a (maximal) convex set of personal probabilities” over the admissible options. However, in Seidenfeld’s example, the agent is unsure what she will go on to choose because she lacks a preference between her future options, not because she is indifferent between them. Steele (2010) discusses this approach as it applies to cases of indifference as well. Generalizing a decision theory to handle imprecise probabilities is no easy task. Exploring whether this is a promising strategy for proponents of REUT to pursue is beyond the scope of this paper.

More precisely: When deciding from a menu M of options, if there is a way of setting the agenda A(M) such that, were you to set the agenda that way, rational choice would result in the selection of \(X \in M\), then every way of setting the agenda is likewise such that, were you to use it, rational choice would result in the selection of X. What it’s rational for you to do is invariant across agendas.

In a series of influential papers (Tversky & Kahneman, 1979, 1984, 1986) Daniel Kahneman and Amos Tversky argue that, for many of us, how a decision-problem is framed does matter. However, their examples pertain to how particular options are framed—that is, how various features of an option are described—and not to the way in which those options are considered. Holding fixed how the options themselves are described, should it matter e.g. the order in which they are considered? Furthermore, Kahneman and Tversky are engaged in a descriptive project, not a normative one. They agree that principles, like the one above, are “normatively essential” (Tversky & Kahneman, 1986).

This is not obvious. See “Appendix B” for details of the calculation.

Again, see “Appendix B” for the calculations.

See “Appendix B” for details.

See “Appendix B” for details.

What if she thinks she’ll use Process of Elimination to determine which of the ways to set the agenda? This, like before, recapitulates the previous decision: there are three different ways to set the agenda for making that decision, each one resulting in a different one of the ways of setting the agenda for the first-order decision, and each of which is equally valuable to her. A regress looms.

Note, however, that there is no analogous problem for EUT. Although Eunice might consider using the same procedures as her sister (e.g., picking one of the three prizes at random, using Process of Elimination using the Tournament Method), each will have the same value for her as each of the prizes themselves. So, opening Door #1, for Eunice, has a stable value: it’s the same value she assigns to each of the prizes she knows awaits if she does.

The argument presented above shares certain similarities with the one Seidenfeld (1988a) develops against decision theories that jettison the Independence axiom. REUT, in virtue of violating Independence, is subject to Seidenfeld’s objection. The argument is developed and further refined in Seidenfeld (1988b, 2000a, b) in response to criticism by McClennen (1988) and Rabinowicz (1995, 1997, 2000). (See Steele (2010) for further discussion of the dialectic). My argument differs from Seidenfeld’s in some key respects. His argument relies on a dynamic coherence constraint that requires one’s evaluations of plans to be unchanged by substitutions, at choice nodes, of indifferent options. He shows that decision theories that jettison Independence violate this constraint—they prescribe evaluating plans in a way that is, according to Seidenfeld, dynamically incoherent.

Recall, Reu values each version of Process of Elimination at \(\$2\frac{1}{8}\); she values picking one of the three randomly at $2; she values two of the versions of the Tournament Method at $\(2\frac{5}{64}\), and the other at $ \(2\frac{1}{32}\).

Somewhat surprisingly, their mean absolute deviations also equal 0.75. That is a coincidence. Typically, a gamble’s mean absolute deviation and its variance will not be the same.

References

Borch, K. (1969). A note on uncertainty and indifference curves. The Review of Economic Studies, 36, 1–4. https://doi.org/10.2307/2296336

Buchak, L. (2013). Risk and rationality. Oxford University Press.

Dreier, J. (1996). Rational preference: Decision theory as a theory of practical rationality. Theory and Decision, 40, 249–76.

Hajek, A. (2003). Conditional probability is the very guide of life. In H. E. Kyburg & M. Thalos (Eds.), Probability is the very guide of life: The philosophical uses of chance (pp. 187–88). Open Court.

Johnstone, D., & Lindley, D. (2013). Mean-variance and expected utility: The borch paradox. Statistical Science, 28(2), 223–237. https://doi.org/10.1214/12-STS408

Köbberling, V., & Wakker, P. P. (2003). Preference foundations for nonexpected utility: A generalized and simplified technique. Mathematics of Operations Research, 28(3), 395–423.

Machina, M. J. (1989). Dynamic consistency and non-expected utility models of choice under uncertainty. Journal of Economic Literature, 27, 1622–1668.

Machina, M. J., & Schmeidler, D. (1992). A more robust definition of subjective probability. Econometrica, 60(4), 745–780.

Markowitz, H. (1952). Portfolio selection. The. Journal of Finance, 7(1), 77–91.

Markowitz, H. (1959). Portfolio selection: Efficient diversification of investments. Monograph 16. Cowels Foundation for Research in Economics at Yale University.

McClennen, E. F. (1990). Rationality and dynamic choice: Foundational explorations. Cambridge University Press.

McClennen, E. F. (1997). Pragmatic rationality and rules. Philosophy and Public Affairs, 26(3), 210–258.

McClennen, E. F. (1988). Ordering and independence: A comment on professor seidenfeld. Economics and Philosophy, 4, 298–308.

Oddie, G., & Milne, P. (1991). Act and value: Expectation and the representability of moral theories. Theoria, 57(1–2), 42–76.

Rabinowicz, W. (1995). To have one’s cake and eat it, too: Sequential choice and expected-utility violations. The Journal of Philosophy, 92(11), 586–620.

Rabinowicz, W. (1997). On seidenfeld’s criticism of sophisticated violations of the independence axiom. Theory and Decision, 43, 279–292.

Rabinowicz, W. (2000). Preference stability and substitution of in differents: A rejoinder to seidenfeld. Theory and Decision, 48, 311–318.

Rothschild, M., & Stiglitz, J. (1970). Increasing risk: I. A definition. Journal of Economic Theory, 2(3), 225–243.

Samuelson, P. A. (1967). General proof that diversification pays. The Journal of Financial and Quantitative Analysis, 2(1), 1–13.

Savage, L. J. (1954). The foundations of statistics. Wiley.

Seidenfeld, T. (1988). Decision theory without ‘independence’ or without ‘ordering’. Economics and Philosophy, 4(2), 267–90.

Seidenfeld, T. (1988). Rejoinder [to Hammond and McClennen]. Economics and Philosophy, 4(2), 309–315.

Seidenfeld, T. (2000). Substitution of indifferent options at choice nodes and admissibility: A reply to Rabinowicz. Theory and Decision, 48, 319–322.

Seidenfeld, T. (2000). The independence postulate, hypothetical and called-off acts: A further reply to Rabinowicz. Theory and Decision, 48(2), 319–322.

Steele, K. S. (2010). What are the minimal requirements of rational choice? Arguments from the sequential-decision setting. Theory, 68, 463–487.

Thoma, J. (2019). Risk aversion and the long run. Ethics, 129(2), 230–253.

Tversky, A., & Kahneman, D. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–291.

Tversky, A., & Kahneman, D. (1984). Choice, values, and frames. American Psychologist, 39, 341–350.

Tversky, A., & Kahneman, D. (1986). Rational choice and the framing of decisions. The Journal of Business, 59(4 Part 2: The Behavioral Foundations of Economic Theory), S251–S278.

Ullmann-Margalit, E., & Morgenbesser, S. (1977). Picking and choosing. Social Research, 44(4), 757–785.

Acknowledgements

For feedback and discussion, I would like to thank Luc Bovens, Richard Bradley, Geoff Brennan, Jennifer Carr, Tom Dougherty, Caspar Hare, Ze’ev Goldschmidt, Simone Gubler, Patricia Rich, Geoff Sayre-McCord, H. Orri Stefánsson, Johanna Thoma, Ittay Nissan-Rozen, Fabian Wendt, the audiences at the Mini-Workshop on Attitudes to Risk at the Hebrew University of Jerusalem, the UNC PPE retreat, and the University of San Diego. I’d also like to thank two anonymous reviewers whose generous comments helped improve the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

A: Variance and other measures of risk

In §3, I claimed that the gambles f, g, and \(f\oplus _{\nicefrac {1}{2}}g\) all have the same variance: 0.75. I’ll now show why that is the case.

Recall that, for any gamble \(h = \left\{ x_1, E_1; x_2, E_2; \dots x_n, E_n \right\} \) (where EU(h) is its expected value), the variance of h is:

Therefore,

The gambles f and g have the same variance, as does their 50/50 mixture. This is no coincidence. In general, if two gambles have the same mean and variance, then any probabilistic mixture of the two will also have the same mean and variance.

A related measure of the “dispersion” of a gamble’s outcomes is its mean absolute deviation:

But, as inspecting the previous calculations might make clear, this change makes no difference to the three gambles’ relative standing: \({\textsc {MAD}}(f) = {\textsc {MAD}}(g) ={\textsc {MAD}}(f\oplus _{\nicefrac {1}{2}}g)\).Footnote 23

One criticism of both of these measures is that they treat correspondingly large deviations from the mean the same whether those deviations are positive or negative. However, variation below the mean might be thought to contribute more to a gamble’s riskiness than correspondingly large variation above the mean; downside risk, it might be thought, weighs more heavily than upside risk. If that’s right, we might might want to exclusively focus on a gamble’s lower semi-variance: the probabilistically-weighted squared deviation from the mean of those outcomes whose values are below the mean. Or, at least, we might want to weight a gamble’s lower semi-variance (\({\textsc {SemiVar}}^-\)) more heavily than its upper semi-variance (\({\textsc {SemiVar}}^+\)) when assessing its riskiness.

But, as another glance at the previous calculations can reveal, there are no weights \(\alpha _1\) and \(\alpha _2\) such that

This is because

And so the only way to weight f’s and g’s lower and upper semi-variances so that their sums are equal is if they are weighed equally: \(\alpha _1 = \alpha _2\). But in that case \(f\oplus _{\nicefrac {1}{2}}g\) will be ranked right alongside f and g again. Even if downside risk should loom larger than upside risk, \(f\oplus _{\nicefrac {1}{2}}g\) isn’t any riskier (in that sense) than both f and g.

B: REU calculations

Let’s look at the risk-weighted expected value of deciding between each of the pairs. First, consider deciding between gamble f and its sure-thing cash equivalent \(\$f\), which—because Reu has no reason to think she is more likely to select the one rather than the other—corresponds to a 50/50 lottery between the two.

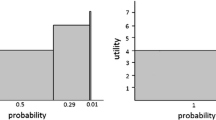

If Reu thinks it’s equally likely, when picking between f and \(\$f\), that she’ll end up with either, then picking between the two is valued at \(\$2\frac{5}{64}.\) (See Fig. 4.)

Next, consider the decision between gamble g and its sure-thing cash equivalent \(\$g\) (which, again, because Reu is indifferent between f and g, is identical to \(\$f\)).

Gamble Between \({{\textbf {g}}}\) and \({\varvec{\$}{} {\textbf {g}}}\) | ||||

|---|---|---|---|---|

Pick | g | Pick \(\$g\) | ||

E | \(\lnot E\) | E | \(\lnot E\) | |

\(g\oplus _{\frac{1}{2}}\$g\) | 1 | 3 | \(2\frac{1}{8}\) | \(2\frac{1}{8}\) |

If Reu thinks it’s equally likely, when picking between g and \(\$g\), that she’ll end up with either, then picking between the two is valued at \(\$1\nicefrac {63}{64}\) (See Fig. 5).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Doody, R. Risk-taking and tie-breaking. Philos Stud 180, 2079–2104 (2023). https://doi.org/10.1007/s11098-023-01947-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11098-023-01947-1